Currency Wars: Competition at Work

News

|

Posted 07/04/2022

|

8722

In 1973 Nixon and Kissenger saved the Dollar by instating the Petrodollar with the Saudis. In return for military support from the US, the Saudi royal family agreed to only sell oil in Dollars. In 1973 the Saudis were the largest energy producer and the US the biggest consumer. It made sense for the two to set the tone. However, in 2022, the picture is very different. Russian gas and oil holds sway and the Chinese are purchasing.

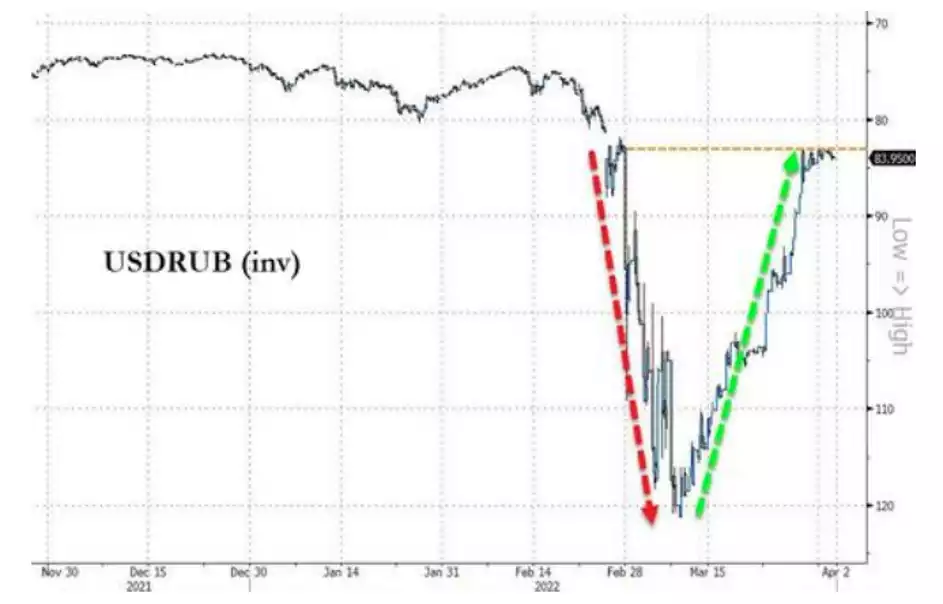

As energy costs increase, so does inflation. Without Russian energy exports, large parts of Europe are descending into darkness. The EU spent almost 2 trillion on Russian Oil and Gas in 2021 and increased demand for the Russian fiat currency is all but guaranteed if they continue to demand payment in the Rouble. The Rouble has now regained almost all of its losses against the Dollar since the announcement of the invasion of Ukraine - from 75 to 150 and now back to 83 Rouble to the Dollar. The Rouble has been underwritten by the oil, gas and gold reserves of the country since coming under fire. The effect has been clear:

As the Rouble has been appreciating against the Dollar, the floor price of 5000 Roubles per gram of gold has been looking more like the current spot price of gold. When the Rouble gold floor was announced, the equivalent cost per ounce was US$1509, at time of writing it is an equivalent of US$1873, only $50 below that US denominated spot price. It is important to recognise that this is a floor only, not a fully fledged gold standard, as the Russian Central Bank is only buying gold at that rate, not selling.

On 23 March the Kremlin drew up a list of unfriendly countries. The majority of the EU member states were included (27) as well as Australia, Canada, the United Kingdom, the United States, New Zealand, Japan and South Korea. In the same way that the Americans built demand for their currency in the 70s for Saudi Oil, the Russians are forcing the hands of the ‘unfriendly countries’ to buy up the Russian Rouble. But how does this actually work?

Given that the accounts of Russian energy exporters have now been frozen, the Russians are demanding that importers open accounts at Russian banks and make payments for their energy. The sanctions on Russia have presumably triggered force majeure clauses in the contracts that the Russians are no longer willing to honour if they aren’t paid for their oil and gas. Germany, for example, will need to buy Roubles on foreign exchanges, and then transfer them to banks approved by the Russian Central Bank to avoid being cut off. Doubtless, through this teething period, many Germans will suffer through cold showers with clenched fists cursing Putin.

The question is how long each side can sustain the currency war. At present, the Russian government debt as a percentage of GDP is 20%, the US is now 98%. Russia has a flat tax rate of 13% on income, which resembles the US before 1916, when the top rate capped out at 15%. One major difference however is the dependence that the Russians have on their energy exports, with 40% of their GDP deriving from the ever critical oil and gas.

The war appears on the ground, but the heaviest hits are arguably made in the financial sphere. Either way, gold is the beneficiary as the focus of market participants shifts to the question of “what is money?” Russia is seeking to establish the clout of currency on the back of resources. This is no different to the formation of the petrodollar. Ultimately, currencies are strengthened by commodities that people need to run the world. Game on Currency Wars.

In other news, China has been signing major agreements with major exporters such as Nigeria for their oil and other commodities. India has signed agreements with China and late last year signed a number of blockbuster deals with Russia when Putin visited the Prime Minister Narendra Modi. Iran has been locked out of SWIFT for years and they are still trading. There is a growing block of countries with hard assets that have been accumulating gold for years. The question is, if they are all accumulating, who are they accumulating from, and are they likely to be like Australia and the RBA, happy to leave 99.9% of our physical gold reserves in the Bank of England. We are always reminded of this famous meme…

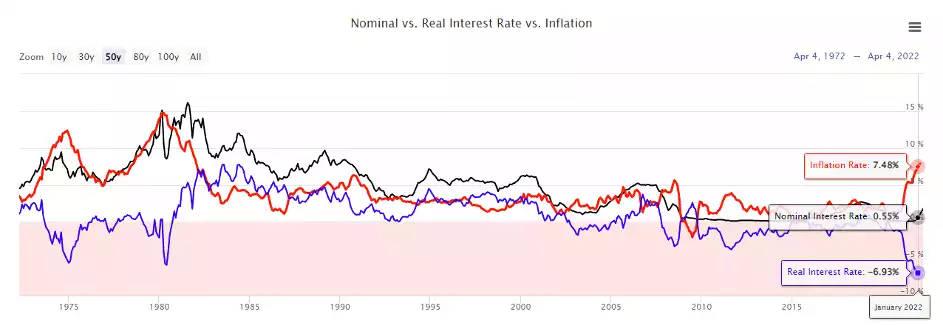

We have been talking in the news about inflation and real interest rates finally lighting fires under precious metals prices. We have seen nickel, copper, aluminium, tin, lead all make major moves, while we wait for PMs to join the party. We have had nearly two years of climbing inflation even on official figures, and the same period has seen increasingly negative real rates and descending. You can see in the graph below (bottom right) that Inflation has spiked to the upside, and as a result real rates have diverged strongly. The last time we saw these kinds of divergences were in the 70s and 80s (bottom left).

If you missed it, we talked recently here about what happened in the 80’s…