Another New 2020 Record – Over 1000 tonne into ETFs

News

|

Posted 09/10/2020

|

7062

The World Gold Council have just released their latest update for gold inflows to ETF’s for September which are remarkable in the context of the price falls we have seen over that period but also another new record.

Their highlights:

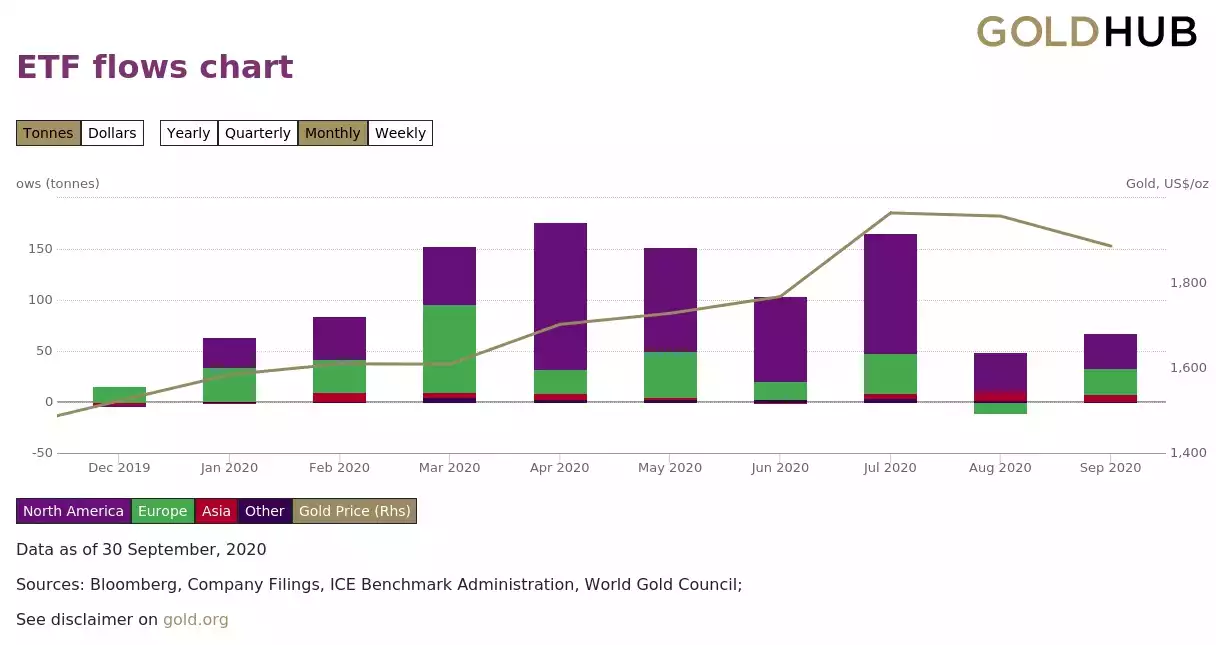

“Gold-backed ETFs and similar products recorded their tenth consecutive month of net inflows during September, matching equivalent stretches in 2008 and 2016. Gold ETF holdings increased by 68.1 tonnes (t) (US$4.6bn) or 2.0% of assets under management (AUM) despite gold’s worst monthly price performance since November 2016. Global net inflows of 1,003t (US$55.7bn) in 2020 have led overall gold investment demand and taken the gold ETF holdings universe to a fresh new all-time high of 3,880t and US$235bn in AUM.”

