Debt v Rates “Collision”

News

|

Posted 08/06/2018

|

8299

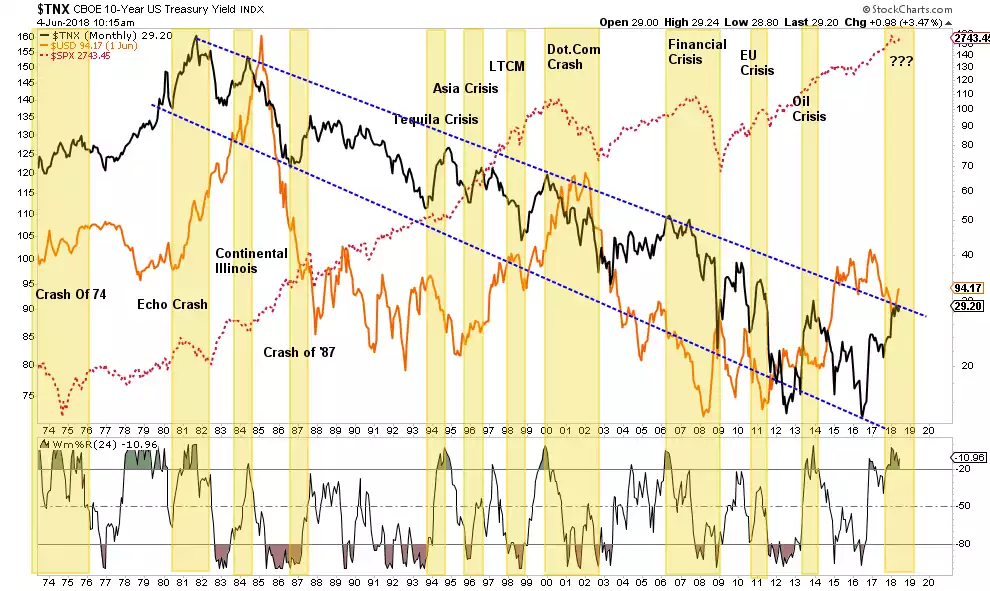

Last night’s ‘flash crash’ in US Treasury yields coincides with another excellent article from Lance Roberts of Real Investment Advice. Talking to the following graph he said:

“With the 10-year treasury rate now extremely overbought on a monthly basis, combined with a stronger dollar, the impact historically has not been kind to stock market investors. While it doesn’t mean the market will “crash” today, or even next week, historically rising interest rates combined with a rising dollar has previously led to unexpected and unintended consequences previously.”

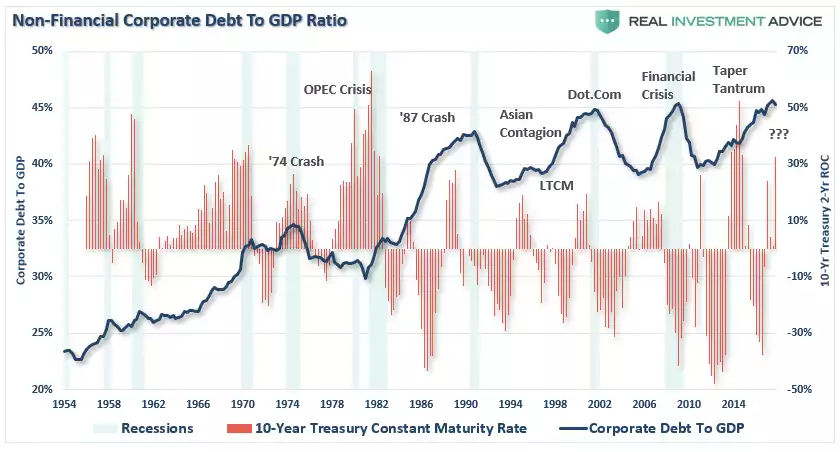

The backdrop is the market fully expecting the Fed to raise rates again when they meet mid next week. Rising interest rates inevitably mean rising costs to business and it’s all about pace. The chart below compares total non-financial corporate debt to GDP to the 2-year annual rate of change for the 10-year Treasury bonds:

Whilst listing the impacts of rising rates should sit in the ‘bleeding obvious’ category, the ‘obvious’ can often be conveniently forgotten in an ‘everything’s awesome’ environment, so here’s 10 reminders:

1) Rising interest rates raise the debt servicing requirements which reduces future productive investment.

2) Rising interest rates slow the housing market as people buy payments, not houses, and rising rates mean higher payments.

3) An increase in interest rates means higher borrowing costs which leads to lower profit margins for corporations.

4) One of the main arguments of stock bulls over the last 5-years has been the “stocks are cheap based on low interest rates.”

5) The massive derivatives and credit markets will be negatively impacted. (Deutsche Bank, Italy, etc.)

6) As rates increase so does the variable rate interest payments on credit cards and home equity lines of credit. With the consumer being impacted by stagnant wages and increased taxes, higher credit payments will lead to a contraction in disposable income and rising defaults.

7) Rising defaults on debt service will negatively impact banks.

8) Many corporate share buyback plans and dividend payments have been done through the use of cheap debt, which has led to increased corporate balance sheet leverage.

9) Corporate capital expenditures are dependent on lower borrowing costs. Higher borrowing costs leads to lower CapEx.

