Fund Managers’ Biggest Risks and Gold Bet

News

|

Posted 15/02/2017

|

5946

Last night at her semi annual monetary policy testimony before Congress, US Federal Reserve Chair Janet Yellen said “Considerable uncertainty attends the economic outlook,” referencing.. “possible changes in US fiscal and other policies”. Those ‘other policies’ are likely a direct reference to Trumps trade protection policies that have everyone around the world nervous. The market read her broader address as indicating rates may be hiked sooner than later.

And so, topically and continuing the theme of yesterday’s article today we look at some charts courtesy of Bank of America Merryll Lynch’s (BofAML) latest monthly survey of fund managers.

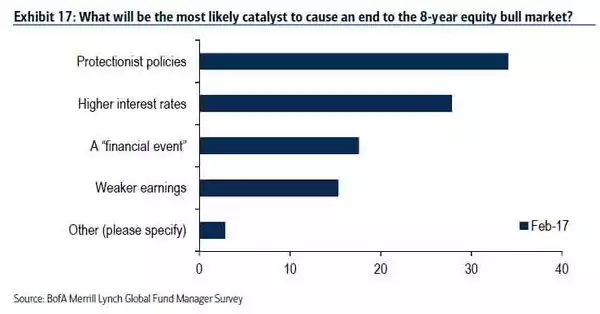

When asked what catalyst will likely start the next bear market, guess what was top of the list? #1 Yellen’s fear and #2 Yellen’s actions.

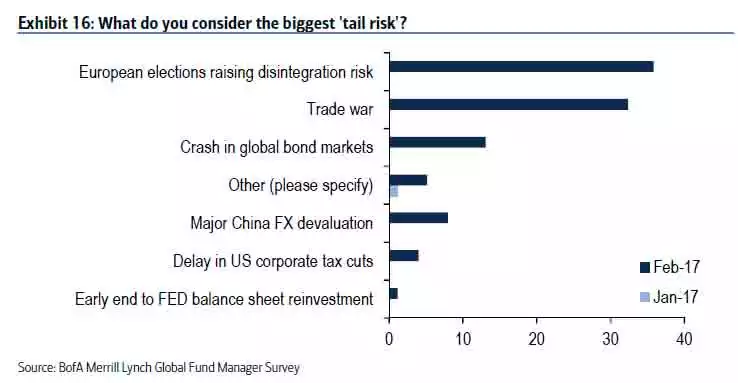

Likewise (and again directly relevant to yesterday’s news) the following outlines their thoughts on what presents the biggest tail risk to their portfolios:

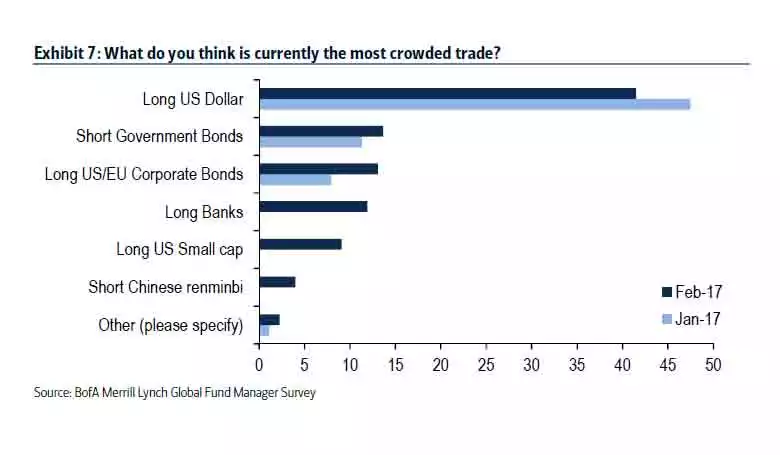

It is often instructive to look at where the crowd is. History shows over crowding often ends in tears as over exuberant ‘group think’ v real fundamentals inevitably sees the latter prevail. At the moment, with expectations of more rate hikes to come, the high USD low US bonds trade is very full.

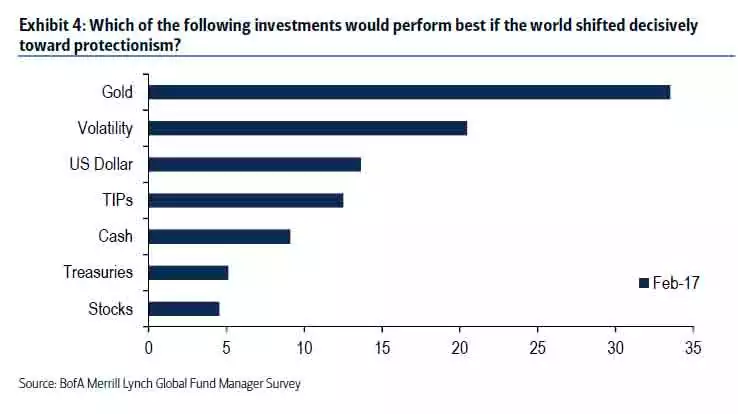

That ‘should be’ negative for gold but as last night demonstrated, after an initial dip on Yellen’s testimony, gold bounced straight back. It’s like the market is happy to play the trade, but they also want their insurance or hedge in place for when it inevitably goes wrong and they mistime their exit. Enter exhibit 4 below…