Crypto Market Rangebound – Where to Next?

News

|

Posted 28/09/2021

|

5923

The Bitcoin market experienced volatile downside price action this week, opening at $47,328 on Monday and sliding to a low of $39,876. The sell-off comes alongside continued pressure on the industry from regulators, a sell-off in equities markets, challenging conditions in Chinese debt markets, and yet another Bitcoin ban in China. Alongside this uncertainty, the week was full of exciting and positive news related to both El Salvador's adoption, and Twitter's implementation of the Bitcoin Lightning Network.

Ahead of China's latest bitcoin and crypto crackdown, on-chain data is showing that big investors have begun pivoting out of bitcoin futures and into Ethereum amid a strong divergence in demand. Large investors are avoiding bitcoin futures, pivoting instead to Ethereum as the number two cryptocurrency by value gains momentum thanks to the ongoing non-fungible token (NFT) craze and expectations Ethereum-based decentralised finance (DeFi) will rival traditional finance. The 21-day average Ethereum futures premium rose to 1% over actual ether prices. This points to a much healthier demand for Ethereum vs. Bitcoin by institutional investors.

"[Ethereum] is seeing an explosion in developer activity thanks to NFTs and DeFi," Cathie Wood, the chief executive of Ark Invest, said last week, revealing her confidence in Ethereum "has gone up dramatically."

"I'm fascinated with what's going on in DeFi, which is collapsing the cost of the infrastructure for financial services in a way that I know that the traditional financial industry does not appreciate right now," said Wood.

However, it's been predicted that U.S. Securities and Exchange Commission (SEC) could greenlight a long-awaited bitcoin exchange-traded fund (ETF) as soon as next month—something that could send the bitcoin price as high as $100,000, giving BTC a needed boost to outperform ETH. There’s still a high probability that the U.S. is just going to follow Canada, maybe with a futures-based bitcoin ETF.

"There are now over [bitcoin ETF] 30 applications, and the fact that money is migrating from the U.S.—from Cathie Wood and Ark—towards Canada, the pressure is quite strong and high for the U.S. regulators to say: 'All right, we’re kind of missing out here and we need to do that.'"

Earlier this month, major investor Fidelity urged the SEC to approve a bitcoin ETF, pointing to increased investor appetite for virtual currencies, growing bitcoin adoption the existence of similar funds in other countries, according to media reports. However, the SEC has signalled it will continue its cautious approach under new chair Gary Gensler, following suit with his predecessor Jay Clayton.

Looking at the BTC market from an on-chain point of view, we can see that only the HODLers remain. The relatively low utilisation of Bitcoin block-space has been widely discussed of late, with a case to be made on both sides as to whether it is bullish, bearish, or both:

- The bull case is that it is a result of the growing adoption of efficient transaction techniques such as SegWit, transaction batching, and the usage of Lightning Network.

- The bear case is that the 50%+ correction in May resulted in flushing out of many retail traders and investors, and thus interest in the protocol has waned since early 2021.

- The most likely case is both of these are in effect.

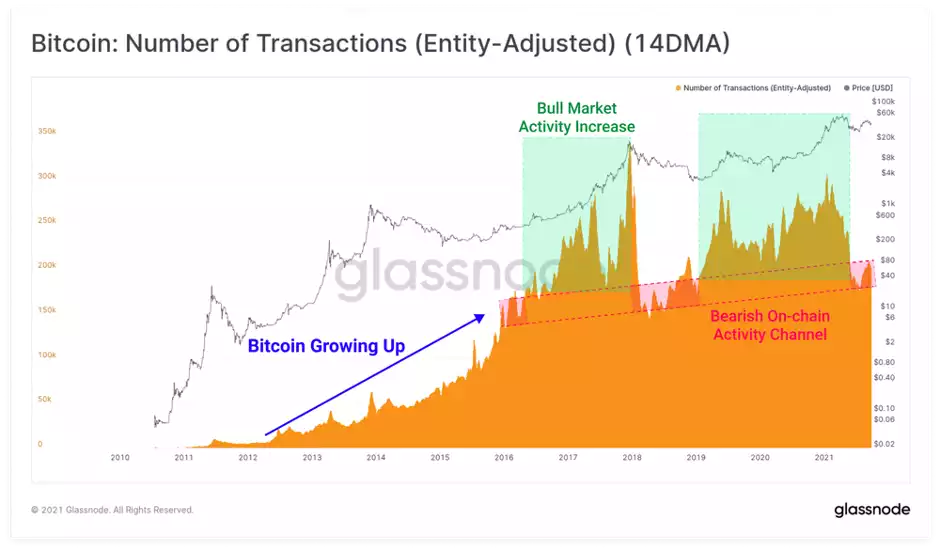

The chart below shows that transaction counts have indeed declined since May, returning to what could be considered a 'bearish on-chain activity channel'. Higher transaction counts are characteristic of bullish conditions as new entrant’s swarm into the network and demand for block-space increases accordingly. Conversely, lower transaction demand can signal fewer market participants are active, and less relative interest in the asset.

Transaction counts are currently at around 175k to 200k transactions per day which are similar to levels seen in the 2018 bear market. If that is the case, the explosion out of the lows will be unimaginable…