Central Banks Getting Ready with Gold

News

|

Posted 14/03/2018

|

6920

We learned last week that Hungary joined the recent moves of Austria, Germany and the Netherlands in repatriating their gold reserves to home soil. The Hungarian National Bank announced it was bringing back its 3 tonne of gold from London vaults to further strengthen market confidence towards Hungary.

Like many countries Hungary sold off most of its gold after the end of the Bretton Woods system where money was backed by gold. It, like most countries, saw the future in pretend (Fiat) money and bought debt in the form of bonds paid for with real money (gold). Prior to 1970 Hungary held around 70 tonne, not dissimilar to Australia’s current holding of 79.7 tonne. Of course Hungary has a relatively tiny holding but it is a reminder of the changing attitude of central banks.

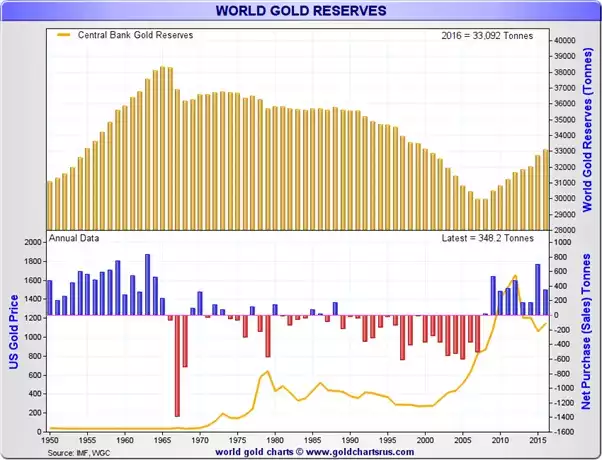

The charts below clearly map out the psychology of the central banks from prior to the end of Bretton Woods to now. After Nixon removed the gold peg to the USD in 1971, you can see central banks selling off the ‘barbarous relic’ and buying other people’s debt in the form of bonds instead. What could possibly go wrong? The GFC gave them a salient reminder of exactly what can go wrong in a debt based system and whilst the central banks printed their way out of it before it fully unwound, they (probably more than most) knew this was only a temporary fix and look what they started doing afterwards…

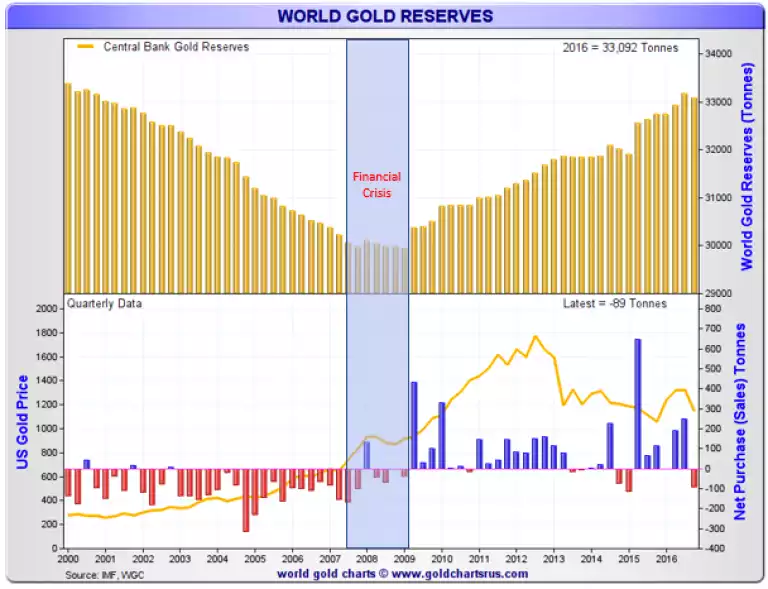

Zooming in a little…

We speak regularly of the strategic build up of gold by the east and Russia and the following chart is a reminder of the sheer scale of this:

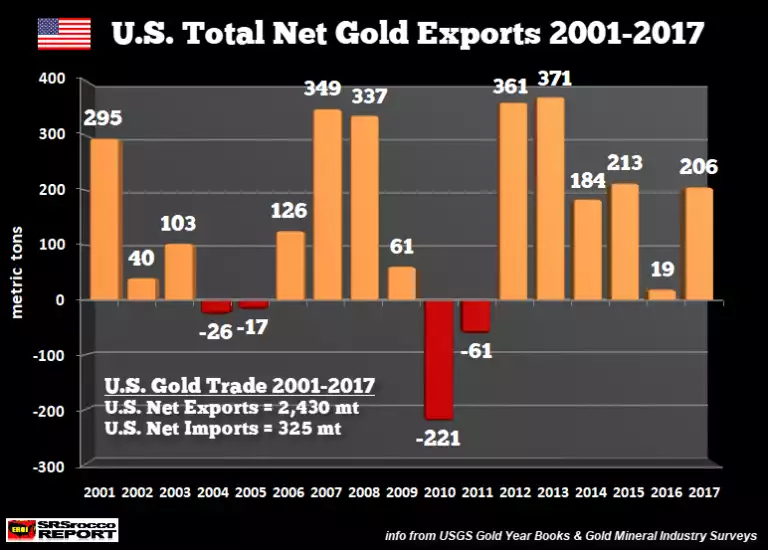

So where is all this gold coming from (other than China being the world’s biggest producer)? The west. The west is still fully on board with the ‘everything’s awesome’ ‘credit bubbles never end’ narrative. Consider the following graph for the US alone…

For context, since the turn of this century, the US exported just less than the combined official gold reserves of U.K., Saudi Arabia, Portugal, Taiwan, European Central Bank and India…