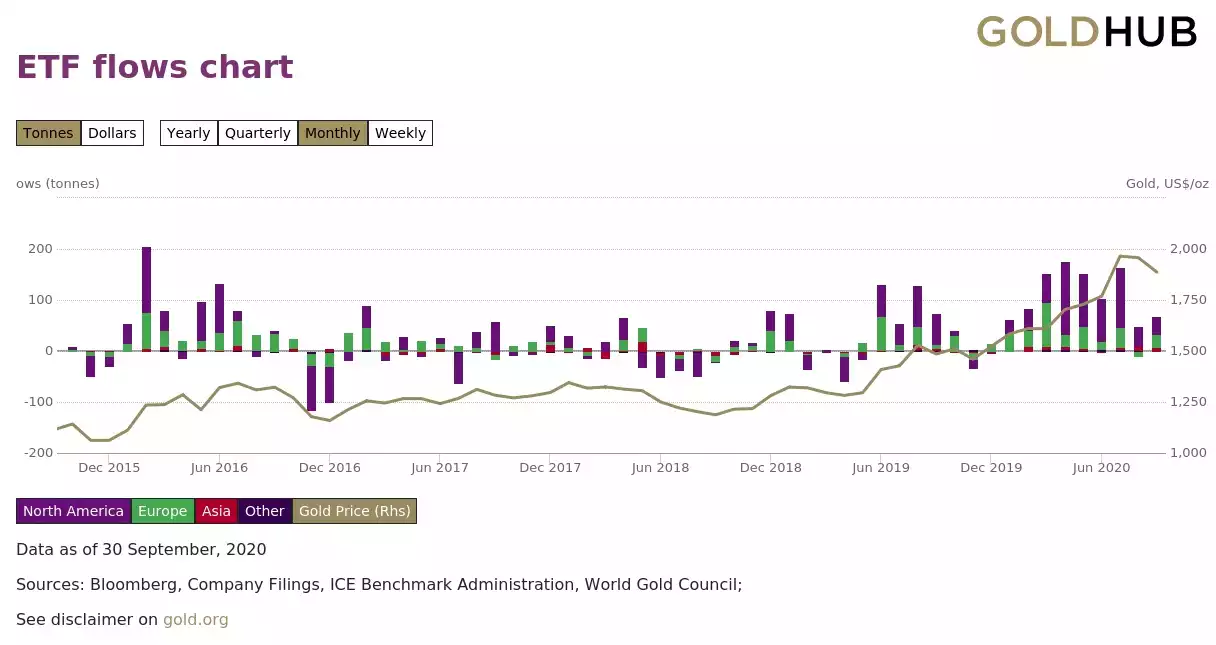

Zooming out again to look at the remarkable inflows since the start of this bull run in November 2015 you can see how solid they have been this year in particular.

You can see too how dominant the North American market is. It should be noted that European’s have a much higher propensity to buy physical bullion than Americans and hence ETF’s seen as a secondary option as is also the case for Asian investors. Simplistically, Europeans and Asians have a deeper ‘cultural memory’ of failed governments, failed currencies, and geopolitical turmoil. They see ETF’s as yet another derivative or ‘paper promise’ with the counterparty risk that accompanies that. Physical bullion or fully allocated bullion removes that counterparty risk and hence its preference by those who have memories for when that really matters…

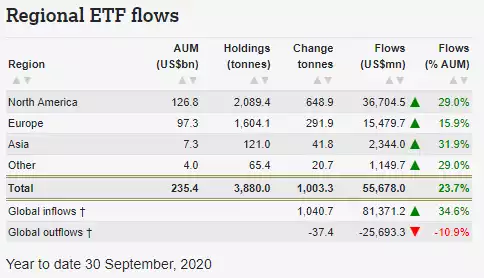

However in the meantime this is nothing but bullish for gold holders as it is all demand nonetheless. That year to date total inflows of over 1000 tonne is geographically split as follows:

