Gold As A Tail Risk Hedge

News

|

Posted 27/04/2020

|

13937

A hedge is an investment to minimise the risk of adverse price movements in a portfolio or asset. Gold is often spoken of in such terms as it is normally uncorrelated to ‘risk on’ assets such as shares. We are at pains to repeat that we don’t think you should go ‘all in’ gold and silver as you never know what markets are going to do. There are certainly times where you would adjust the balance toward gold and likewise times reduce it. Arguably the most used economic adjectives of late is ‘unprecedented’ given the quite extraordinary nature of what we are witnessing. By its very definition that means we can’t tell exactly what will happen when there is no precedent. We often talk of ‘balance’ and ‘diversification’ in a portfolio and gold’s role in that.

The World Gold Council last week released the paper “Investment Update: Gold, an efficient hedge” where they look at gold’s performance as a hedge against tail risk ‘events’ compared to other traditional hedges as opposed to it’s simple role of balance and diversification. A tail risk is usually defined as a market move seeing more than 3 standard deviations from the norm and can occur at either end of the curve.

The report is timely as we see investors piling back into shares, particularly in the US, on the non-fundamentals basis of ‘don’t fight the Fed’. Against a backdrop of the economic fallout from the virus that seems, well, ‘brave’…. So the report in part talks to participants playing that casino and how they protect themselves.

Here is the report:

The benefits of certain portfolio hedges came into clear focus during the 2008-2009 financial crisis and did so again during the subsequent European sovereign debt crisis, the 2018 December stock market pullback and the most recent COVID-19 pandemic.

Many tail hedges work well during crises if timed appropriately, but are technically complex investments, and can be expensive to hold systematically.

Historically, gold prices have not increased as rapidly in tail events as hedges that track market volatility indices. But, importantly, gold has served as a safe haven, improving risk-adjusted returns and adding welcome liquidity during times of crisis, without the costly effects of systematic implementation or the difficulties of market timing.

Comparing hedges across metrics

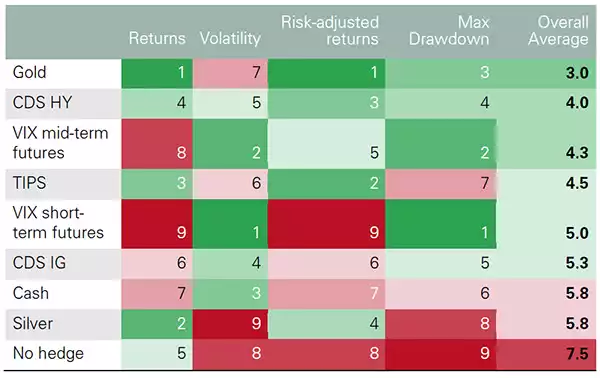

We focus on volatility and credit hedges as well as real assets, particularly precious metals, and adjust the amount of a given hedge in a portfolio depending on the risk exposure of that portfolio.5 Finally, we ranked the effectiveness of each hedging strategy based on attributes including returns, portfolio volatility, risk-adjusted returns and portfolio drawdown.

Our analysis shows that, historically, any of the hedging choices are better than a diversified hypothetical portfolio without hedging (Table 1). And while each of the choices have merit in various market conditions, our analysis shows that historically, gold is generally the overall optimal hedge over the long run when considering these attributes.

Table 1: Performance of hedging strategies in an average pension fund portfolio over the past 20 years*

Ranked (1= most optimal to 9 = least optimal) for each category and overall.

Hedging tail events is often a compromise between the greatest protection and cost

