Gold Demand Trends Full Year 2021

News

|

Posted 31/01/2022

|

6155

The World Gold Council’s full year demand trends report is out and as usual we summarise for you. In short a strong Q4 lifted full demand up a solid 10%.

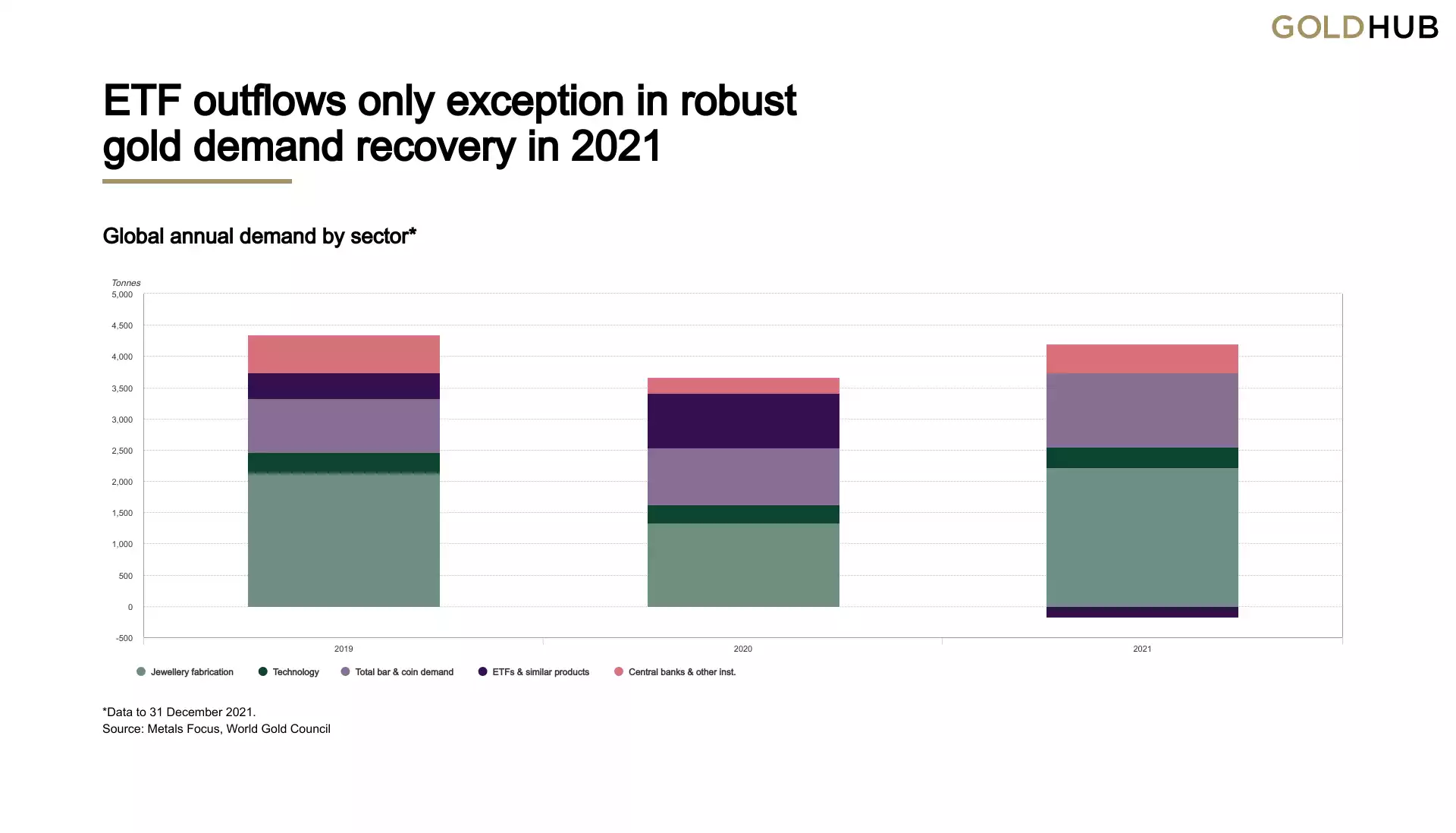

Annual demand recovered across virtually all sectors – the notable exception being ETFs, which saw net annual outflows.

