Getting Out of Dodge…

News

|

Posted 31/08/2015

|

4488

People are nervous. They are looking for signs everywhere. At the end of last week US markets rallied on one Fed member talking down a September rate rise. Over the weekend another talked it up so who knows what happens next.

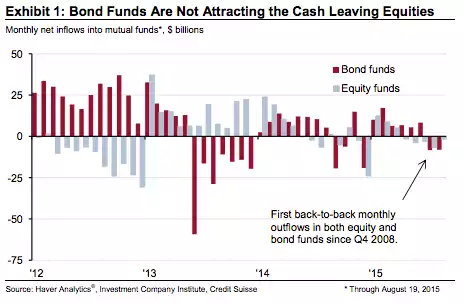

Credit Suisse noted late last week the phenomenon shown in the chart below. For the first time since Q4 in 2008 (ala GFC precipice) we’ve just had back to back months (July and August) of retail investors getting out of both shares and bonds. As they said:

“Anytime you see something that hasn’t happened since the last quarter of 2008, it’s worth noting…..It may be that this is an interesting oddity but if we continue to see this it could reflect a more broad-based nervousness on the part of household investors.”

Whilst this is another red flag for the bond market, it pails to what we reported last week with China dumping over $100b in US Treasuries in just 2 weeks on top of what they’ve been unloading through Belgium and Switzerland this year.