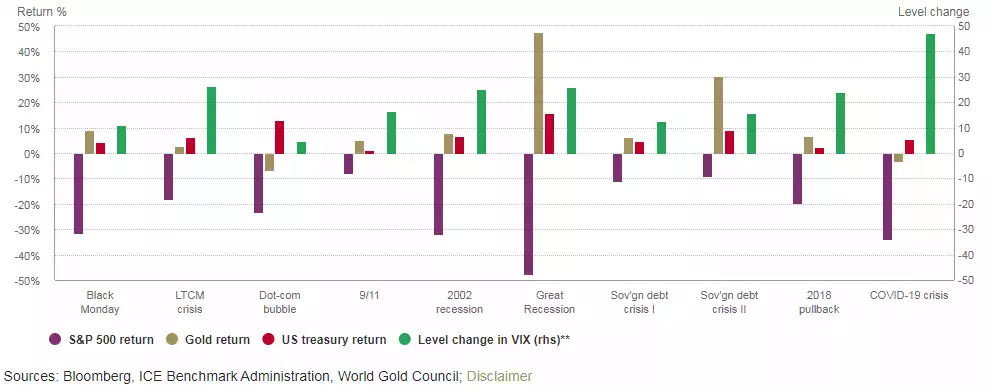

We often highlight gold’s role as a safe haven, most recently in our Investment Update: Gold prices swing as markets sell off, which shows that gold can provide liquidity and protection in risk-off scenarios, especially during so-called systemic events that affect multiple regions and industries (Chart 1). When stock markets sell off quickly, correlation across risk-assets can increase and portfolios that were thought to be diversified could experience unexpected drawdowns, forcing margin calls and low funding ratios.

Chart 1: Gold tends to outperform in left-tail events

Performance of gold, US Treasuries and S&P 500 during VIX spikes

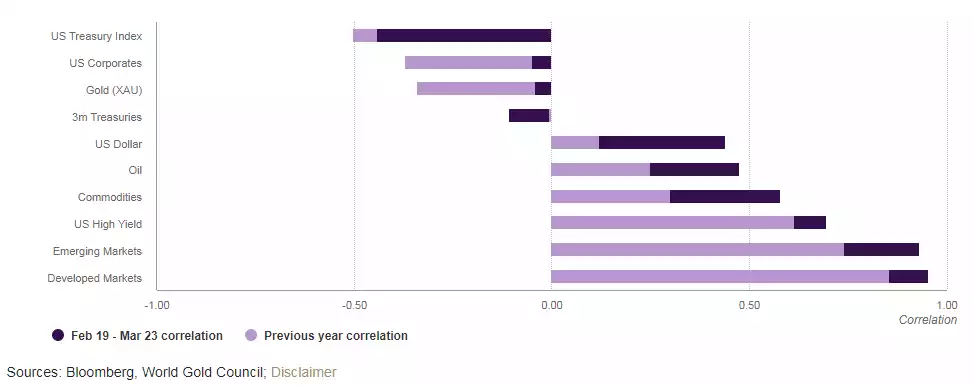

Investors often rely on selling highly liquid assets like gold in these events, which can sometimes lead to temporary liquidations, as seen in the recent COVID-19 selloff. While correlation for most major asset classes, including gold, increased meaningfully during the most recent stock market selloff, gold’s correlation to the stock market remained flat to slightly negative (Chart 2).

Chart 2: Correlation increased across all major asset classes except three-month Treasuries during the COVID-19 selloff

One-year daily correlation of some widely followed major assets and the S&P 500 versus the daily correlation during the selloff.

