End of the Road – Steins Law

News

|

Posted 18/12/2020

|

6244

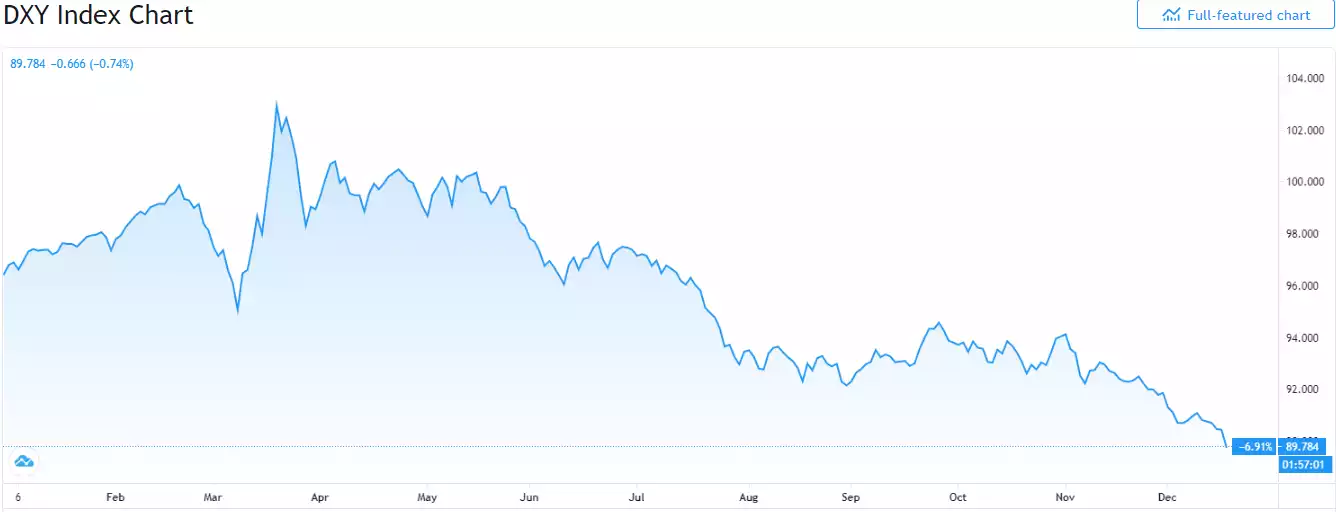

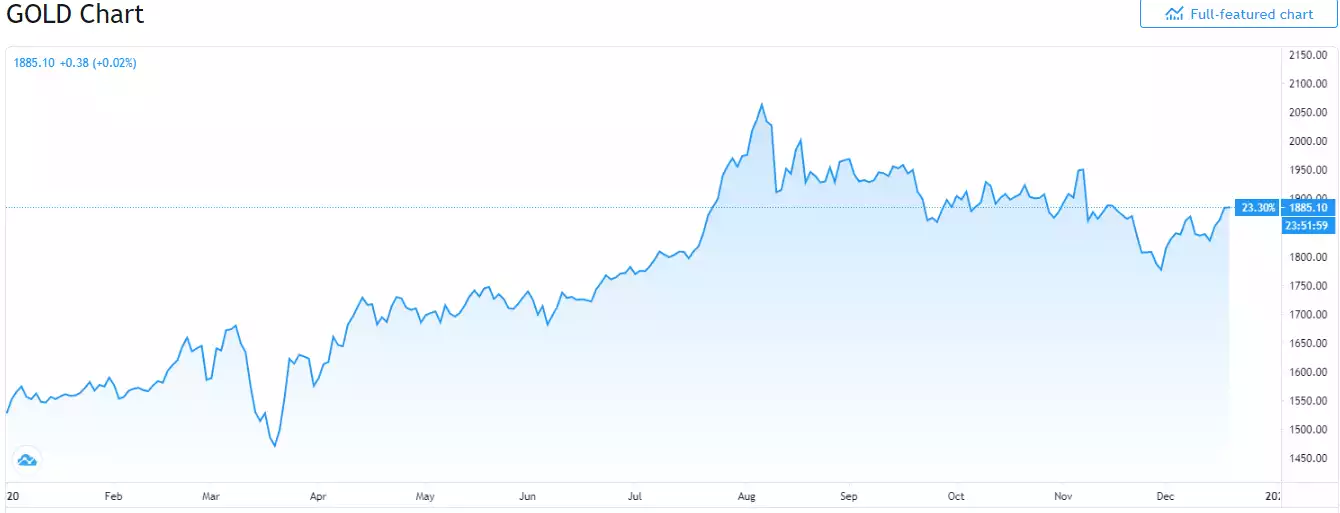

A ‘must read’ today…. Gold and silver had another solid night last night, up US$21 (1.1%) and US$0.68 (2.7%) respectively. That this was off USD weakness saw the AUD rising again to over 76c and hence the AUD gains were a slightly lesser $11 and $0.69 respectively. Last night saw the USD enter an 80 handle for the first time since April 2018 at 89.77 as this was written. The USD has been in decline ever since the liquidity crash induced spike up in March of this year.

In contrast, gold has been one of the best performers of 2020:

That is completely logical as the Fed and US government have unleashed unprecedented money printing that should debase the value of the currency they have printed more of. Gold on the other hand is real money, the supply of which only expands at around 2% per year and hence has intrinsic value.