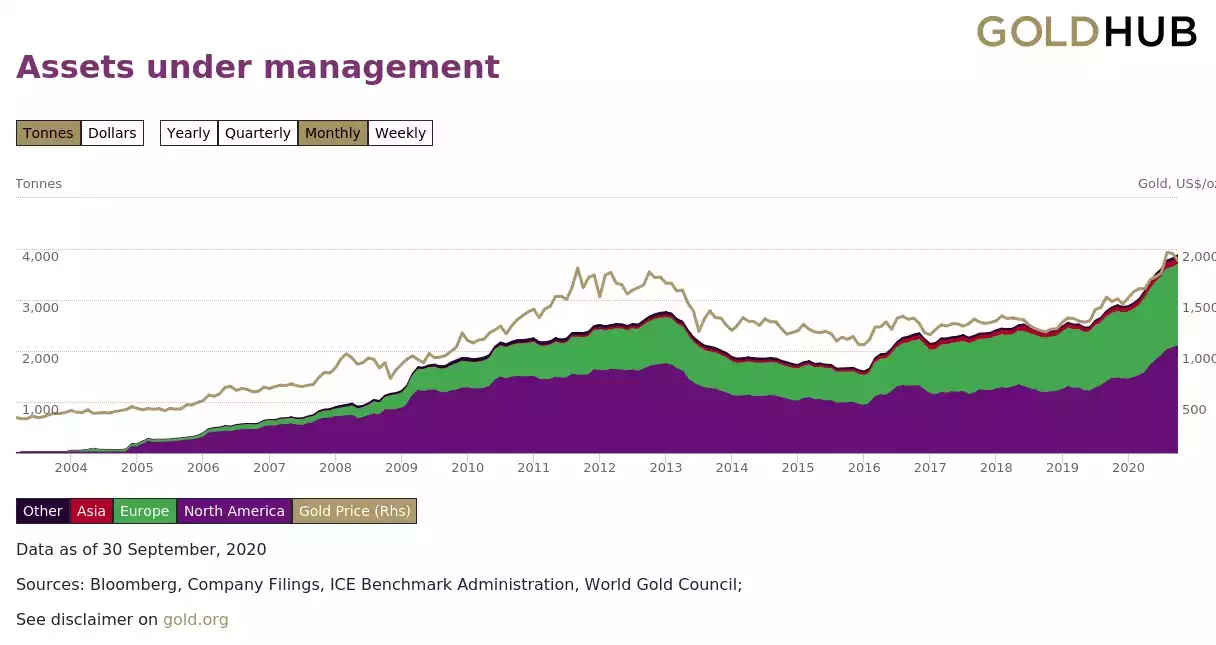

And looking at the total AUM since inception in 2004, you can see the unprecedented nature of that 1000 tonne in one year – and we are only at the start of October!!

The end of September also marks the end of the 3rd quarter.

“Gold ETF holdings grew 7% during the third quarter, adding 273t or US$16.4bn in assets as the price of gold finished nearly 7% higher during the same period. North American funds remained the primary recipients of inflows. However, inflows in Asia stand out, as the region grew holdings by 17% and four new funds listed in China. Assets in Europe and other regions grew by 3% and 9% respectively.”

The report also gives their take on the price action in gold:

“Gold’s 3.6% September pullback was likely tactical in nature. Gold rallied sharply (22%) between April and July, reaching an all-time high in early August. When prices move this quickly there is often a subsequent pause or pullback in the price related to profit-taking or positioning. The recent Commitment of Traders (COT) report for gold COMEX futures of 759t (US$46bn) confirms reduced net long positioning. While still above the 2020 average of US$189bn, net long positioning has fallen nearly 40% since the February 2020 all-time highs of 1,209t (US$63bn).3 Volumes also fell from US$228bn in August to US$199bn in September. Notably, global gold ETF volumes fell to US$3.2bn from US$5.2bn the previous month. Despite the weaker prices, positioning and volumes, investment demand via gold ETFs increased, suggesting continued long-term strategic positioning.”

Looking forward they are seeing positive indicators for the gold price:

“The higher inflation allowance policy is gaining momentum in multiple regions

Last month, we noted that the US Federal Reserve would no longer pre-emptively increase rates to cool higher inflation, implying that rates could remain near zero for many years, and that this monetary policy philosophy could trickle into other regions, assuring negative global real rates for the foreseeable future. This appears to have been corroborated following the ECB’s announcement that it may consider allowing inflation to run higher for longer than usual. Subsequently, the improved opportunity cost of gold4 has helped investment demand so far in 2020, outweighing decreasing demand in the jewellery and central banks’ spaces.

The fourth quarter could be volatile

There are numerous catalysts for market volatility in the fourth quarter:

- US - Market analysts believe there is a good chance the US Presidential election will be contested and unresolved for some time after election day. Moreover, contentious dynamics around the stimulus bill and the Supreme Court Justice nomination are already whipsawing markets

- Europe - a no-deal Brexit scenario is possible and could disrupt trade in the region

- Global - COVID-19 cases are on the rise as we move into the fall, with President Trump the most recent infected world leader.

On a positive note, economic indicators are improving in China, and during the holiday season there could be an uptick in consumer gold purchases as China single-handedly accounts for over 20% of annual gold demand. Additionally, India (the world’s second largest gold-consuming nation) has seen healthy monsoon rainfall for a second straight year—something that has not happened since the 1950s. This could soften the negative impact of COVID-19 in rural areas which have historically generated around 60% of Indian jewellery demand. Finally, the potential for a COVID-19 vaccine emerging during the quarter has gained momentum.”

For those still looking for an ‘easier’ alternative to physical bullion but without the risk of ETF’s we remind you of our Gold Standard and Silver Standard tokens. These use the security, transparency and cost effectiveness of blockchain technology (or DLT) combined with real physical bullion in a fully allocated model where every bar’s serial number is recorded, all tokens issued backed completely by those bars, that fact verified by global assurance firm PKF, and fully insured by the world’s leading insurer. Because of the use of the blockchain and the large format of the bars used to back them, the spreads on the tokens are lower than buying any physical bullion bars.

ETF’s are deliberately vague and the Product Disclosure Statements full of ‘vomit clauses’ making them unaccountable for your supposed holdings. Gold and Silver Standard are fully transparent, fully verified, fully insured and offer free storage and ultra low premiums over taking the bullion.

Call us on 1800 987 648 to discuss or go to www.goldsilverstandard.com to learn more.