Decoupling from reality…

News

|

Posted 30/04/2015

|

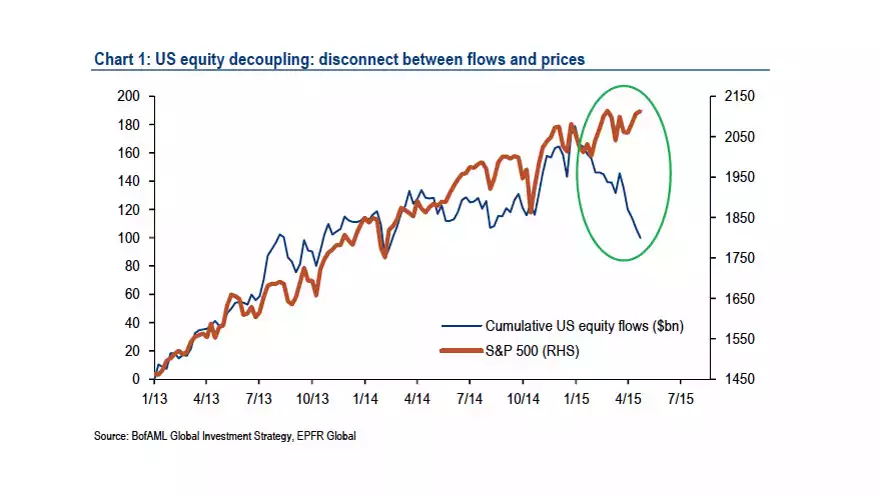

4351

Last night we posted an excellent article from Time Magazine on a topic we speak of often. It also explains in part the phenomenon playing out right now on the US stock market, and one Bank of America Merrill Lynch described as a “big decoupling in recent weeks between U.S. equity flows and prices”. In short we are seeing an exodus of investors from the US sharemarket yet prices still rising to new highs. This exodus, no less than $79b just this year, is at the greatest rate since 2009 and BoFA ML are warning of a correction soon unless new funds start coming in. The graph below says it all. On no level is this sustainable or real and it makes talk of US Fed tightening seem almost farcical. Earlier this week we also learned China is about to start its own Quantitative Easing type bond buying (money printing) program to inject liquidity to stimulate its sharemarket amid falling corporate profits and shore up its $2.6t local government debt problem. So like the prices in the graph below, Shanghai shares have risen 40% this year despite a property slump and, per their National Bureau of Statistics "The operational situation of industrial enterprises remains grave". If you know this is sustainable you should invest everything in shares. If you don’t know or actually think it will end badly then you should diversify into proven safe haven investments that generally go up when financial markets crash. Hint – in the GFC shares halved and gold doubled….