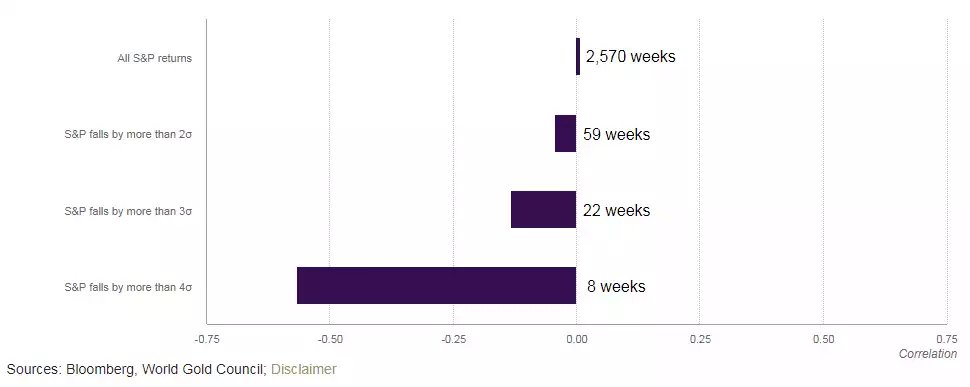

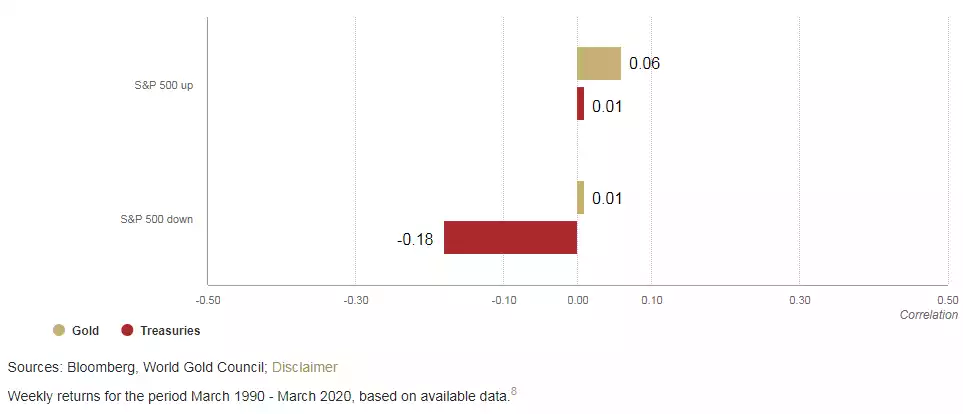

But, as systemic events unfold, gold tends to outperform. In general, the stronger the pullback in the stock market, the more negatively correlated gold becomes with the market highlighting its effectiveness in a sustained pullback (Chart 3).

Chart 3: Gold and stock market correlation becomes more negative with more pronounced market moves

S&P 500 and gold weekly correlation in tail events*

Analysing tail events is important, but the events are not always contained within a neat periodic window. They can occur at much shorter intervals and barely register in weekly returns, as we saw during the infamous ‘flash crash’ of 2010 when markets fell precipitously, only to recover quickly. They could drag out like 2008 and span several months with non-contiguous but frequent selloffs. In fact, an effective tail-risk hedge may need to extend its performance beyond the window that defined the event.

Volatility-related hedges like VIX futures and other index put option strategies have been shown to mean revert. In other words, if the selloff is an isolated event, then the value of the hedge is likely to come tumbling back towards the average quickly afterwards. Owning put options, in particular, is a form of insurance that requires ‘buying’ protection. Because there are various forms of listed option structures outside of VIX futures, we focus on the VIX as a barometer for option performance. Much like the VIX, option insurance can erode overall portfolio performance meaningfully if implemented systematically.

This is why we consider overall portfolio performance, risk-adjusted returns and the portfolio drawdowns to assess the best overall hedges (Table 1 and Table 3). Each metric highlights different qualities of a hedge; namely overall portfolio performance, portfolio volatility, how that volatility impacts performance, and how well the hedge helps with pullbacks or tail-events. We now address the behaviours of some of the various hedges in each category.

Volatility hedges are costly, but historically have provided protection if timed right

VIX can work well - if you time it!

While the VIX itself is not investible, owning VIX futures across most tenors, along with portfolio insurance via option strategies like put options has historically provided the clearest levered or explosive protection during a tail event. This was evidenced most recently in the COVID-19 pullback, as the VIX traded at or near record highs. Timing the event with VIX futures or options purchased would have paid out handsomely.

