Fed pedal to metal as PCE hits 30 yr high

News

|

Posted 28/06/2021

|

6117

Sick of hearing about inflation? Got a firm view on whether it is transitory or ‘sticky’? The reality is that it is both very important AND very hard to tell which way it will go. There are very smart people on both sides of the inflation argument making compelling cases.

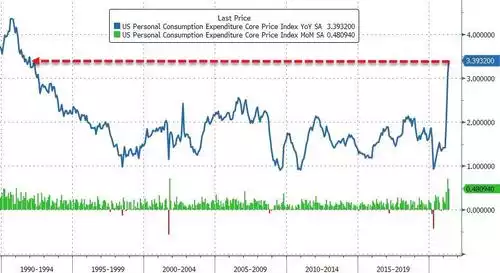

On Friday we saw the latest print of the Fed’s favourite inflation indicator, the Personal Consumption Expenditure Core Price Index (PCE Deflator) hit a 30 year high, up 3.4%. Now before we blame ‘base effects’ for the year on year print (the fact that a year ago it was SO bad that of course it will be huge) check out the green bar of month on month. This was still a very big print in its own right.

This is becoming increasingly hard for the Fed to ignore or pass off as ‘transitory’ and this was very evident when on the same day the Boston Fed President, Rosengren, acknowledged that he "worries about froth in markets” and also the ‘Fed’s got our back’ narrative and hence he "worries people will assume very easy monetary policy is nearly permanent.". If that wasn’t clear enough he straight out said he is "not surprised by high asset valuations," as "it's tied to easy Fed policy." And here again in black and white is the Fed’s trap. Most of them still think it is transitory and are happy to keep the printers going. Whilst Rosengren warned "it's time to think about how quickly to remove accommodation... it's time for The Fed to start thinking about pulling back support." We don’t need to tell you what happens next as you only need to look back to 2018 for your answer. But remember since then the Fed has dug its hole much, much deeper.

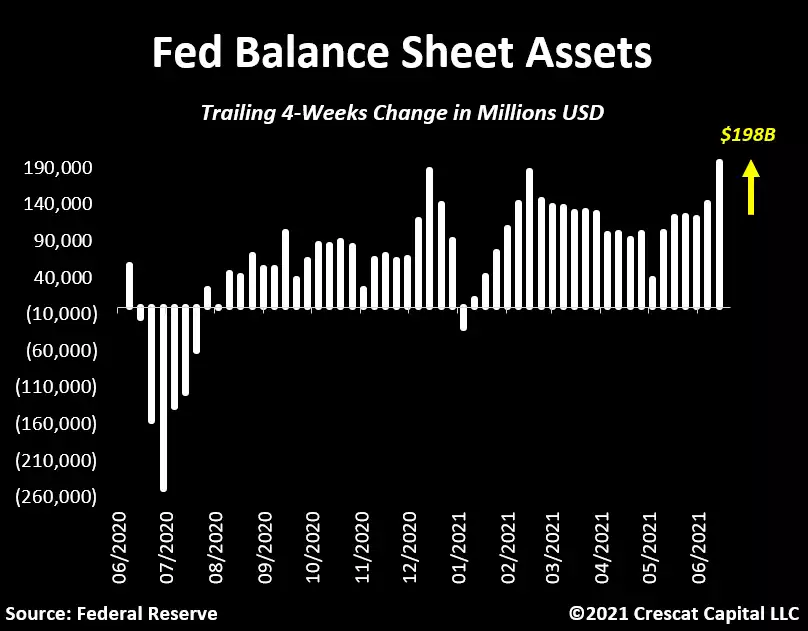

Sometimes its more instructive to look at the Fed’s actions over their jawboning. And so just as we listen to “talking about talking about” tightening and tapering this is what they have just done…. From the chart author: “The Fed just added the largest amount of assets to its balance sheet in over a year. $200B in the last 4-weeks.”

