Ethereum 2.0 – Why It’s BIG News

News

|

Posted 18/08/2020

|

6351

As Ethereum celebrates its fifth birthday, we are a step closer to the launch of ETH 2.0, a system-wide upgrade that will fundamentally change the way the blockchain operates. These changes include a shift away from proof of work to proof of stake (PoS), the implementation of sharding, and an improved virtual machine – the Ethereum WebAssembly.

Overall, these upgrades will make Ethereum more efficient and bring improved throughput compared to the current limit of 10-15 transactions per second, opening up dApps to operate with less latency and at lower network fees.

ETHEREUM CURRENTLY

Ethereum is the second-largest cryptocurrency by market capitalisation and the most popular programmable blockchain network. In Q2 2020, the total transaction volume on the Ethereum network reached an all-time high of US$14.3 billion, with 768 active dApps and over 1.5 million users. This rapid growth in dApps usage recently has been driven by the rapid rise of decentralised finance (DeFi).

Ethereum’s extreme popularity does not come without its drawbacks. Ever-increasing transaction fees have been problematic whenever the market heats up. Data on etherscan shows the average gas prices have increased over 400% in the past 3 months. This means a transfer on the Ethereum network has gone from $0.50 on average to over $15 during periods of network congestion.

Ethereum has a scalability trilemma. Luckily, Ethereum’s founder recognised the problem early. The network has severe trade-offs when choosing between scalability, security and decentralisation – where only two can be satisfied.

ETHEREUM 2.0 SOLUTION

Ethereum 2.0 will attempt to make the Ethereum network more scalable and efficient while retaining or even improving its security and decentralisation. The primary change will be changing to a proof of stake consensus model. This will make the entire network more energy-efficient and decentralised.

The proof of work system that Ethereum is moving away from has a consensus mechanism which requires validators to buy expensive hardware to solve computationally intensive cryptographic equations. This process is also energy-intensive, increasing validators electricity costs.

The proof of stake system only requires validators to propose and vote on transactions and the only opportunity cost is staked collateral. By forgoing the energy-intensive mining process, proof of stake is a much more efficient, fair and environmentally friendly process than a proof of work. Because of the lack of energy consumption on the part of the validators, the rewards do not need to be as high in proof of stake as in proof of work too, leading to lower token inflation.

Proof of stake relies on validators to stake large amounts of assets on the network before they can partake in transaction validation and claim rewards for doing so. This collateral at risk makes it such that if a validator acts dishonestly, their assets can be taken away by the network.

