Euro Money Printing Gone Mad

News

|

Posted 09/09/2016

|

4937

As we reported in today’s Weekly Wrap and further to Wednesday’s article on the topic, the ECB last night surprised the market by not announcing any extension of their already $90b/month QE program nor lowering of their -0.4% deposit rate. Even though they lowered their inflation forecast well below their target and to an almost stagnant 0.2% from 1.1% just a year ago (when they thought all this stimulus would actually work…), they appeared reluctant to move at this stage, most likely waiting to see what the US Fed will do in the September meeting on the 21st.

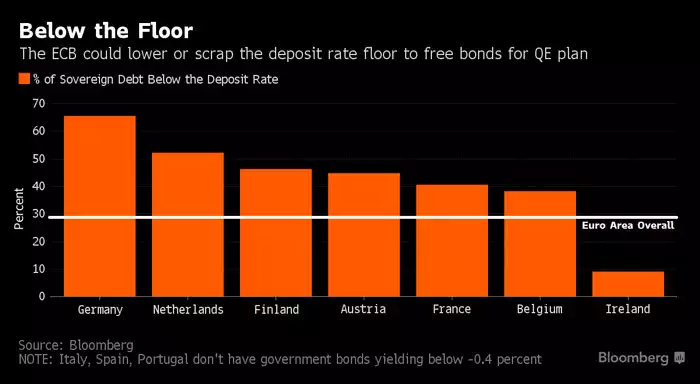

As we touched on in Wednesday’s news, their issue is they have current rules around what they can and cannot buy. These include purchasing bonds with maturities ranging from 2-30 years but more critically in this world with $13.5 trillion of negative yielding bonds, they must purchase bonds with a yield above their deposit rate of -0.4%. When you look at the graph below from Bloomberg you can see how man that excludes

These restrictions eliminate around $1.5 trillion of otherwise eligible Government bonds. To make it harder they can’t buy more than a third of any EU member country’s bonds, all equating to only around $2 trillion being available. Purchases are then further restricted as they are supposed to be proportionate to the size of those country’s economies meaning the more attractive propositions like Germany are likely to be the ones they exhaust first. All terribly inconvenient when you just want to print with reckless abandon to achieve…. just 0.2% inflation!?

As Citi bank said in an interview this week:

“There are various estimates of when the ECB will hit a wall because it does not provide exact breakdowns of the bonds it already owns — but everyone agrees that it is close to reaching its limit….And the bank cannot slow the pace of bond purchases without sending out a signal to the markets that something is wrong.”

The obvious question is…. When you have a negative interest rate, when there are $13.5 trillion of bonds where you PAY for the privelege of holding someones debt (not them paying you interest for your risk), and when your central bank is buying basically all available debt issuance above your said negative interest rate with freshly printed money to the tune of $90b per month, and your inflation and GDP are both not responding… why would increasing that indicate “something is wrong”.