DeutscheBank – Bubbles Everywhere

News

|

Posted 07/09/2017

|

8259

Gold’s price drop last night is almost sadly amusing… the debt ceiling crisis has been delayed! Hurray! Who needs gold now?

Ummm… by 4 months! ‘Can’ kicked. Even the Donald is not happy…

Such is the attention span and debt addiction of this deluded market that a 4 month delay to something that few people actually think will play out sees shares rally and gold come off.

However lets cross the Atlantic to Europe where the debt and monetary stimulus insanity is in full swing. Yesterday and last night we heard yet more warnings of the repercussions of the post GFC central bank stimulus strategy.

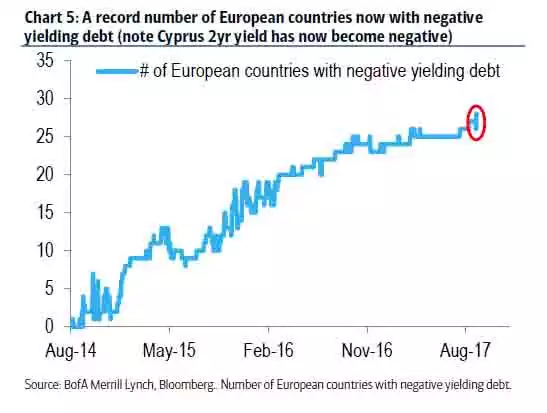

First for context you may recall our recent article on the incredible amount of negative yielding Euro debt. The chart below shows the proliferation of this economic anomaly since 2014 post the Euro debt crisis:

Is it any surprise then, that overnight we learn that Europe’s biggest bank, Deutsche Bank, is warning of trouble ahead. DB’s CEO said this (courtesy of Bloomberg):

““We are now seeing signs of bubbles in more and more parts of the capital market where we wouldn’t have expected them," and

"the era of cheap money in Europe should come to an end - despite the strong euro."

Before we get lured into thinking a bank cares and is worried about investors losing their shirts… the main thrust of his concern is that just as people are turning to these bonds and gold as they become increasingly concerned about a looming pop of the aforementioned bubbles, they are also turning to cash. That cash ordinarily finds its way into his bank, some EUR285b at last count, and with negative interest rates that actually costs him money. Whilst not everyone is in love with banks, the reality is they constitute a large part of the economy and financial markets and that’s ultimately not good for investors either.

The choice of more QE stimulus, however, may soon not be the ECB’s to make. The following also from Bloomberg yesterday:

“Bond scarcity is increasing in more and more countries,” says Louis Harreau, an ECB strategist at Credit Agricole CIB in Paris. “The ECB will be forced to reduce its QE regardless of economic conditions, simply because it has no more bonds to purchase.”

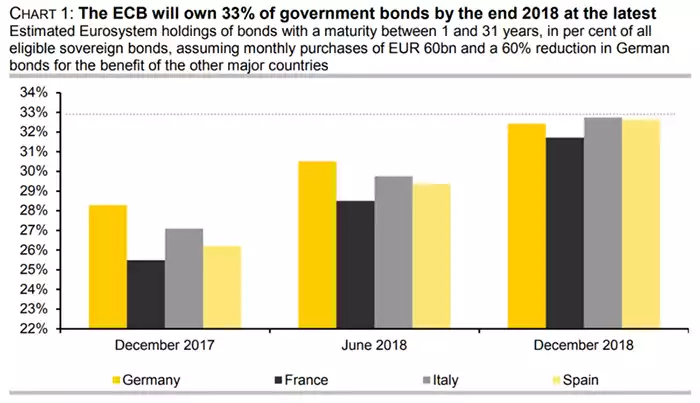

That’s right, the ECB have monetised soooo many bonds they are starting to run out! They have a rule that prohibits them buying more than 33% of a country’s debt and they are racing toward hitting that limit in 4 of the biggest economies per the chart below:

Commerzbank Chief Economist Joerg Kraemer has this to say:

“It appears that the ECB’s lone viable option is to accept the legal limits and gradually scale back the purchases next year,” says Kraemer. “In a first step, it could reduce the monthly purchases to 40 billion from 60 billion euros at the start of 2018 and step back further at midyear. But by the end of 2018, the purchases are likely to be history.”

The most casual observation of global financial markets in recent times shows that when talk of reducing stimulus – be that low or negative rates, quantitative easing, or kicking the debt ceiling can down the road – happens, those markets spit the dummy and gold goes up. We are apparently on the verge of both the US Fed and ECB actually taking the plunge of tightening in a meaningful way. Central banks tightening into a fundamentally weak economy never ends well.