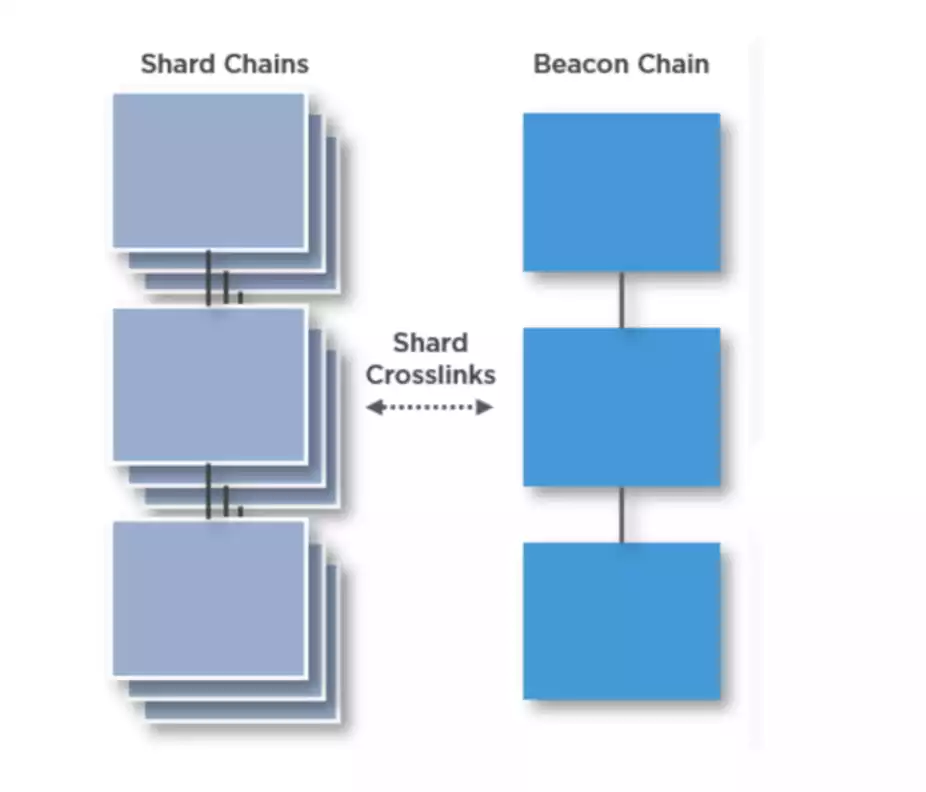

Currently, the Ethereum network can only process around 10-15 transactions per second, which is a severe limitation when network traffic is high. The main reason for this low throughput is that every node must process every transaction. While this does mean the network is ultra-secure, it comes at the cost of speed. Sharding is the scaling solution being implemented as the best option to achieve long term and massively increase scalability – achieved by removing the need for every node to verify every transaction. This is essentially freeing up the network to churn through transaction while other nodes verify another set of transaction.

IMPLEMENTATION

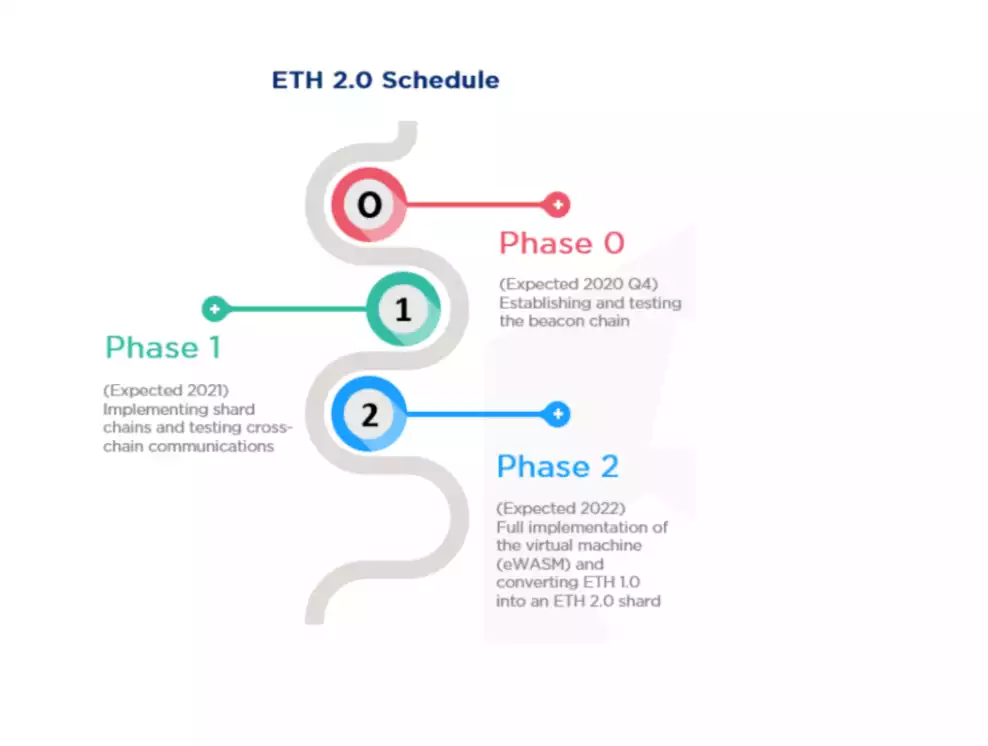

Although Ethereum 2.0 has already launched its public testnet, the fully functional version of Ethereum along with its dApp functionality and sharding won’t be live right away. Ethereum 2.0 will be launched in phases (its complexity calls for a process that is being managed extremely carefully):

ETHEREUM 2.0 ECONOMICS

On Ethereum 2.0, validators will be rewarded for securing the chain. So how can one become a validator and what kind of returns could they expect?

