China’s Economic Freeze in Charts

News

|

Posted 17/02/2020

|

13378

China’s Economic Freeze in Charts

As we discussed on Friday, the implications of the Coronavirus on the economic house of cards that is China cannot be understated. Today we give a quick run through of the quantifiable impacts already.

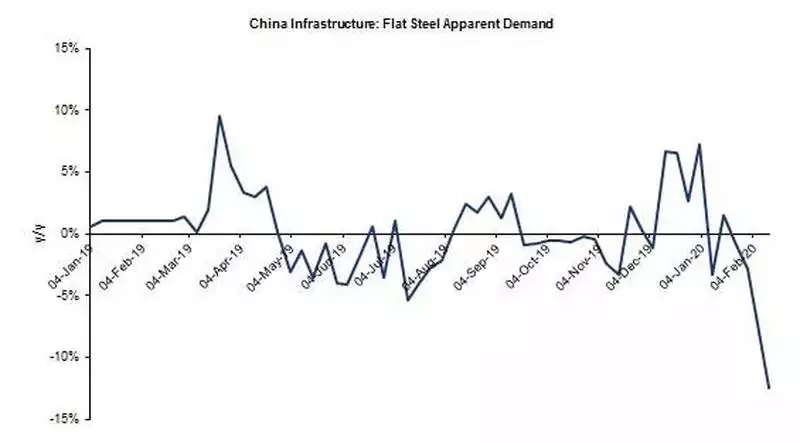

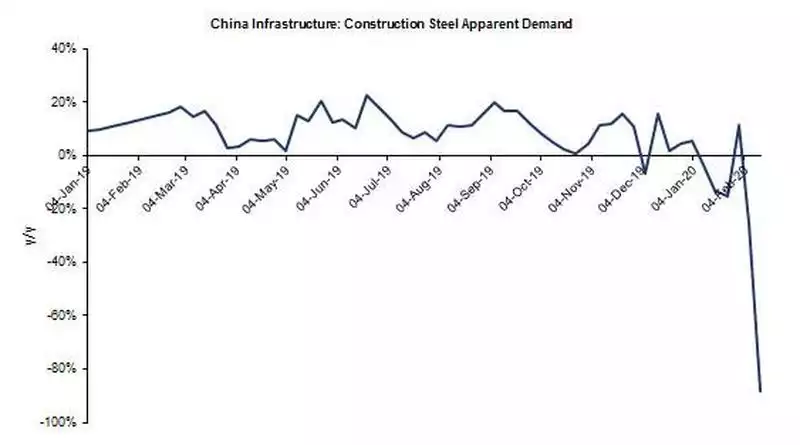

First, and no surprise to the materials supplier - Australia, a huge component of China’s GDP is its investment in infrastructure and fixed assets through construction and manufacturing – all requiring steel. For Australia that has been fantastic as we provide the ore, the coking coal and the thermal coal to make it. However since the outbreak steel demand has dropped 40%, down 12% for flat steel used for manufacturing cars and the like and 88% down for construction steel, approaching zero.

