Gold & Bitcoin – “It ain’t what you know”

News

|

Posted 25/08/2017

|

7045

Gold v Bitcoin – it is becoming a common question. But should the ‘v’ be there?

Tomorrow (26/8/17) we will be presenting at the Understanding Money Conference, helping young people understand money in all its various forms. Spoiler alert…. We will be repeating one of favourite quotes from Mark Twain that goes like this:

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just isn’t so.”

Why do we like that? Because it strikes to the heart of what we preach, and that is balance. It’s our Trademark - “Balance your wealth in an unbalanced world”.

You see we all have our investment biases. Property guys think property ALWAYS goes up, shares guys think it is the only way to go, gold bugs think the other 2 will crash any minute and are ‘ALL IN’ gold. We even reinforce that bias by only reading material that agrees with our own narrative. The fact is that neither you nor we have any idea what will happen, or at least when it will happen. For all we know this apparent financial bubble could continue for years…. or end tomorrow.

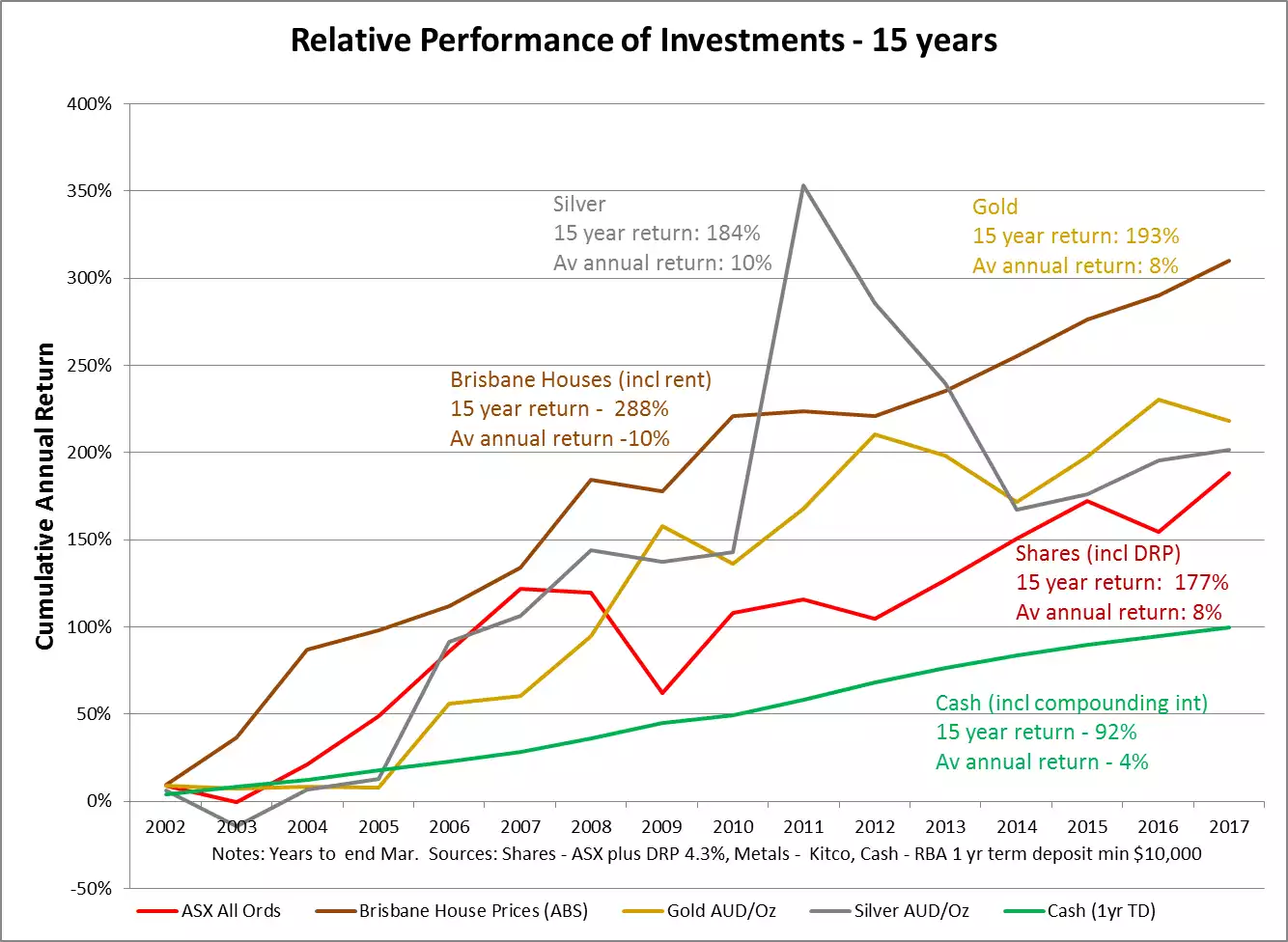

What you need is a mix of uncorrelated assets. We wrote most recently on this here. For the presentation tomorrow we updated our 15 year look back at the main investment classes. As usual we levelled the playing field for the non yielding gold and silver by adding in rent for property (sorry for the Brisbane focus for interstate readers), dividend reinvestment plans for shares and compounded the interest for cash. No surprises that property wins the race, it’s had a stellar run. (You might want to read our recent article here though for context.)

But what about bitcoin you say? To be honest, the chart wouldn’t fit it.

You see bitcoin essentially started from scratch in 2010. It traded at $0.003 on the first exchange. Putting a c180m% gain on the graph doesn’t work. Just in the last 12 months it’s up over 620%.

Year to date its up over 300% versus gold (in AUD) up just 2%. Based on that, the human temptation is to choose bitcoin over gold. There are endless people that “know for sure” that bitcoin is going to the $10’s of thousands and likewise those that say gold and silver will shoot to the moon soon too. Again, neither group really know. The allure of bitcoin is strong. It looks to exhibit many of the same properties we love about gold – it’s value is intrinsic, it appears not to be correlated to financial markets, it has no counterparty risk, it’s ‘out of the system’, it’s easy to trade, and it ticks all 7 fundamentals of what constitutes money.

Bitcoin is also becoming a more ‘mainstream’ investment asset. One of the world’s largest asset managers, VanEck in the US is a long term provider of gold ETF’s, indeed they launched the first US gold fund in 1968. This gold specialist is now launching a bitcoin ETF. Casey Research today had this to say about why the two can coexist:

“… the global gold market is already worth $7 trillion. With a market that size, it just can’t compete with the profit potential of bitcoin.

Bitcoin has a market cap of just $66 billion. It doesn’t have to displace gold to rise another 10 times from here.

It just needs to become an alternative “chaos hedge,” and we could see bitcoin at $40,000 per coin.”

In other words bitcoin may have the greater speculative potential, but gold and silver are the steady, 5000 year old, known assets. In other words don’t back one horse, balance your exposure. Both appear to have enormous potential in these uncertain times and that is why Ainslie now offer both. Importantly, as opposed to an ETF (which introduces counterparty risk as you are relying on that certificate they give you to actually own all the underlying metal or bitcoin), you get the real thing from Ainslie. Even the bitcoin is completely off line. Read more here about buying bitcoin from Ainslie and here for details on why to be wary of ETFs.

Finally here is what VanEck had to say about bitcoin:

“VanEck believes that the technology underlying digital assets, known as distributed ledger technology [blockchain], has tremendous potential to revolutionize finance and trade. Digital assets are an investable asset class in their own right and continue to be integrated into the broader economy.”

If you haven’t got your free tickets for tomorrow, here is the link.