Do As They Do, Not As They Say

News

|

Posted 17/07/2018

|

8000

During the days of the great gold rushes, regular people who got in early made fortunes. These weren’t mining magnates or industrialists. Much like today’s crypto investors, they were savvy speculators pouncing on an opportunity. What happened to all those early-stage prospectors? Many of them were swindled out of their mining shares.

At the time murder, intimidation, and misinformation were used to force people to sell their claims. Unscrupulous manipulators would even go as far as purchasing newspapers in the town to influence public opinion. Crypto investors may recognize some of these strategies in a modern context. In a bid to buy in cheap, gold manipulators started to float rumours that the government would seize all land in the town. Prospectors believed the rumours and sold their mining stakes for small fractions of their underlying value.

Today we hear regular stories in the press about how the Securities and Exchange Commission (SEC) is cracking down on cryptocurrencies. We hear that the Commodity Futures Trading Commission (CFTC) is starting a new investigation. We hear JPMorgan’s CEO saying he’ll fire any of his employees buying cryptos, then we find out his traders in London are buying with both hands. We hear central banks float stories designed to scare and ward off crypto investors (you may recall our article on BIS recently). In February 2018, the Polish central bank even admitted it hired a firm to spread a “smear campaign” against cryptos.

All year long, we’ve been under assault by rumours of central bank collusion against cryptos: threats of bans… endless investigations… and the ceaseless drumbeat of negativity from the traditional press. And yet, amid this shower of negative news, careful observers will have noticed institutions are actually running as fast as they can into crypto investments.

Right now, we’re seeing financial institutions, regulators, and the press drown the market in negative news. They’re using the same old tricks used to scare speculators from the gold rush days to scoop up the bounty for small fractions of underlying value, and it’s working as well as it did back then. Institutions are getting the best prices on cryptos since mid-2017. While the average investor is panic-selling, big investors are buying.

Crypto Wealth Is Being Redistributed

Over the last 90 days, we’ve seen some of the biggest investors in the world flood into cryptos:

• Wall Street investment bank Goldman Sachs announced that it would launch a crypto trading desk.

• Susquehanna, the 12th-largest trading firm in the world by volume, announced it would start trading cryptos, too. The firm even went as far as creating its own custody company to hold its cryptos.

• Billionaire investor George Soros, one of the world’s greatest money-makers, gave the green light to his team to buy cryptos.

• Coinbase, one of the world’s largest crypto exchanges, launched a crypto index fund for wealthy investors and institutions.

• Financial services company State Street said it’s considering acting as a custodian for bitcoin. State Street has $2.7 trillion under management.

• Wellington Capital, with over $1 trillion of assets under management, stated its intention to start trading bitcoin.

• The Rockefeller family’s venture capital firm, Venrock, said it’s also buying cryptos., and finally;

• Last night the world’s largest asset manager, BlackRock, announced it had formed a team to look into ways to take advantage of the cryptocurrency market and blockchain. This latter announcement saw Bitcoin jump over $100 back above $6500.

Large numbers of big name lawyers in the investment space are overwhelmed with crypto questions from their institutional clients. That’s just the latest evidence that institutions are trying to get into this market - not stay out of it.

Don’t Fall Victim

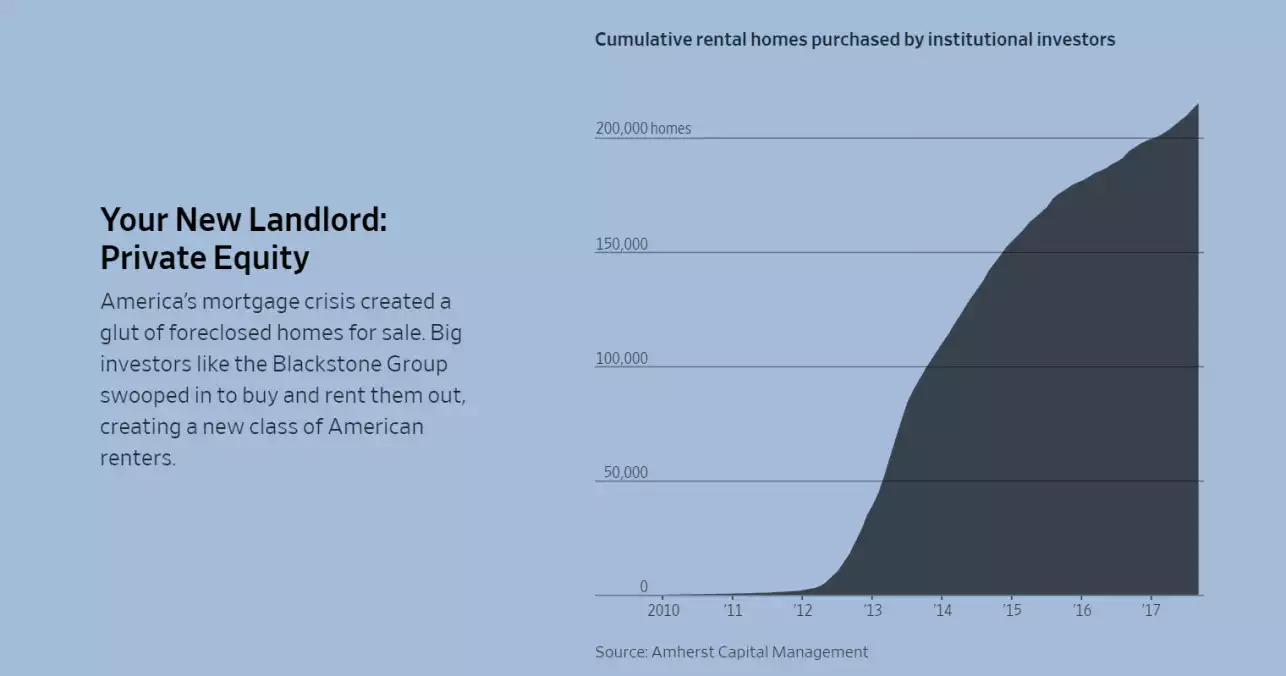

Make no mistake, we appear to be in the middle of a massive handover of wealth from individuals to institutions. We saw this happen after the housing crisis in 2010–2012, when institutions started buying up foreclosures by the thousands… but individual investors couldn’t get a mortgage. Below is a visual depiction of wealth transfer after the 2008 GFC.

We also saw it in 2003 after the dot-com crash, when institutions started buying up internet and technology stocks on the cheap, but in the mainstream media they kept telling the public it was too early to buy. We’ve seen this institutional blueprint for stealing wealth play out again and again.

To not be a victim of this strategy the key is to focus on what institutions are doing… not on what they’re saying. Across the world, institutional investors are embracing cryptos - not rejecting them. Just as the manipulators made a fortune using misinformation to buy up gold mines on the cheap, institutions know they will make vast fortunes buying cryptos at depressed prices. Otherwise, they just wouldn’t bother with it.