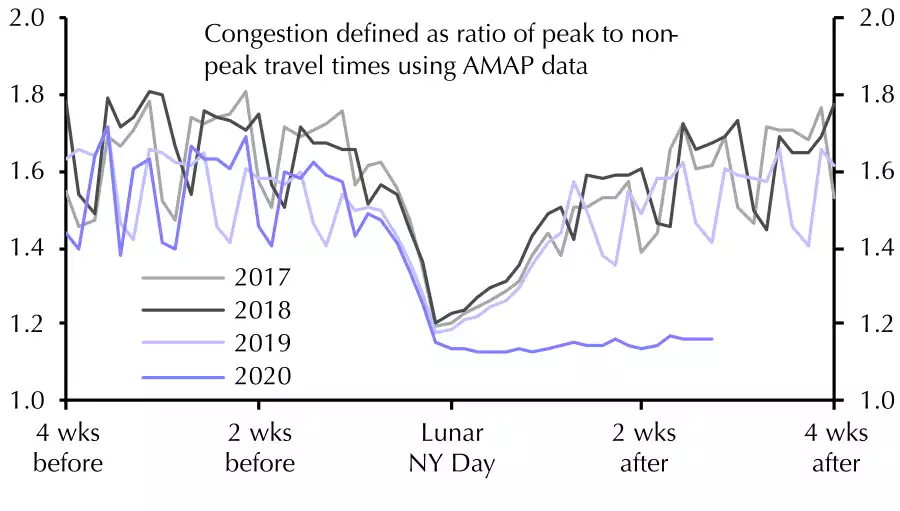

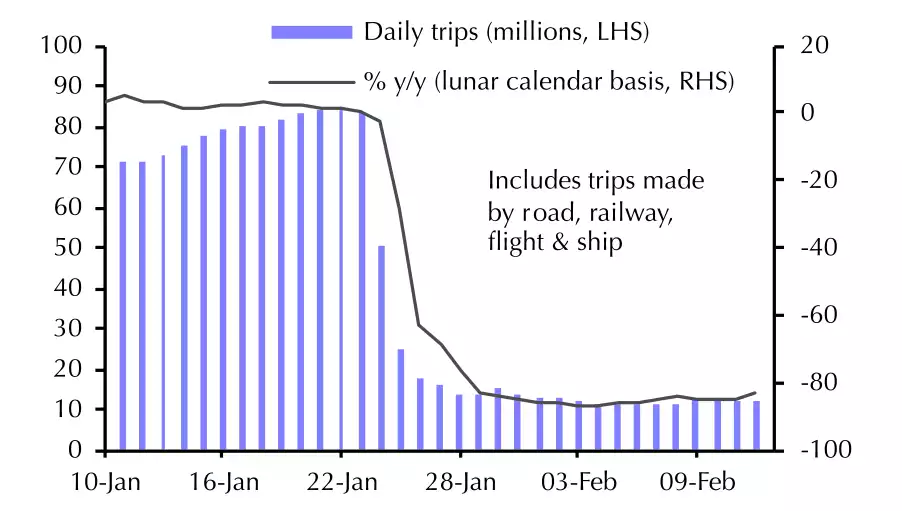

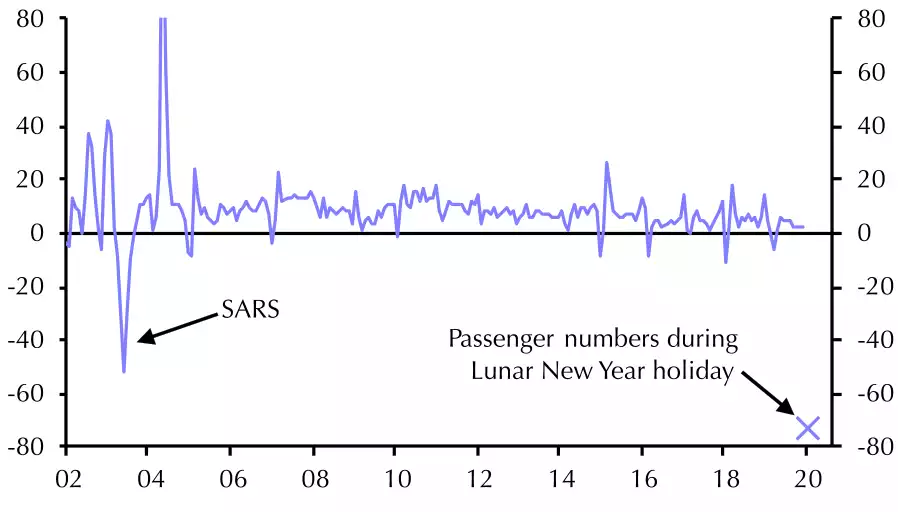

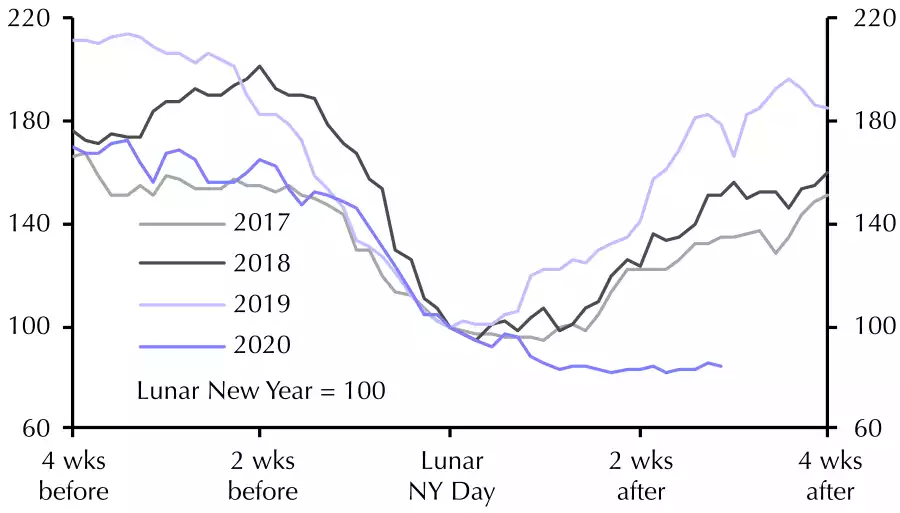

The following charts via Capital Economics give a number of real time indicators. Firstly traffic congestion, a good proxy for commerce and economic activity has simply not rebounded since the Chinese New Year holiday during which the outbreak commenced:

And putting that into context against the SARS outbreak that saw 70% wiped off Chinese GDP in that quarter:

Most of China’s power is generated by coal fired plants and the chart below shows consumption again has not only not recovered but further declined since the holiday. This indicates clearly that there is no manufacturing demand as the demand is even below the purely domestic personal use of the holidays:

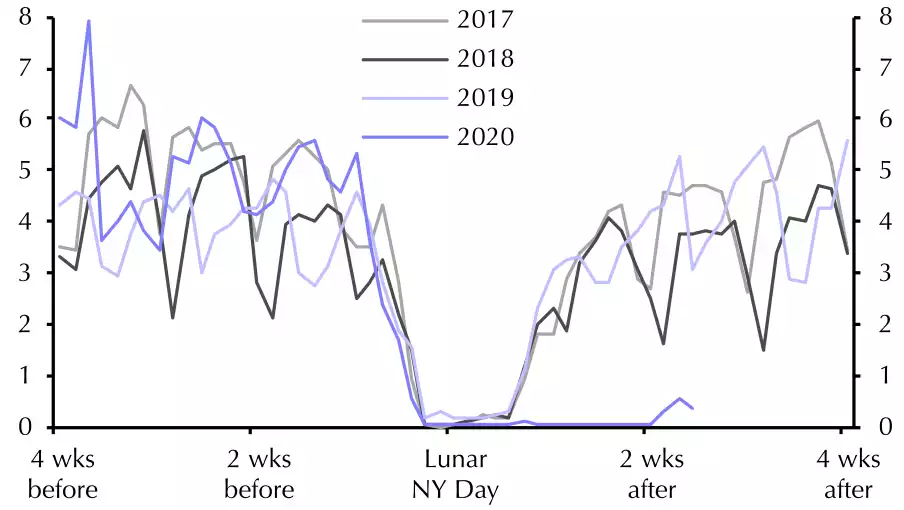

The property market is another big economic driver in China and sales have essentially stalled altogether:

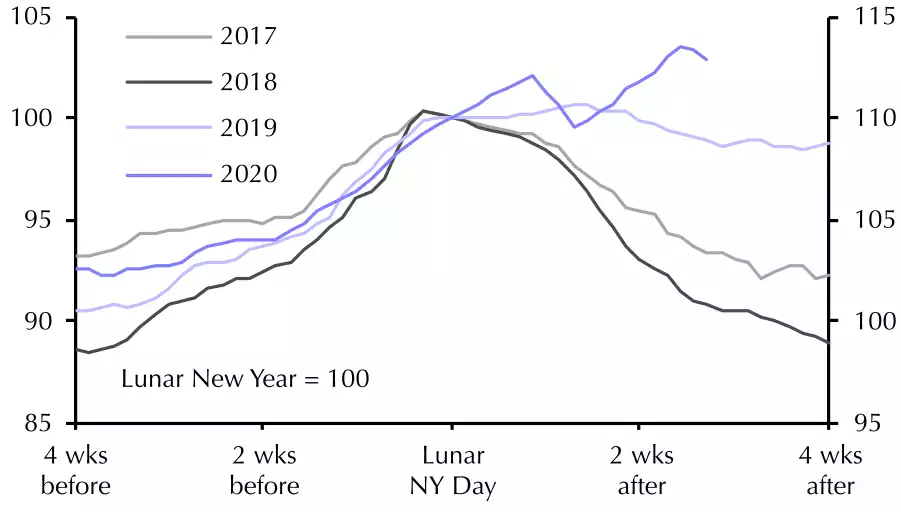

To add to the pressure of economic output and flows, the chart below illustrates the squeeze happening in the life essential of food as supply chains freeze and panic buying exacerbates shortages:

These are all very early indicators in a situation still in its infancy. If you didn’t read the article on Friday, as an Australian it is important you understand this setup. The implications for Australians are two-fold. Not only will we experience the inevitable global contagion in financial and property markets, but we are so completely beholden, more than nearly any other country, to China’s economy that the impacts will be far deeper again.