10) The deficit/GDP ratio will rise as borrowing costs rise.

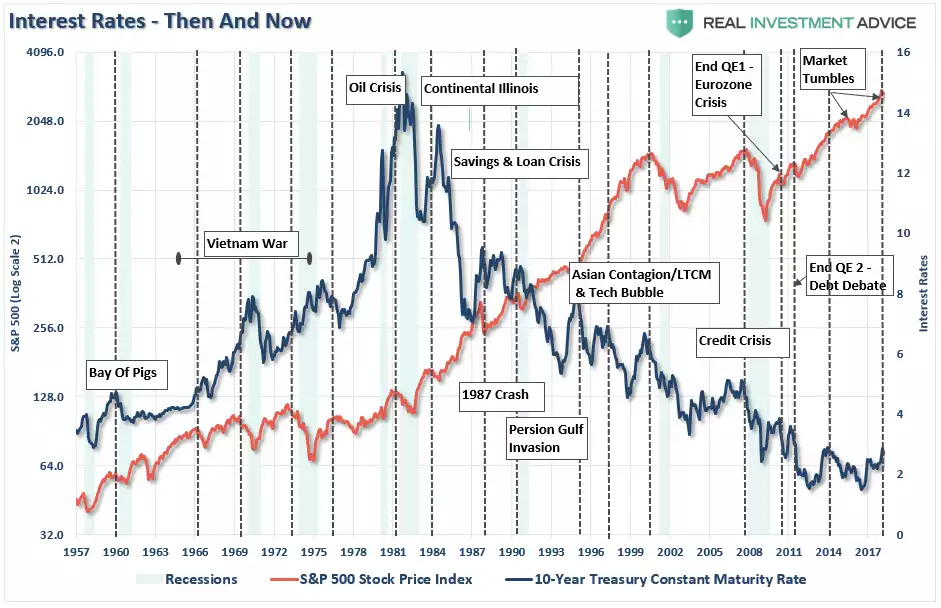

There is still the belief that rising rates aren’t bad for shares either, as they implicitly signal strength in the market. At a micro level that is often the case, but stepping back at the macro level becomes very interesting. Interest rates have generally been on the decline since those heady days in the early 80’s. Notice how shares reacted:

Let us leave with you with the 6 things Lance says you “need to know”:

“1) There have been ZERO times when the Federal Reserve has embarked upon a rate hiking campaign that did not eventually lead to negative economic and financial market consequences.

2) The median number of months following the initial rate hike has been 17-months. However, given the confluence of central bank interventions, that time frame could extend to the 35-month median or late-2018 or early-2019.

3) The average and median increases in the 10-year rate before negative consequences have occurred has historically been 43%. We are currently at double that level.

4) Importantly, there have been only two times in recent history that the Federal Reserve has increased interest rates from such a low level of annualized economic growth. Both periods ended in recessions.

5) The ENTIRETY of the “bullish” analysis is based on a sustained 34-year period of falling interest rates, inflation and annualized rates of economic growth. With all of these variables near historic lows, we can only really guess at how asset prices, and economic growth, will fair going forward.

6) Rising rates, and valuations, are indeed bullish for stocks when they START rising. Investing at the end of rising cycle has negative outcomes.”

And in conclusion:

“For all the reasons currently prognosticated that rising rates won’t affect the “bull market,” such is the equivalent of suggesting “this time is different.”

It isn’t.

Importantly, “This Cycle Will End,” and investors who have failed to learn the lessons of history will once again pay the price for hubris.”

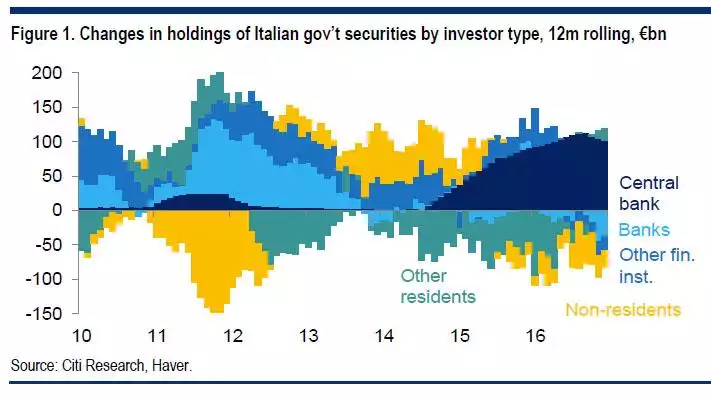

So again all eyes will be on the Fed next week, not so much for the widely expected rate rise, but more so for the messages hidden in the wording of the minutes signalling how many and how quick for the next. Next week is also notable for the European Central Bank (ECB) meeting amid the Italian chaos with the big question being around their commitment to unwind their QE, supported by recent inflation figures but despite the Italian situation. We wrote about Italy’s, or maybe more to the point the ECB’s issues recently. In the context of the Euro’s biggest debt pile, let’s look at who owns it all… the ECB.

Should the ECB stay true to their guidance that they will begin unwinding the QE program (which bought all that dark blue debt above) it will be an enormous snub to Italy and add to the anti EU sentiment in that country now ruled by a populist government.

And finally we also have the Bank of Japan meeting next week as well.

It should be an interesting week….