Peak Silver

News

|

Posted 05/12/2016

|

6268

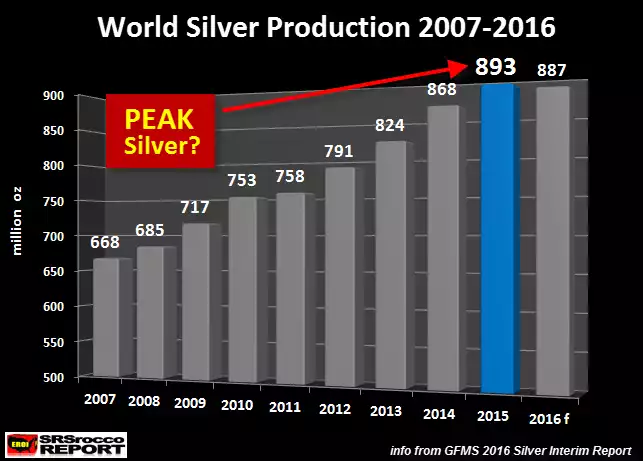

We have written before about ‘peak gold’ and now mining analysts Thomson Reuters GFMS have presented evidence and a forecast to support that silver production peaked last year. The chart below illustrates that now with advanced estimates for 2016 showing a decline on last year to reinforce those previous forecasts.

Their latest report also had this to say:

- We estimate that mine supply peaked in 2015 and will trend lower in the foreseeable future.

- Declining total supply is expected to be a key driver of annual deficits in the silver market going forward.

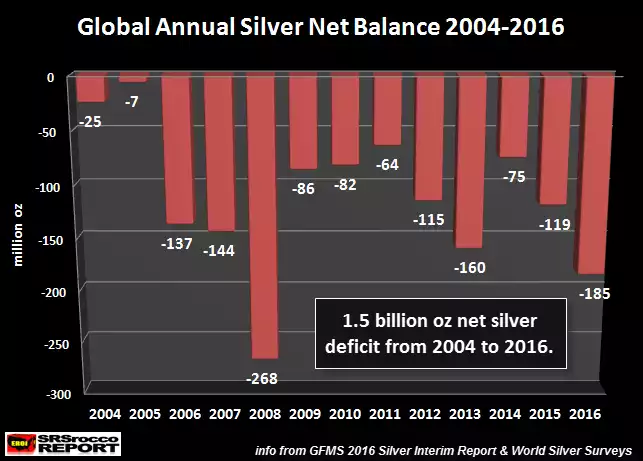

Those deficits are courtesy of strong demand outstripping supply. Indeed we have seen deficits since 2004 and 2016 is on track to be the second biggest, beaten only in 2008 in the throes of the GFC. The chart below illustrates this. This year saw the silver price surge, up into the mid 40%’s for the year with huge inflows to ETF’s accounting for 133m oz (to Sept). The correction after this may well see this number reduce but it shows the impact of a decent rally in investment silver demand.

As the graph inset states, since 2014 there is a cumulative 1.5 billion oz silver deficit. Whilst the surpluses of the 80’s and 90’s have ensured adequate supply to date, with declining supply, growing industrial demand and all the reasons for investing in silver alive and well, it foretells a shortage to come.