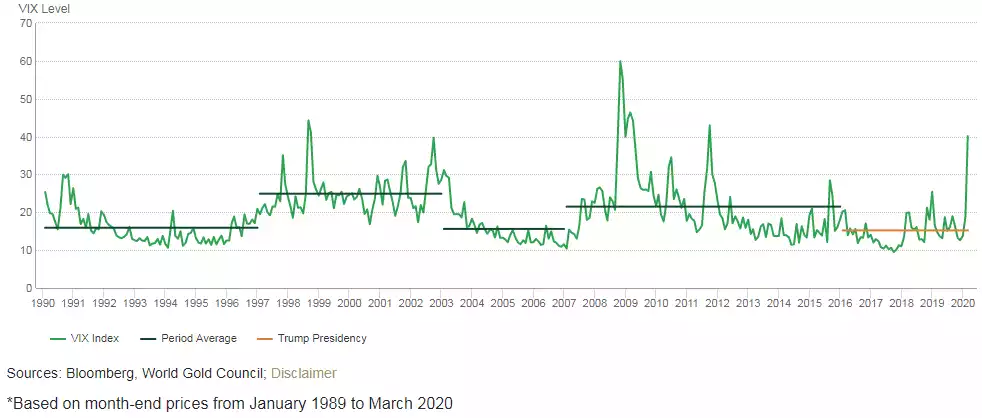

The problem with owning VIX futures specifically is that, when implemented systematically, they provide a negative expected value, seriously eroding portfolio performance over time and requiring resources that require position monitoring not present in passive hedging strategies. Owning VIX short-term futures, for instance, can erode performance by nearly 2% a year (Table 3). This portfolio attrition has been more significant during the past four years, linked to what is known as the “Trump bump”, with quantitative easing measures as well as low rates propelling stocks to their longest bull market in history (Chart 4). It is worth noting that all of the hedges in our analysis, except the short-term VIX futures, have historically improved risk-adjusted returns, when compared to a portfolio with no hedges over the past 20 years.

Interestingly though, while VIX futures risk-adjusted returns performed poorly, they significantly reduce portfolio volatility. VIX futures greatly reduce portfolio drawdown, but at a considerable cost.

Chart 4: Market volatility has been much lower since the financial crisis and Trump presidency*

Credit hedges have had the best tail-event performance since the financial crisis

Credit hedges

Liquid indices on credit default swaps (CDS), a type of insurance on credit events on corporate bonds, such as a stress or default, are popular with investors. They represent an easier way to express a bearish view on corporate bonds than actually shorting the bonds - though access for ordinary investors is limited, as they generally trade over-the-counter (OTC). While holdings of these structures over the long term can hurt cumulative returns because of the premium paid, many of the most recent tail-events were credit related. As such, these positions have positively contributed to portfolio performance since the financial crisis, performing better than any other hedge during these events (Table 2).

Table 2: Short credit trades via CDS have done particularly well since the financial crisis

Investment grade and high yield CDS have led performance in the past five tail-events including and following the financial crisis*

Fixed income hedges can act like risk assets

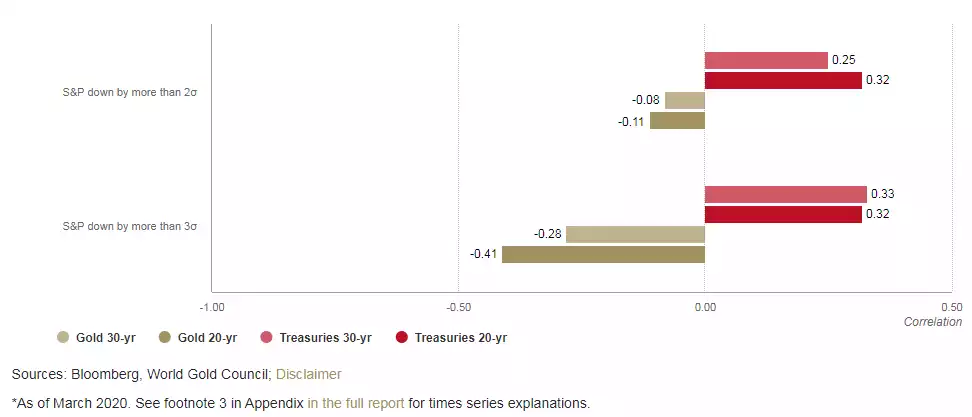

Treasuries provide limited diversification

Investors often include US Treasuries as hedges to their stock allocation. But while there is generally an initial positive move in Treasuries as crises begin, contrary to popular belief, when looking at the last 20 and 30 years, the correlation of US Treasuries to the S&P 500 is generally somewhat positive in tail events; it is during the non-tail events that Treasuries provide diversification. (Chart 5 and Chart 6). During the COVID-19 drawdown in stocks, for example, longer-dated bonds had a daily correlation of 0.60 with the S&P 500.

