Secret Fed Meetings Spark Gold Demand Surge

News

|

Posted 19/04/2016

|

5222

Last week we raised the idea that something unusual was happening at the Fed. In particular was the ominous first occurrence of President Obama and Vice President Biden both attending the same meeting with Chairman Yellen to “discuss the state of the American and global economy”. Furthermore, discussions and inventive rumours have surfaced since our article of last week exploring the possible substance behind and consequences of the particular Federal Reserve Board of Governors meeting relating to a “Bank Supervisory Matter”.

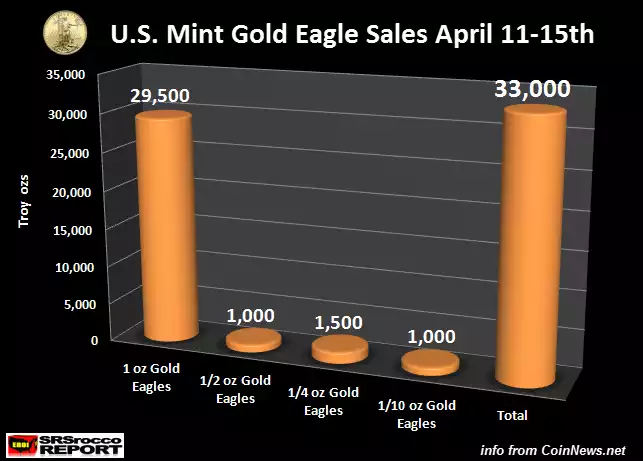

This week we are able to look at the investment impact of this news. Using only data spanning from Monday 11th of April to Friday 15th April inclusive we note that Gold Eagle sales at the U.S. mint have surged to their highest levels in around 3 months. Last month saw 38,500oz of Gold Eagle sales at the mint whereas last week alone saw 33,000oz of Gold Eagles and an additional 6,000oz of Gold Buffalos sold. For comparison using Eagles alone, the latest data would suggest a total of 132,000oz sold if extrapolated out to a monthly total. The vast majority of these sales were comprised of the 1oz Eagle coin as depicted in the following chart.

As an additional note, weekly allocations of Silver Eagles at the U.S. mint continue to be exhausted with sales currently 26% higher than the comparable period in 2015. With the SGE Yuan denominated gold benchmark opening today, it is reasonable to expect some changes in the gold market landscape in the future and data such as last week’s Gold Eagle sales as presented here would certainly imply that the investing public at large is becoming more amenable to the virtues of physical gold holdings.