Full year 2021 gold demand (excluding OTC) increased to 4,021t, propelled by Q4 demand which jumped almost 50% to a 10-quarter high. Demand recouped much of the COVID-related losses sustained during 2020. Demand for gold in the consumer-driven jewellery and technology sectors recovered throughout the year in line with economic growth and sentiment, while central bank buying also far outpaced that of 2020. Investment demand was mixed in an environment of opposing forces: high inflation competed with rising yields for investors’ attention.

Jewellery

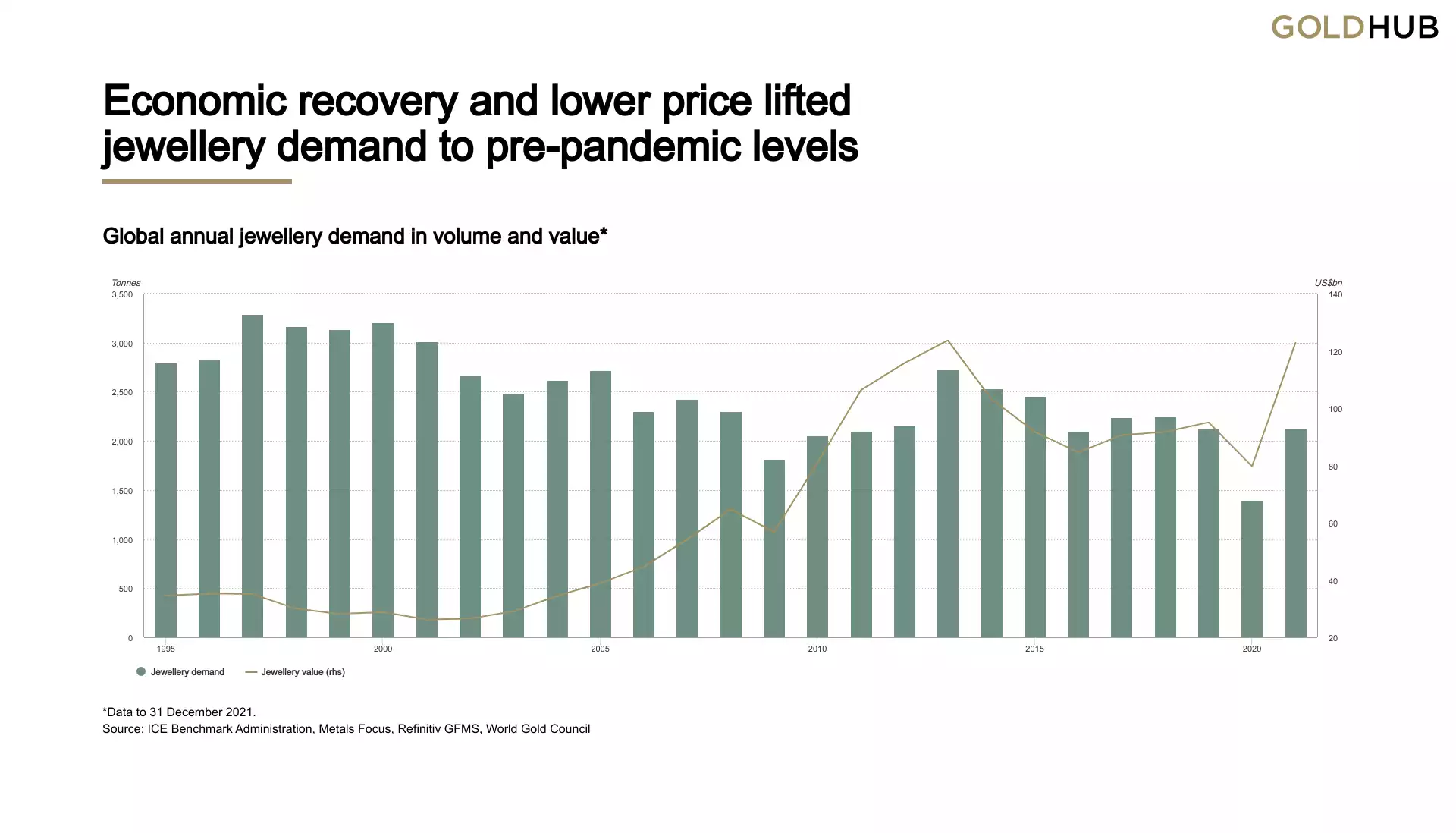

Annual jewellery consumption rebounded to pre-pandemic levels, boosted by Q4 sprint finish.

- Annual jewellery consumption grew 52% in 2021, fully recovering the losses sustained during 2020

- Rocketing Indian demand helped drive the fourth quarter global total to 713t – the highest since Q2 2013

- In value terms, annual demand reached US$123bn to virtually match the 2013 record.

