WGC – 2017 Full Year Gold Demand Trend Report

News

|

Posted 07/02/2018

|

6272

Yesterday the World Gold Council released their 2017 Full Year Gold Demand Trends report. The following is a summary of the report:

Overall

- Despite a 6% gain in the final quarter, gold demand for the full year declined 7% to 4,072 tonne.

Investment

- Unsurprisingly gold demand for investment purposes fell in 2017. After the market turmoil in 2016 and the return to ‘everything’s awesome’ in 2017 gold was never going to surpass 2016’s levels.

- ETF inflows, whilst still a robust 203 tonne, were down nearly a third on 2016’s big 547 tonne figure. Interestingly, 73% of ETF inflows were Europe based as arguably Europe is more attuned to geopolitical risk and still exposed to negative interest rates, compared to the blindly bullish US market and its rising rate environment. With the volatility in markets over the last few days the 2018 Q1 figures for ETF’s will be one to look out for.

- Bar and coin demand dropped 1.9%, or 19.5 tonne to 1029 tonne entirely due to US coin demand making a record drop from 93t to 39t, its lowest since just before the GFC in 2007. Countering that, we saw China up 8% to 306t, its second highest ever, and India up 1.6% to 164t. Interestingly Turkey had the biggest jump, 78%, to 52t.

Jewellery

- Overall jewellery demand rose 4% to 2136 tonne, seeing its first year of growth since 2013.

- India lead the way, up 12% to 563t (over a quarter of the whole market) and China was up 3% to 647t (nearly a third of the whole market).

- Amusingly, for probably the same reason investment gold was down in the US (‘have you seen my stock portfolio dude!?’), jewellery returned to growth in 2017, up 3% to 122t, as people started spending their awesome unrealised gains….

Central Banks

- Continuing the unabated annual net increases since the GFC, central banks acquired another 371 tonne, though this was down 5% on 2016.

- Russia was the dominant player accounting for over half of that at 224 tonne and China was notably quiet. Whilst the WGC dare not talk about it, we have written a few times about the transparency of China’s official reserves. Even the most die hard believers acknowledge China are most likely only telling the market what they want them to know and for a country that produces 450 tonne (and keeps every oz) and imports 1000 tonne, its clearly going somewhere…

- Venezuela effectively sold 45 tonne in Q4 for its widely publicised ‘cash needs’.

Technology

- Up 3% to 333 tonne, 2017 saw the first increase in 7 years.

- Electronics is the dominant player, up 4% to 265 tonne

- It seems people want white fillings not gold and dentistry continued its decline, down another 6% to 17 tonne. Go figure…

Supply

- Total supply fell 4% to 4,398 tonne

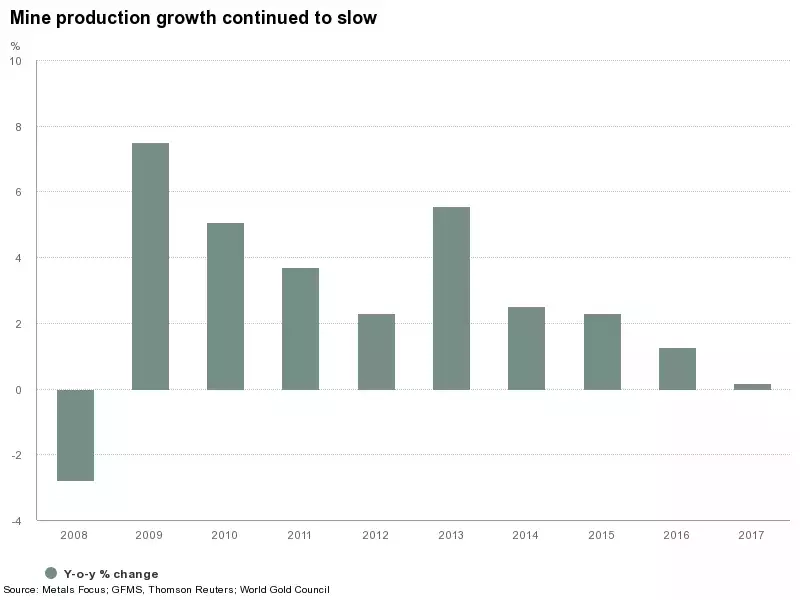

- Reinforcing the ‘peak gold’ calls, mine production remained relatively stagnant at 3269 tonne but the graph below tells the bigger picture story.

- Recycling supply fell sharply (10%) to 1,160 tonne, probably due in part to a lower price than the rally in 2016.