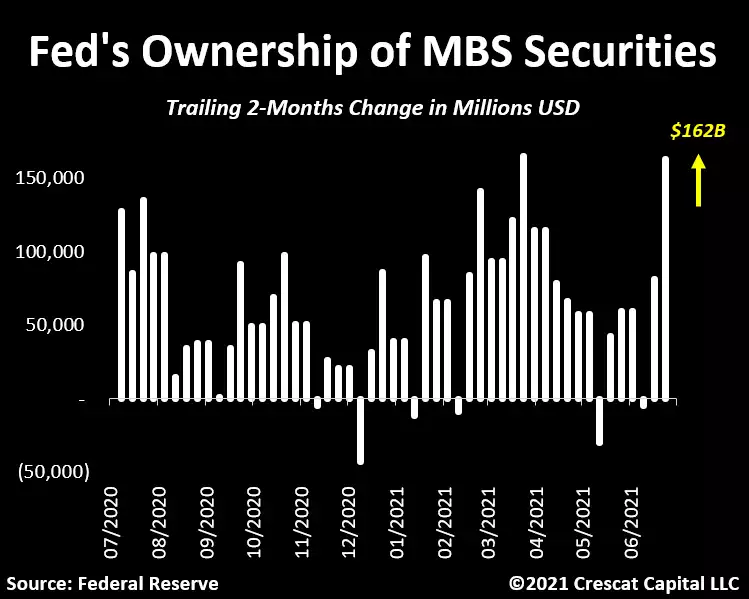

And “Not only that, but they also bought $162B of mortgage backed securities in the last 2 months. That was the largest amount in since March.”

Billionaire hedge manager Kyle Bass had this to say on CNBC:

"I think look we're going to see a short-term turn-down in inflation because the initial inflationary burst was enormous...this transitory comment may play out to be true for a short period of time but I think Sarah when you look at the money supply, the broad money in the US system from 1980 to 2010 it vacillated between 50% and 60% of GDP, and post the global financial crisis it moved up from roughly 60% to 68% - 69% of GDP now that we're approaching 90%, so in the one year period, one and a half year period since COVID started we have introduced 34% more broad money in our system in the shortest time period in the history of the United States. So we're going to see prices stay high and move higher over time if the fed continues to expand its balance sheet,"

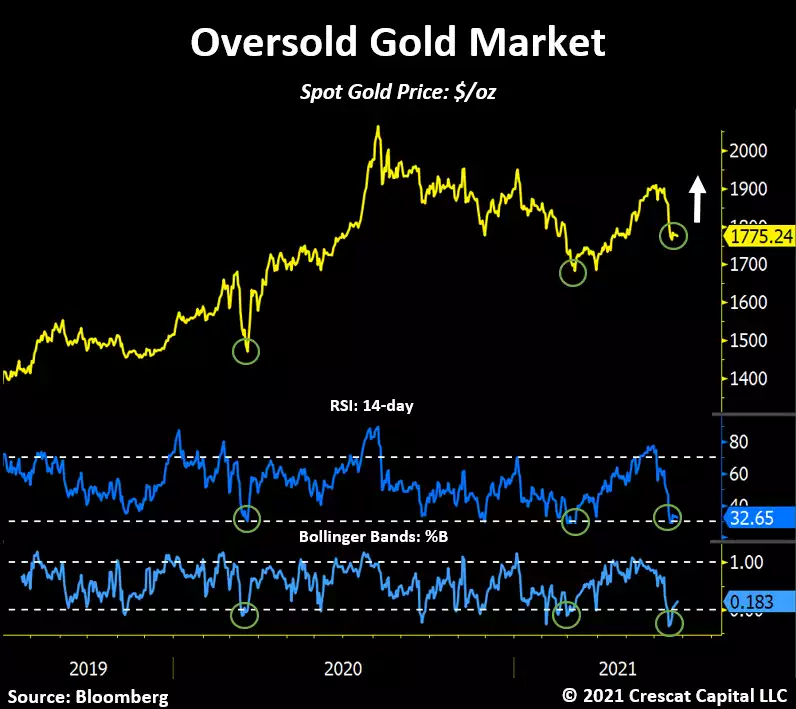

And so whilst gold and commodities have come off of late, the realization of this inevitable outcome will soon hit home. Already the gold market, technically, is looking oversold as you can see in the charts below: