Goldman Sachs $1600 Gold & Vault Demand

News

|

Posted 11/12/2019

|

17408

Goldman Sachs have predicted USD1600 gold (AUD2350 at today’s rate) by March next year due to a host of combined drivers stating "We still see upside in gold as late cycle concerns and heightened political uncertainty will likely support investment demand for gold as a defensive asset."

There are some key takeaways (and generally avoiding the reasons we write of daily, to remain concise).

Goldman’s separate ‘visible’ and ‘unexplained’ investment gold flows. The former is the likes of reported entities including ETF’s and the latter the non transparent flows that they calculate by deducting those visible flows from net imports.

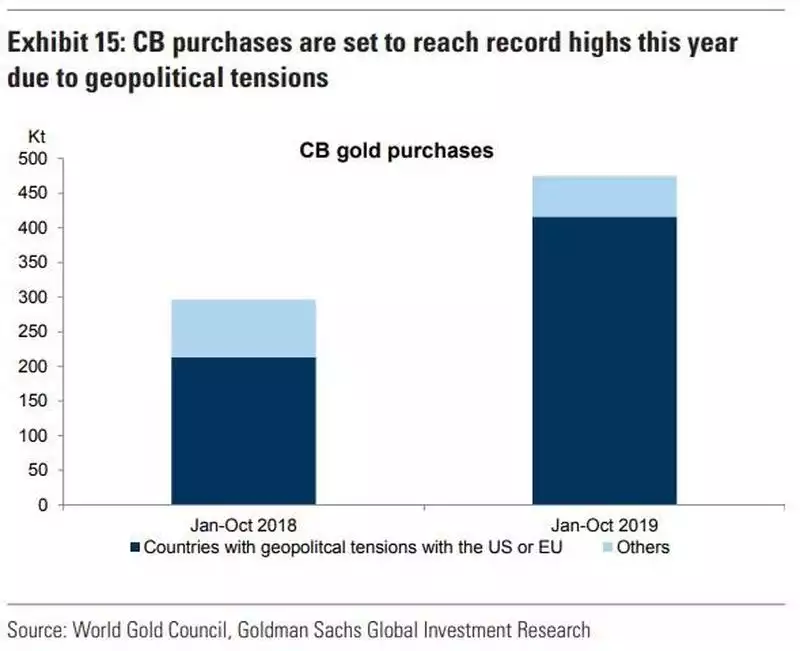

They predict, based on YTD flows, that central bank purchases this year will reach 750 tonne and exceed the already record year last year:

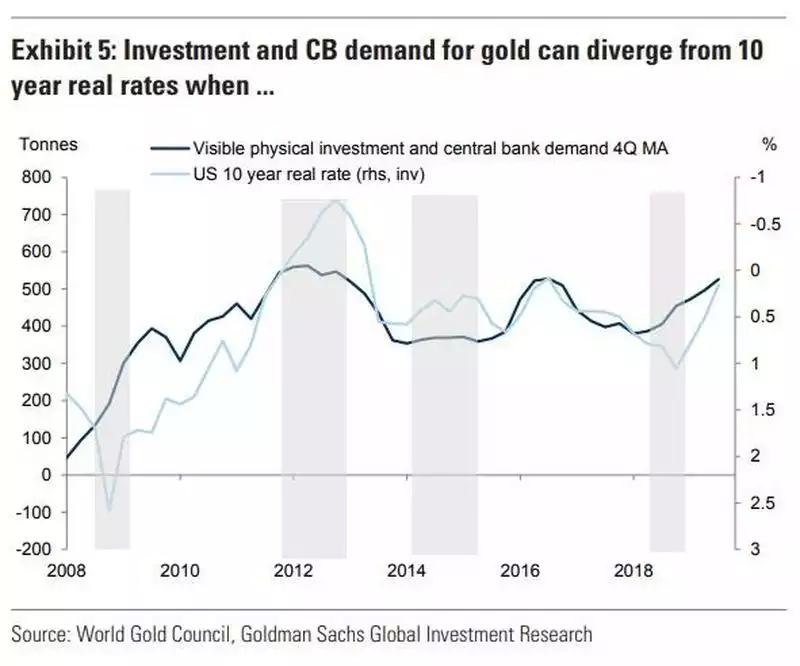

They then illustrate the inverse correlation between both CB purchases and that visible investment gold with US 10 year real rates, i.e. real as in the 10 year rate less inflation.