Treasury Inflation-Protected Securities (TIPS) have done meaningfully well as a portfolio hedge, particularly as it relates to overall portfolio performance. Part of this is likely a diversification factor and the fact that bonds have enjoyed a multi-decade bull market. TIPS, however, are the poorest performers when it comes to tail events and rank near the bottom in portfolio drawdowns (Table 1). While they would likely help in an inflationary event, they have not been shown to effectively hedge systemic events.

Chart 5: In tail-risk events, Treasuries have not behaved according to conventional wisdom….

Gold has acted much better as a tail hedge over the past 20 and 30 years*

Chart 6: …despite good diversification when considering all periods*

Precious metals, like gold, provide a balanced effective hedge

The irony behind diversification is that many investors want it when markets go awry but prefer high correlation when markets do well. Most risk assets have provided diversification on the way up but become highly correlated on the way down. Furthermore, hedges that provide diversification on the way down can erode performance on the way up.

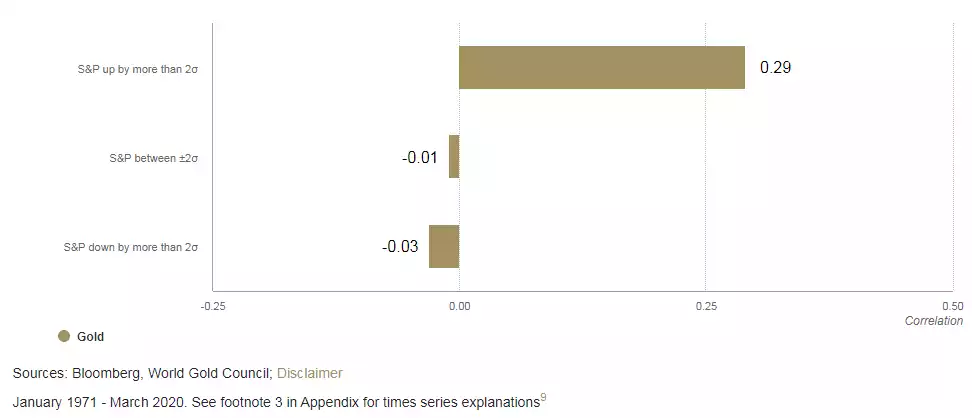

Gold is one of the few hedges that is positively correlated in risk-on environments, yet becomes increasingly negatively correlated in risk-off environments - and has been for nearly 50 years (Chart 7).

Chart 7: Gold works well in varying market conditions

And unlike financial assets, gold is a real asset: it has no credit or counterparty risk and is supported by high inflation. This is why, in terms of cumulative and annual returns, real assets like gold and silver have performed best over the past 20 years.

Silver is often lumped into the gold investment story; its higher volatility than gold makes it compelling to some investors when precious metals, in general, are moving higher. As we discussed in Gold: the most effective commodity investment, silver tends to be much more correlated with the performance of the economy than gold, particularly to the downside. And while it boosts overall returns when used as a hedge, it also increases portfolio volatility to levels above that of an unhedged portfolio, significantly reducing risk-adjusted returns and thus eliminating some of the rationale for a hedge in the first place.

Gold ranks near the bottom in terms of reducing portfolio volatility, the only metric for which it does not land near the top. But, when factoring in its returns, it takes the top spot across various risk-adjusted metrics.

Summary

Gold stands out as a key portfolio component when identifying a long-term portfolio diversifier. Historically, gold has shown that it acts as an effective hedge and a useful part of the larger tail-risk picture.

Volatility-linked hedges like VIX futures and index options, are more effective than gold at reducing both portfolio drawdown and volatility, but the long-term returns of a portfolio that includes VIX futures have been almost halved.

While gold is not necessarily the best ‘volatility hedge’, an allocation to gold can not only improve both absolute and risk-adjusted returns when compared to an unhedged portfolio but can also provide the protection needed in times of market stress. And when one factors in the low cost of ownership, the protection afforded, the low level of active management required and the breadth of application, gold can clearly serve as a valuable alternative.

Table 3: Strategy performance

Blended performance of various hedges over the past 20 years*