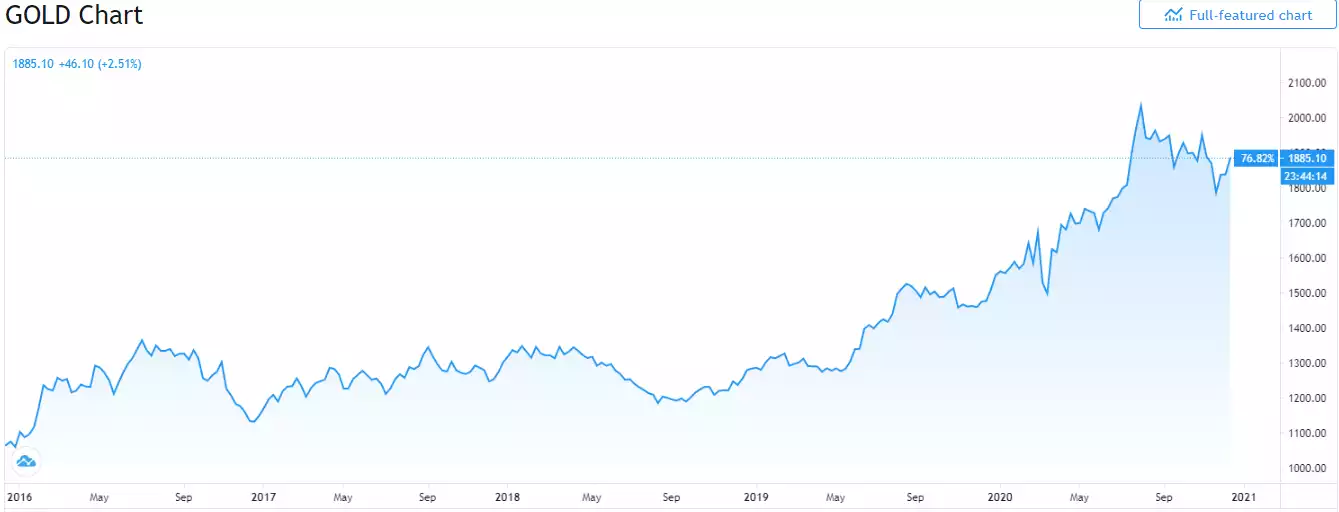

However, the two don’t always enjoy such a perfect negative correlation. If we zoom out a little and go back to the last time the USD sunk to such lows and then rallied generally right through to March this year, you can see that gold generally rallied in unison.

The very simplistic story is of the Fed tightening, the USD rising on that, the gold market saying ‘this is not going to end well’, it not ending well (December 2018 crash), the Fed unleashing stimulus like never before, the USD falling, and gold again saying ‘this is not going to end well’ again.

In December 2018 the sharemarket finished a 20% fall because the market realised it needed the stimulus the Fed had withdrawn. The question is will December 2020 see a similar correction because the Fed inflated the market beyond all reasonable sense? The level of euphoria would suggest that is unlikely to happen just yet, but a strongly rebounding gold and silver price may well again be that smart money signalling they think it is…

As Raoul Pal tweeted last night, it looks like gold is indeed breaking out…

Germany’s second largest bank after Deutsche Bank is Commerzbank. They have just come out predicting $2300 gold next year:

“We do not expect a change in the ultra-expansionary monetary and fiscal policy despite the upcoming vaccinations. Instead, governments and central banks will continue to be required to cushion the negative effects of anti-corona measures on the economy and society. If the necessary fiscal stimulus measures are not adopted in time due to resistance in the legislative process, pressure on central banks to step into the breach with further easing measures would increase.”

Talking to the bit that has markets really torn, i.e. the vaccine fixing everything, they remind us of the not so small issue of the legacy…

“Even if, as we expect, the corona pandemic can be brought largely under control in the second half of 2021 through sufficient immunization of the population, the enormously increased public debt levels caused by the corona policy and the inflated balance sheets of central banks will remain in place for a long time to come. The Fed does not intend to change its monetary policy anyway until inflation is slightly above 2% for a longer period of time, and full employment is achieved. Both criteria together have rarely been met in the last 20 years.”

Whilst central banks have eased off on gold purchases this year as they concentrate on printing money, it is that very action, or the effects of it, that they believe will drive up central bank buying again:

“The arguments in favor of gold have not changed for the central banks at all. The US dollar-denominated bonds held in the foreign exchange reserves hardly generate any positive nominal yields; in fact, the real interest rate on these bonds is almost entirely negative. The euro-denominated bonds even have a negative nominal yield. The price development of gold in this challenging year has also shown that gold offers great advantages as an integral part of foreign exchange reserves.”

Part of what drove gold higher in 2018 despite the Fed tightening was the epic amount bought buy central banks that year, the highest on record. As the USD rose on the back of the Fed tightening, all that USD denominated debt in emerging markets in particular was getting very expensive. An EM crisis was looking more and more imminent with cracks already appearing in Turkey and Argentina. We wrote about this at the time here.

This again highlights the each way bet gold presents and the ‘rock and a hard place’ the Fed and other central banks find themselves in. Maintain easing and the bubble is inflated even more and the burst and/or debt burden even bigger. Tighten and you drive up the USD, up the interest on all that debt, burst the bubble dependent on easy money, and have a full-fledged global crisis on your hands.

The penny is dropping for more and more people. Bitcoin just hit an incredible US$23K or $30K in AUD. Gold and silver look like they are about to follow suit. This is big institutional and retail money alike realising this can only end one way.

The above-linked article concludes with Herbert Stein's 1976 law stating: “If something cannot go on forever, it will stop.”

This monetary stimulus and the relentless accumulation of the debt it generates simply cannot continue. The ‘can’ cannot be continually ‘kicked down the road’. It must stop. What you are left holding when it does is now totally up to you.