The problem is those 10 year rates are already near zero in the US and below zero in some countries.

Topically, gold’s main competitor for safe haven investment is of course sovereign bonds but they predict gold will outperform – “During the next recession gold may offer better diversification value to bonds because the latter may be capped by the lower bound in rates limiting their ability to appreciate materially. This is particularly relevant for Europe where rates are already close to the lower bound. This means that during the next recession when fear spikes, gold may decouple from rates and outperform them.”

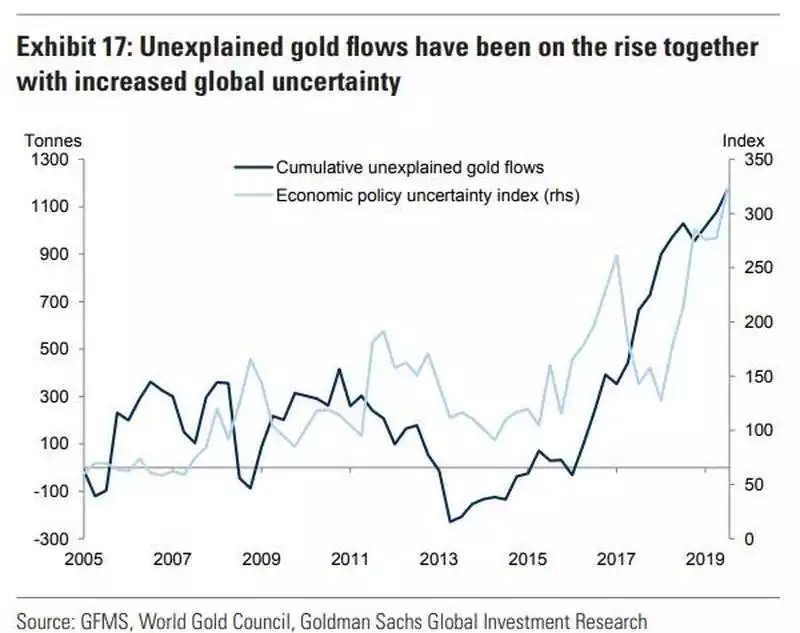

On the ‘unexplained’ investment front they are seeing the rising economic and geopolitical uncertainty risk as a key driver of those investment flows.

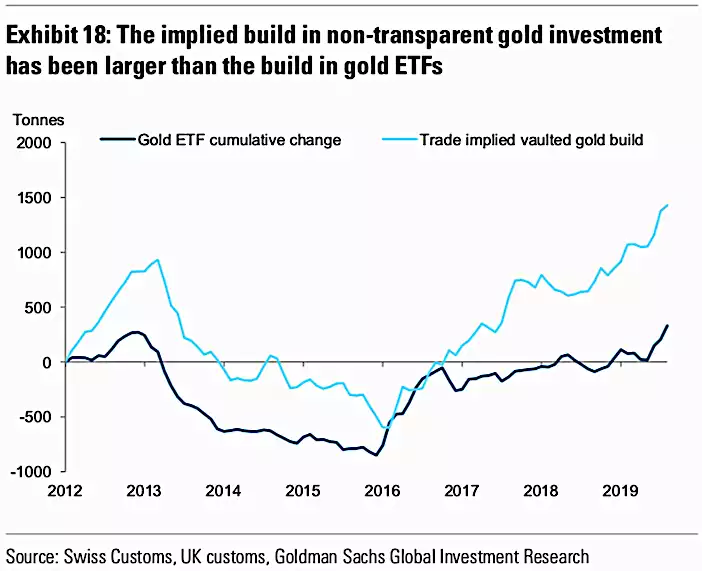

“Exhibit 17 shows cumulative unexplained gold demand based on World Gold Council (post 2010) and GFMS (pre 2010) balances data. It surged since 2016. Similar dynamics can be seen when we look at implied vaulted gold stocks built in the UK and Switzerland, which is calculated as implied cumulative total net imports minus transparent ETF gold stocks. In fact, since the end of 2016 the implied build in non-transparent gold investment has been much larger than the build in visible gold ETFs. This is consistent with reports that vault demand globally is surging.”

