BRICS nations forming USD alternative

News

|

Posted 30/06/2022

|

8603

With China, India, Brazil and South Africa wondering if they will be next in line to suffer sanctions, the BRICS nations are forming a viable alternative to the US Dollar for international settlements. Speaking at the BRICS Business Forum on Wednesday, Putin stated

“The matter of creating the international reserve currency based on the basket of currencies of our countries is under review.” This is the most formalised movement towards a global environment that functions largely without the US Dollar. Saudi Arabia has been in talks for most of the year to sell Oil denominated in Chinese Yuan, and Nigeria is already making those trades.

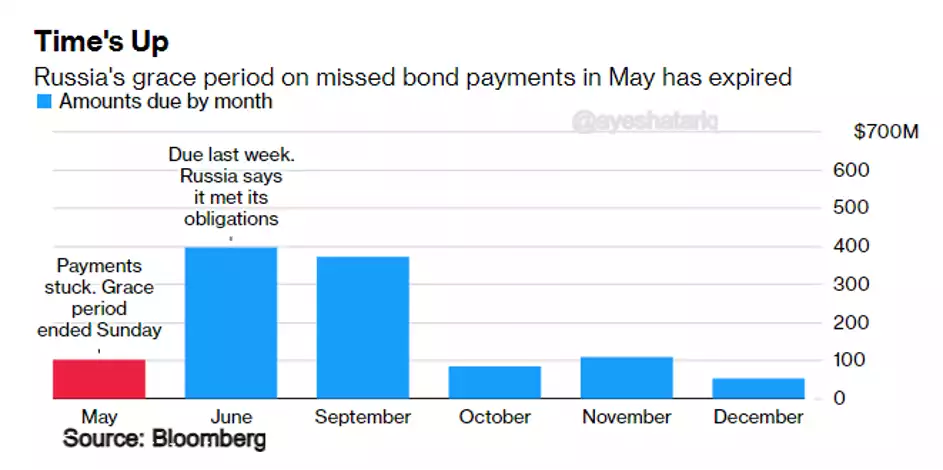

Russia has been shut out of the international financial system since the invasion of Ukraine. With a 30 day grace period expiring, they have been classified as in default according to the White House, Moodys and a number of other significant market participants and international regulatory bodies. As we covered in early February, Russia had approximately US$630 bn of reserves frozen in Western financial institutions. Responding to claims of default, Kremlin spokesperson Dmitry Peskov described claims as ‘absolutely unjustified’ and that the sanctions had prevented their intermediaries from transferring payments.

The formal default may well be a technicality, as they are unable to interact with the SWIFT system to make the payments, but it may affect their borrowing capacity in the future as they are downgraded by credit agencies. With rocketing oil and gas exports and now actively trying to devalue a strengthening ruble to protect export competitiveness, the Russians are far from hard up when it comes to currency.

Other countries outside of the NATO block are looking at the Russian predicament and making alternative plans. Ironically, the US’s use of the dollar as a weapon is pushing other countries away from the dollar hegemony.

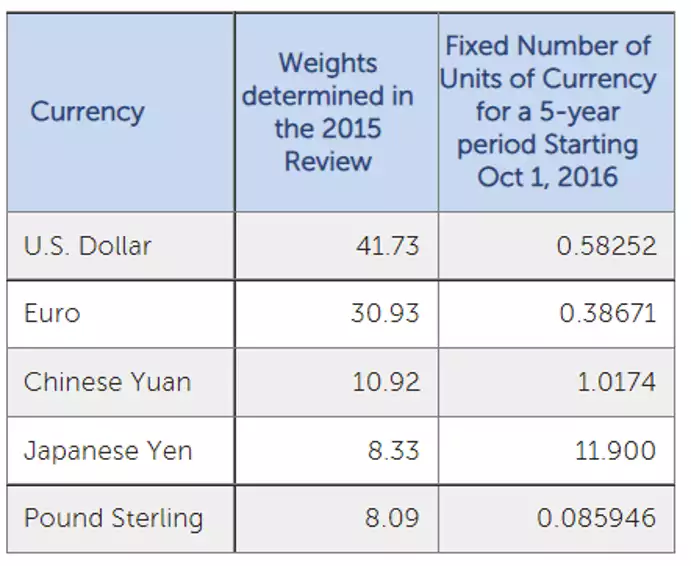

According to the International Monetary Fund, a number of central banks are seeking to “de-dollarise” but holding more non-traditional forex reserves such as the Chinese Yuan, Swedish Korona and the South Korean Won. The statements coming from the IMF are significant because they have long been the distant second in terms of global payments with their own basket of currencies which include: the Dollar, Euro, Yuan, Yen and Pound Sterling. In 1970, the International Monetary Fund introduced a scheme for the creation and issue of Special Drawing Rights (SDRs). It was initially pegged to gold but was replaced with the weighted basket of currencies in the table below soon after.

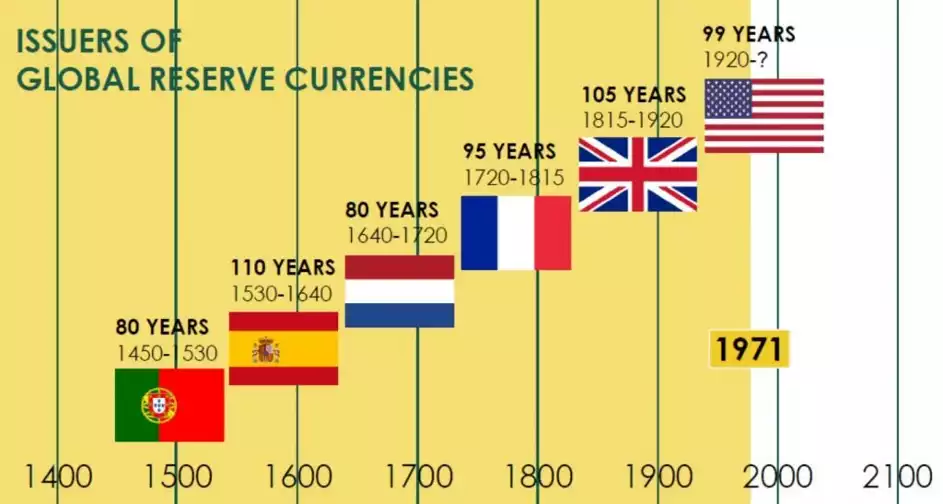

What does all of this mean for precious metals? With the rise of every major power, the global reserve status is both a blessing and a curse. In the early stages of empire, high education standards, efficient workers, manufacturing muscles and agricultural prowess all complemented a growing war machine. As imports can be brought in purely by issuing additional fiat currency, manufacturing and agriculture move offshore and the skills and capacity of the world power slowly atrophy. This leads to trade imbalances and a weaker currency. This phenomenon is dubbed the “Triffin Dilemma” and effectively means reserve currencies have a life span.

Gold has maintained it’s purchasing power on every continent of the globe throughout all of these six previous periods of Portuguese, Spanish, Dutch, French, British and now American dominance. Currencies come and go, but gold and silver are money. When transitioning from one era to another, having a strong allocation to precious metals becomes a hedge against major collapses in purchasing power and monetary dislocation. As the US hegemony is continuing to erode and cracks become more and more evident, gold and silver continue to be the store of value and safe haven of the world.