Does Gold and Silver crash with the rest of the market?

News

|

Posted 07/04/2021

|

5857

As stock markets remain disconnected from national economies, many investors are nervously looking for safety in the event of a stock market meltdown, otherwise known as a “major liquidity event”. While the latter description may look like a euphemism, the key word is “liquidity”. This is because when major funds and private investors need to meet margin calls and raise cash to cover losses, ‘they sell what they can sell, not what they want to sell’.

While Precious Metals may well be one of the only places to hide, initially spot prices are likely to be dragged down in a broader panic. If that is guaranteed to be the case, then investors seeking to time the market should just hold cash and then stock up at the bottom.

Mike Maloney and Jeff Clark from GoldSilver answered this question with two key points:

- Gold and Silver significantly outperform in major crashes

- Supply to retail buyers is greatly reduced in crises

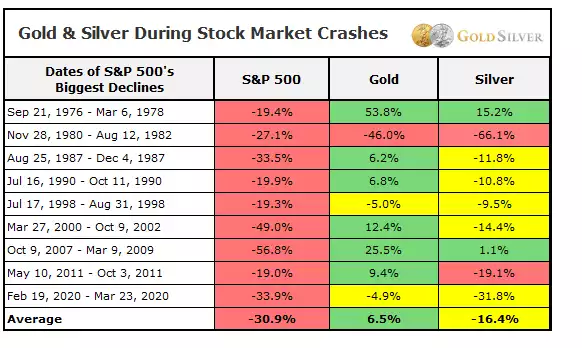

The following table from GoldSilver tracks the three asset classes with green boxes showing actual gains, yellow showing a drop but by less than the S&P 500 and red showing a fall larger than stocks.

Source: The Stock Market Crash Prep Kit for Silver & Gold Investors

As the graph shows, Gold spot prices were overwhelmingly positive throughout crashes. The yellow metal rose by as much as 53% in the late 70s and 25.5% during the Global Financial Crisis of 2008. While it didn’t rise in all crashes, the average was 6.5%, which is great compared with average losses in the S&P 500 of more than 30%. The only time gold underperformed the broader index was in 1980-1982 where the metals were coming off a glittering decade of gains.

In Silver’s case, broad market sell-offs have tended to bring the monetary metal to heel, with average losses of 16%, but these were generally significantly less than stock market losses reflecting their safe haven-like qualities.

What the table doesn’t take into consideration though, is the actual difficulty of acquiring the metals during these periods. While ETFs and proxies for the metal may be sold off significantly, retail demand for metals ramps up as people seek the safety of hard assets. While spot prices may drop suddenly in a panic, investors are even less likely to be willing to sell during those periods.

The moral of the story is: a healthy allocation to Precious Metals, in particular gold, is essential to any balanced portfolio.