Is the Silver Market Cornered?

News

|

Posted 20/12/2016

|

6683

There is a bit of speculation going about that the silver market has effectively been cornered. You may recall the famous Hunt Brothers’ move on silver where they and some business partners effectively cornered the silver market by buying up around 130m oz from 1973 to 1980. That holding accounted for over 40% of the (then) global annual production and drove the price up from $3 to $50 over those 7 years.

Any follower of COMEX analyst Ted Butler will know he maintains J P Morgan have simultaneously been suppressing the price of silver by being the biggest paper ‘short’ (futures seller) on COMEX and biggest buyer of physical silver at the same time. Or as he puts it:

"This year, JPMorgan has taken delivery of more than 6,000 net silver futures contracts (contracts stopped minus contracts issued), all in its own proprietary trading account. That's more than 30 million ounces of silver acquired by JPMorgan, most of which eventually found its way into the bank's COMEX warehouse.

The big theme, as I see it, is JPMorgan becoming more aggressive in acquiring physical silver and gold while at the same time reducing its COMEX short position in each almost as aggressively. It's hard to imagine a more bullish backdrop for futures prices."

Last we read, he has their physical holdings in the order of 300m oz.

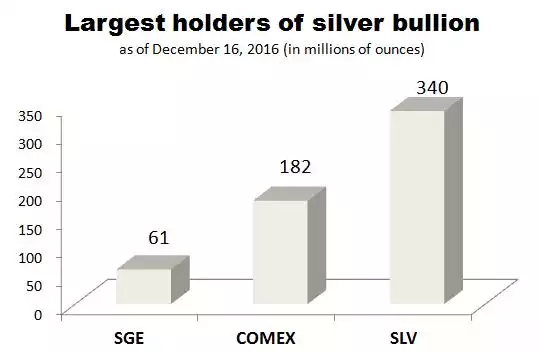

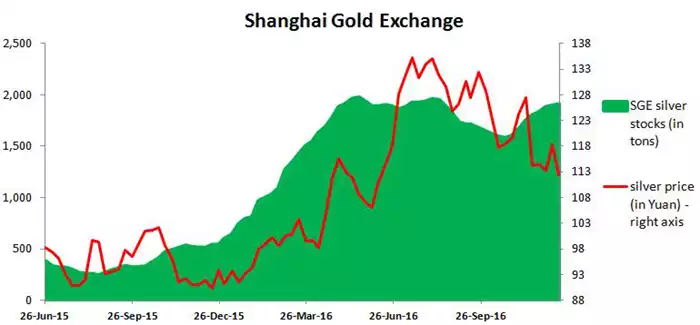

But beyond J P Morgan the concentration of holdings is extraordinary as well. Since the low in the Silver price late last year China ‘backed up the truck’ and acquired huge amounts of silver per the chart below:

Their current holdings (as at 16 December) is 1,898 tonne or around 60m oz. As with gold the Chinese like to buy the dip and you can see they took the foot off as the silver price got crazy this year but are firmly back in the game now. That they increased their holdings by over 700% in less than a year shows how quickly this can happen.

The other big player, as we’ve reported during the year is the ETF’s and non bigger then SLV. During the year, holdings sky rocketed to 11,270 tonne (350m oz). That number sold off a bit in the big correction we are currently experiencing but nowhere near to the extent of gold. Ted Butler maintains this was a big source of J P Morgan acquiring physical too.

And of course J P Morgan aren’t the only participant on the COMEX and they are in the Commercial category too. The Commercials are still net short silver and the speculative/hedge fund Managed Money category is now again near a peak net long position. They’re back.

Looking collectively at these 3 and you see that they are around 66% of forecast 2016 silver production (887m oz). That makes the Hunt Brothers (at 40% at its peak) look decidedly underweight. With 50% of silver used in industry, 66% takes on a whole new meaning from a supply & demand perspective too….