Ground truthing that in Australia and we are seeing Reserve Vault likewise seeing a surge in new clients, this year in particular. Goldmans rightly explain:

“Political risks, in our view, help explain this because if an individual is trying to minimize the risks of sanctions or wealth taxes, then buying physical gold bars and storing them in a vault, where it is more difficult for governments to reach them, makes sense. Finally, this build can also reflect hedges by global high net worth individuals against tail economic and political risk scenarios in which they do not want to have any financial entity intermediating their gold positions due to the counterparty credit risk involved.”

Again, as we have reported previously, for Ainslie this year has been notable for the flow of so called high net worth individuals withdrawing large amounts of cash deposits from banks and putting it all into gold and silver as they become increasingly concerned about bank fragility and reinforcement of that fear with the recently passed bail in laws (explained here) and proposed cash ban (explained here) before the senate right now. Buying and storing gold outside of financial institution and government control means you have control and minimise that aforementioned counterparty risk.

They illustrate the extent of the amount of physical gold being vaulted compared to ETFs below and maybe the message is getting through that ETF’s are just another derivative and a very poor second to owning the real thing:

Whilst the mainstay of gold’s appeal is the lack of, and indeed inverse, correlation, Goldmans throw in a shorter term (week on week) check against the correlation of both against the USD, the other ‘safe haven’ (for now) and note:

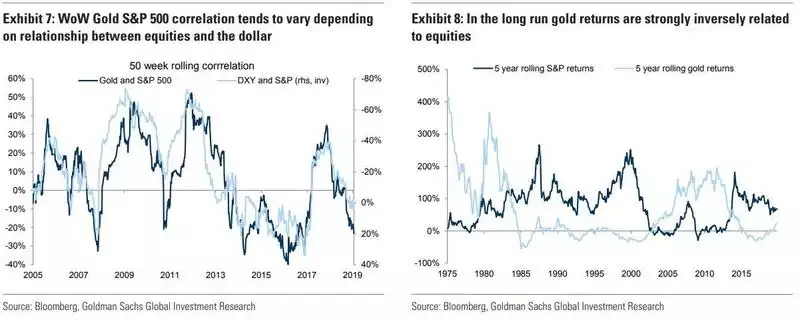

“If we look at week on week changes in gold they tend to be dominated by the dollar. As a result the gold S&P500 weekly changes correlation looks almost identical to correlation of S&P 500 and the dollar (see Exhibit 7).

However, if we look at 5 year returns gold and S&P 500 display strong inverse relationship with gold performing great during the 1970ies and 2000s when the S&P 500 underperformed (see Exhibit 8).

This makes sense given that gold is ultimately a hedge against systematic macro risks, which can lead to long periods of equity underperformance. Our strategy team also finds that gold historically has been a good hedge against periods of large drawdowns of the 60/40 portfolio. This was particularly true when a drawdown is caused by accelerating inflation as it was in the 1970ies. Therefore, if one is concerned that the low macro volatility of 2010s will be followed by higher volatility in the 2020s, which would hurt equities, gold would be a good addition to the portfolio.”

On Monday we spoke to the debasement of USD through the Fed creating new ‘money’ to support the fracturing repo market (doggedly assuring us it is not QE) and the eventual turn of that into QE. Goldmans throw the prospect of Modern Monetary Theory (MMT – explained here) and similar ‘helicopter money’ government responses into the equation with “a potential boost to demand for gold as a debasement hedge” being the result. Such fears of debasement and threat of uncontrolled higher inflation have seen higher gold prices throughout history.