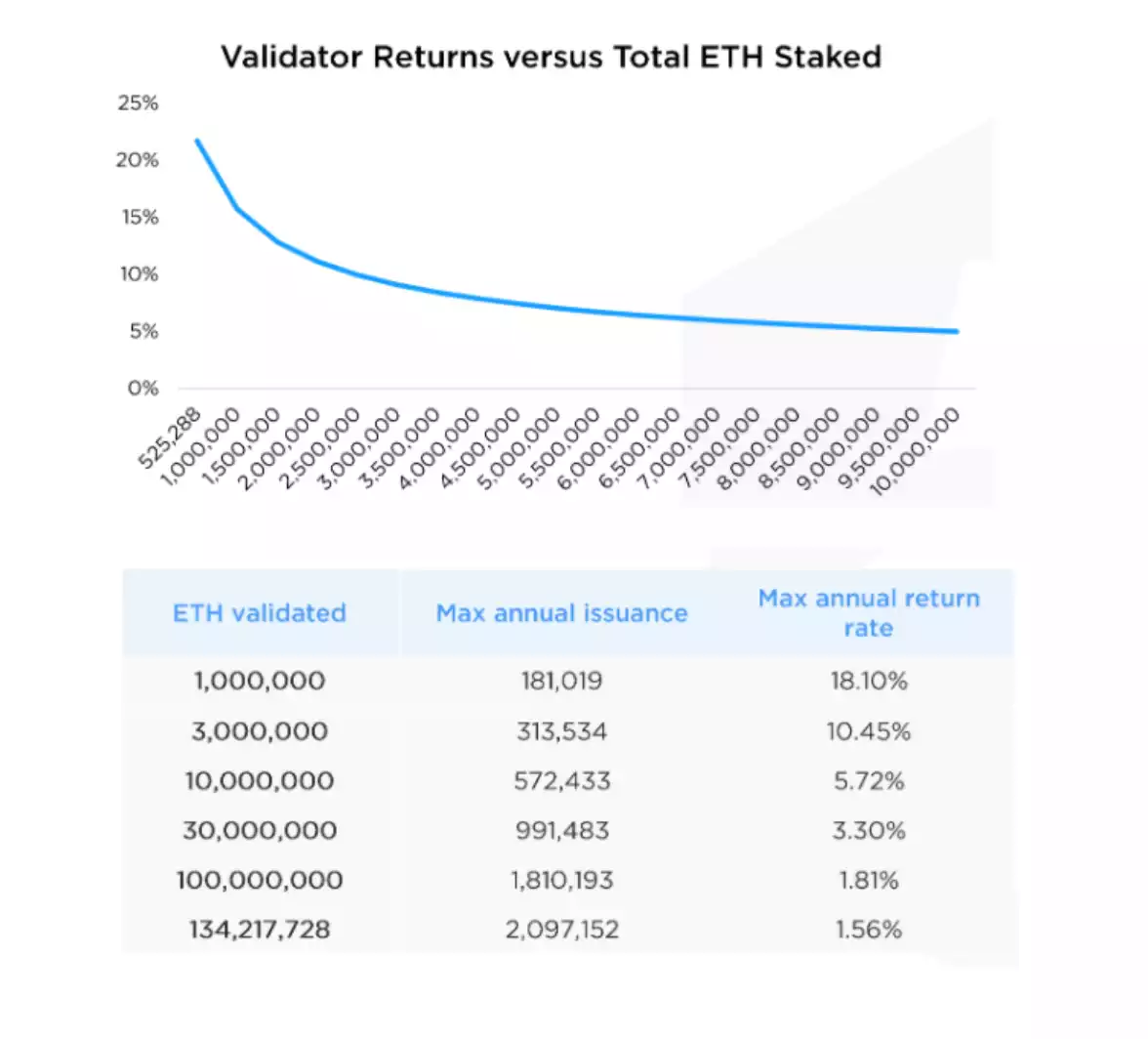

Anyone with 32 ETH can become a validator once phase 0 is implemented. Rewards for validators will vary based on the amount of ETH staked at any point in time. If the ETH staked is low, the return rate per validator increases (to incentivise additional validators to join the system.) Similarly, as the number of assets staked by validators increases, the rewards also decrease.

MARKET IMPACT

The markets attention is already turning towards the price of ETH and the effect that the network upgrade will have on the price. 3 primary factors that would impact the price of ETH that we need to consider are:

- Lockup of ETH supply

- Lower long-term token inflation

- Increased long-term network utility

The obvious argument more a price increase is that ETH 2.0 will result in higher ETH prices from a reduction in circulating ETH. Since there will be a minimum of 16,384 validators, if they are each staking 32 ETH, a minimum of 524,288 ETH is staked (that's $320 million worth at current prices). In all likelihood, ETH 2.0 will attract significantly more stakers than this too. According to research reports, over 80% of ETH supply is currently qualified for staking.

Lower long-term token inflation is a result of lower supply needed to reward validators. Once the chain migrates to ETH 2.0, the 5% inflation currently paid to miners will be replaced by an inflation rate of only 0.5-1%. Over time, this is moderately bullish for the price of ETH, since significantly less value is being sold to help the validators cover electricity costs.

Increased long-term network utility is the primary goal of ETH 2.0 and is also the greatest bullish sign for the price of ETH. Over time, the increased utility will allow for a parabolic growth in the DeFi space – a space which ETH is leading the charge in. The network is able to seamlessly support and facilitate the growth of decentralised exchanges and decentralised lending platforms (along with increased activities in other DeFi applications).

This increased platform activity is a very bullish indicator for ETH. The network as a whole will generate massively increased value to users in the long run – which should lead to increased ETH prices.