Equities Euphoria Sends Signal

News

|

Posted 29/01/2018

|

5710

Whilst Aussies enjoyed their BBQ lamb on Friday sharemarkets continued their incredible run in 2018, the S&P500 now up 7.4% in just 1 month to new all time highs.

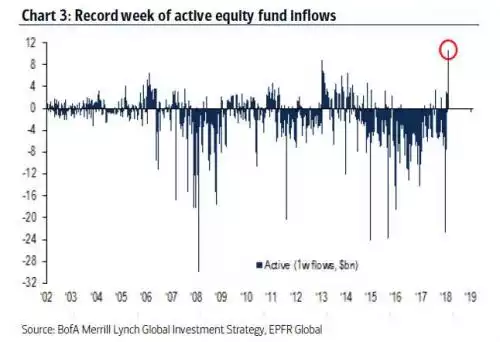

But Bank of America Merrill Lynch are now very worried. This is looking very much like the euphoria stage in a market and they say they are seeing the biggest sell signal in 5 years. The chart below shows the biggest inflows into global equity funds in a week – ever.

In addition to the above $12.2b into active equity funds (not the passive ones we reported on back here), there was a record $32b into all equity funds, and (continuing our ‘smart money hedge thesis’) a near year long high of inflows into gold, at $1.5b.

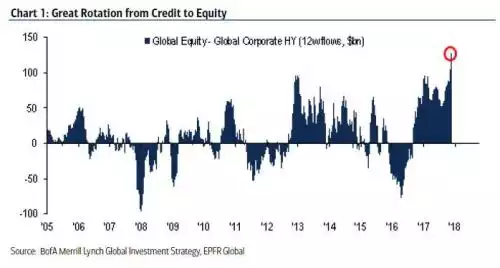

These flows are coming out of debt and also cash reserves. The market is going ‘all in’. Firstly from corporate debt:

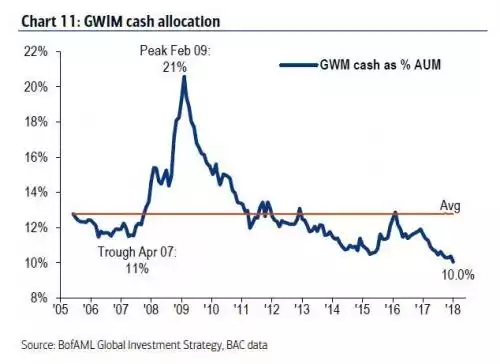

And a record amount of cash, leaving the ‘big money’ at their lowest cash position ever…(GWIM is BofAML’s high net worth fund).

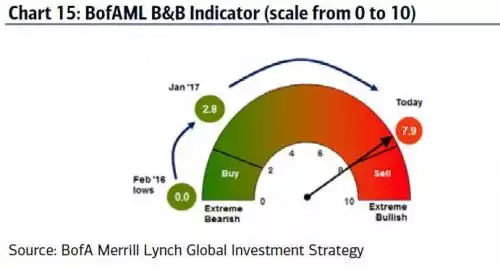

Since BofAML have been doing their Bull & Bear Indicator in 2002 they have issued 11 sell signals and nailed it 11 times. Mind you they aren’t calling for a huge crash, just a correction and with timing of Feb / March. The elephant in the room however is how this strung out ‘all in’ everything bubble will handle such a correction.