Investment

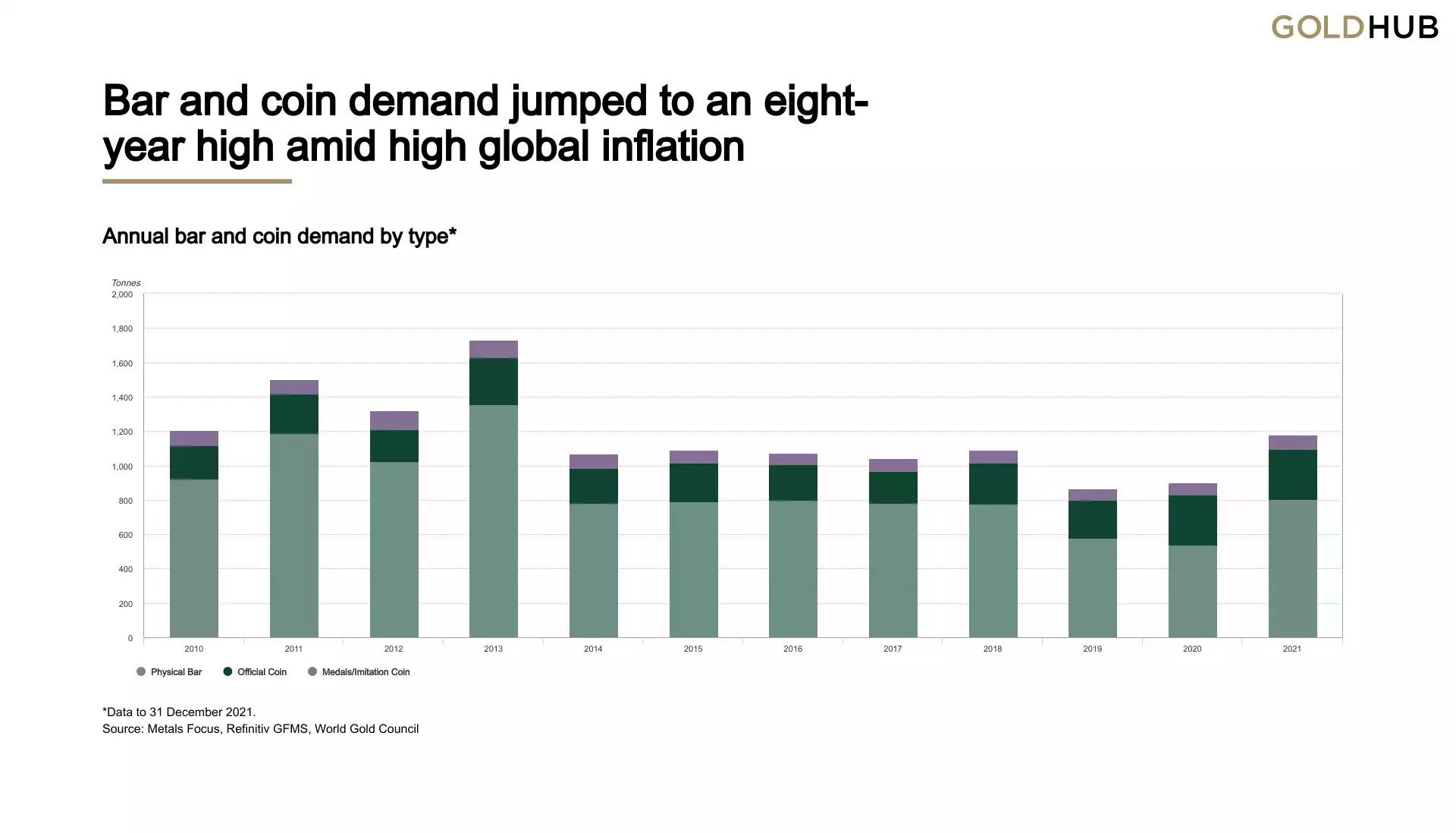

Eight-year high in bar and coin demand collides with annual ETF outflows.

- Annual bar and coin investment jumped 31% to 1,180t, aided by record high volumes in the US and Germany

- Global gold ETFs saw outflows of 173t in 2021, a 5% decline in total holdings

- In Q4, total investment more than doubled y-o-y as ETF outflows were sharply lower than in Q4 2020, while bar and coin demand maintained its momentum.

After four consecutive quarters of y-o-y declines, investment demand jumped 118% y-o-y in Q4. ETF outflows slowed to trivial levels – particularly in comparison with Q4 2020 – while bar and coin investment continued to gain strength.

Despite the significant uptick in Q4 demand, the net result for 2021 was a 43% decrease in total investment to 1,007t. However, the last time gold ETFs saw annual outflows, which was between 2013 and 2015, average annual investment demand was 901t, 11% lower than last year. This highlights the extent to which bar and coin demand growth helped to offset ETF outflows.

