Early signals of inflation

News

|

Posted 06/05/2015

|

4091

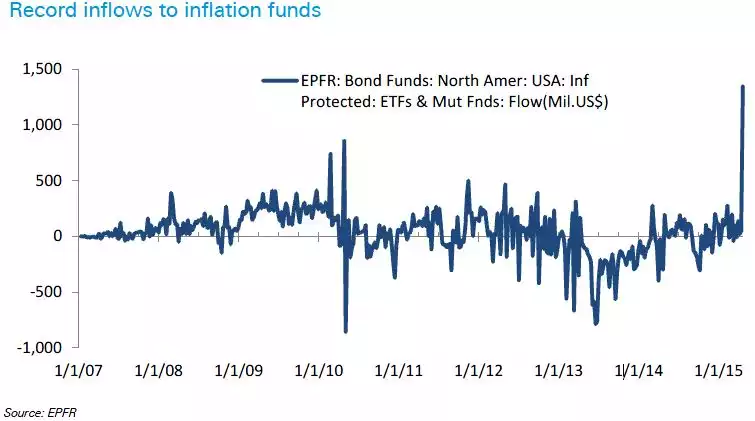

Yesterday we saw our RBA cut the interest rate to its lowest level on record as it tries to stimulate growth in our economy, inflation back to their desired levels, and keep us competitive in the spiralling global currency war. One chart (below) just released by Deutsche Bank is indicating however that the ‘smart money’ is pouring into US inflation funds at a greater rate than any time since the before the GFC. At home we’ve just seen 13 institutional investors buy over $200m of inflation linked bonds with negative yields essentially on the bet we will see further cuts to below inflation. So what does this mean for gold? Well for a start it is another symptom of a system stretched in desperation to avoid a crash, a crash that would see a flight to the safe haven of gold. Secondly these ultra low interest rates mean the ‘cost’ of owning a non-yielding asset like gold are minor, especially in comparison to taxed interest on cash deposits. But also these are early signs of a potential return to inflation, and gold loves inflation. Very early days, but a trend to keep an eye on….