Crypto Market Reacts to FED

News

|

Posted 10/05/2022

|

5910

Markets experienced high volatility and further downside this week, as the market responded to the Federal Reserve's decision to hike rates by 0.5%. Markets initially responded well to the news on Wednesday, with Bitcoin rallying to the weekly high of US$39,881. However, the positive momentum was short-lived, with markets selling off heavily on Thursday, and Bitcoin trading down -13.8% to close the week at $33,890, providing a great opportunity to top up for long term investors.

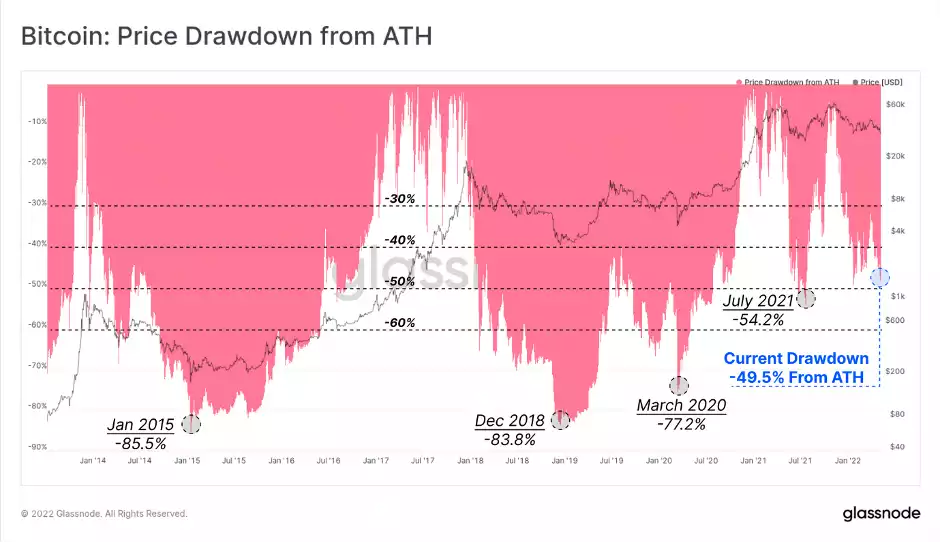

As Bitcoin prices trade lower, the bulls attempt to establish a floor of support. The Bitcoin market is now -49.5% below the November all-time-high.

Whilst this represents a significant drawdown, it remains modest when compared to the ultimate lows of prior Bitcoin bear markets. July 2021 reached a drawdown of -54.2%, and the bear markets of 2015, 2018 and March 2020 capitulated at lows between -77.2% and -85.5% off the ATH.

The Bitcoin accumulation trend score indicator has seen a notably softer month, returning values of less than 0.2 since mid-April. This generally signals more distributive behaviour, and less accumulation has been in play and is coincident with weaker market prices.

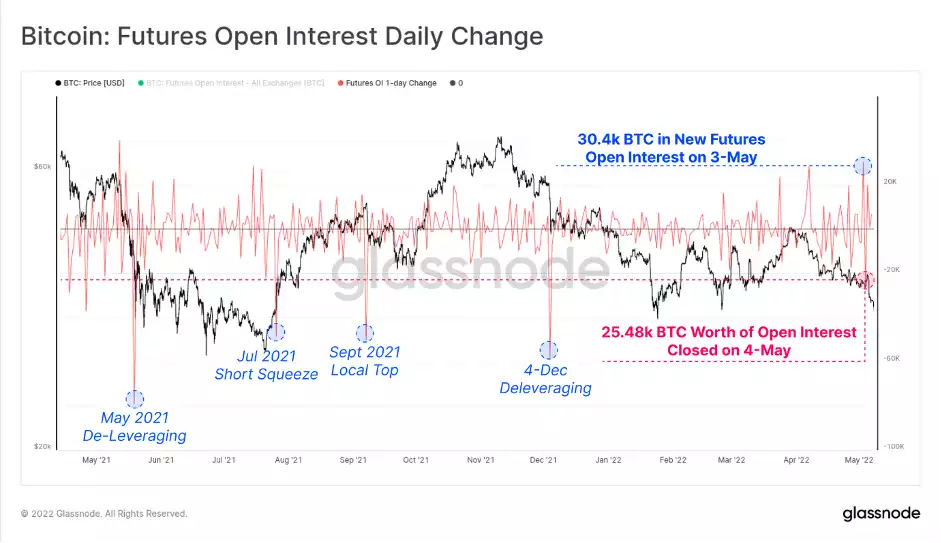

We can see the initial whipsaw action leading up to the Federal Reserve announcement in the 1-day change of futures open interest. Open interest increased by a total of 30.4k BTC on 3-May before 25.48k BTC in value was closed out the following day.

Whilst these values are non-trivial in size, they remain relatively small in comparison to the major deleveraging events over the last 12-months. As such, it appears less likely that excessive futures leverage was a core driver of price action this week.

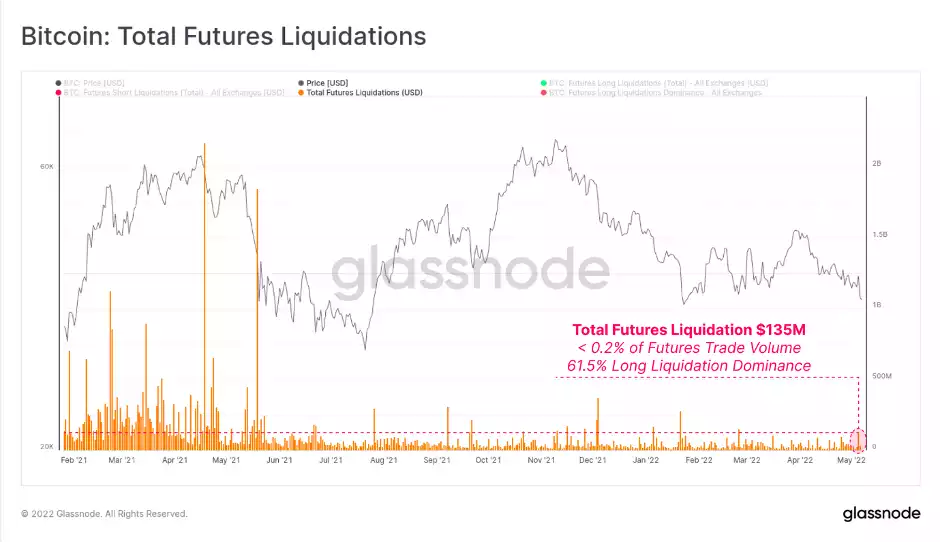

We can add further confidence to this assessment by looking at the total liquidations occurring in futures markets. Generally speaking, during a futures market deleveraging event, we expect a large relative volume of positions to be forced closed via liquidations.

However this week, at the peak of the sell-off, a maximum value of $135M in futures positions was liquidated. This represents less than 0.2% of traded futures volume. As expected, long positions took the brunt of the damage, with a 61.5% dominance of all positions liquidated.

As the Bitcoin market matures, and more institutional capital enters the space, it has become increasingly apparent that the market responds to macroeconomic shocks and tighter monetary conditions. Wider markets responded in a volatile manner to the Federal Reserve's announcement of further rate hikes, which whilst expected, does confirm increasingly tight liquidity across markets.

There appears to be aggregate weakness across almost all sectors, however, it does appear to be primarily driven by poor investor sentiment, and a risk-off mentality, rather than a derivative led deleveraging.