Central Banks and other institutions

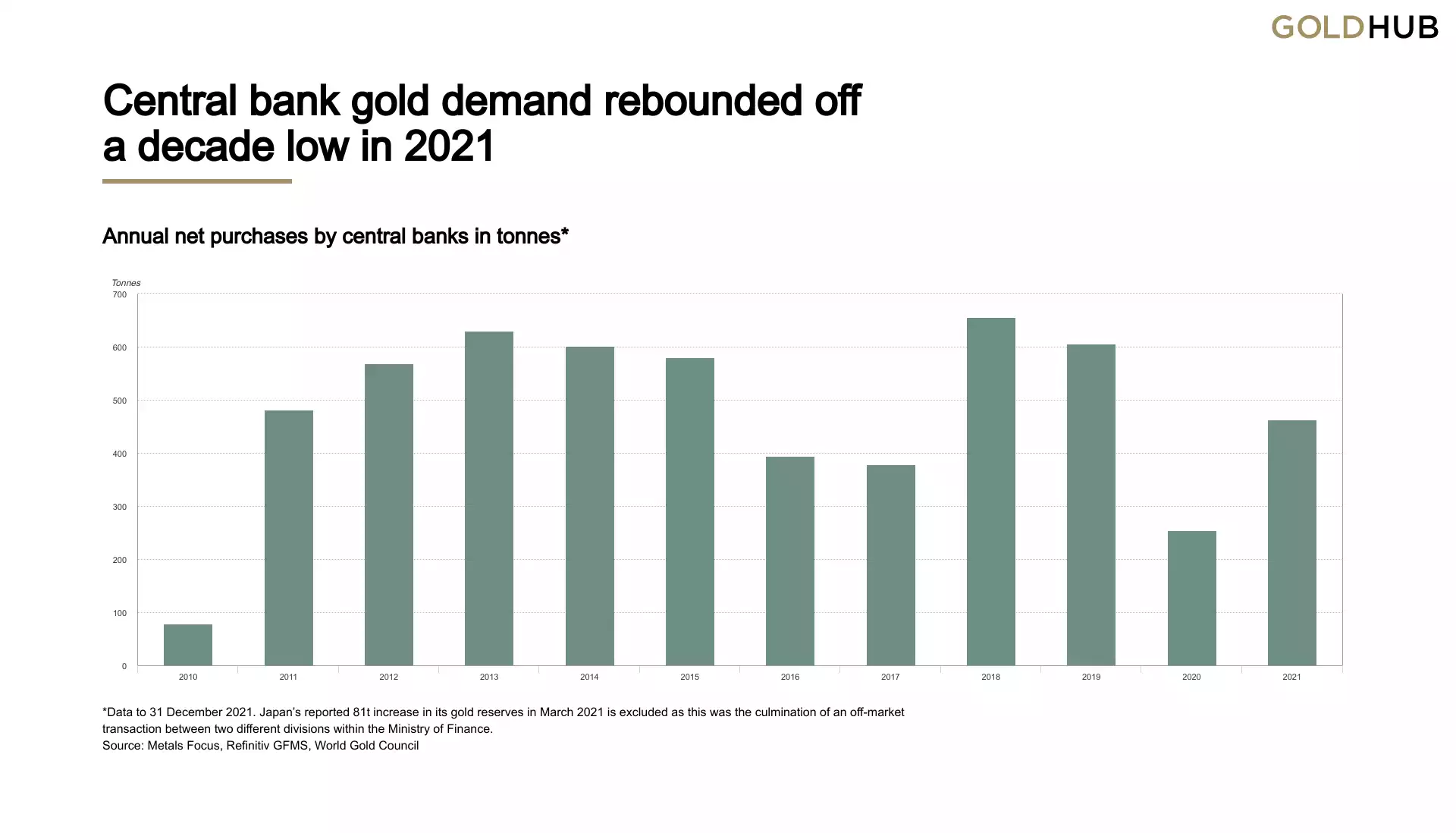

Central bank buying rebounded and developed markets re-joined the fray.

- Central banks added 463t to global gold reserves in 2021, 82% higher than 2020

- This pushed global gold reserves to just under 35,600t, their highest for almost 30 years

- Developed market central banks were also among the notable buyers.

Central bank net purchases totalled 463t in 2021. This marks a significant rebound in demand from this sector following the decade low of 255t in 2020. Buying was heavily front-loaded: 324t was bought during the first half of the year, boosted by several large purchases, before slowing sharply to 139t in the second half. Q4 2021 saw net purchases of 48t – the lowest quarterly level of net buying since Q3 2010.

2021 is the twelfth consecutive year of net purchases, during which time central banks have bought a net total of 5,692t. According to data from the IMF, global central bank gold reserves rose to just shy of 35,600t during 2021, the highest level since 1992.

Technology

Demand for gold in technology staged a rapid recovery in 2021

- Full-year gold demand in the technology sector grew by 9% to 330t, with y-o-y growth seen in all four quarters

- A buoyant electronics sector bounced back from the 2020 impact of the pandemic, growing 9% to 272t

- Demand for gold used in other industrial applications also recovered, rising 12% to 47t, while dental demand continued its steady decline with a 4% fall to 11t.

Supply

Total supply fell 1% y-o-y in 2021; a sharp drop in recycling more than offset higher mine production. It was the second successive year of declines and the first consecutive fall in more than a decade.

- Annual mine production increased 2% y-o-y, clawing back some of the pandemic-driven losses seen in 2020

- The global hedge book is estimated to have fallen below 150t, its lowest level since 2014

- Full-year recycled gold supply fell 11% y-o-y, a reaction to the modestly lower gold price.