Debt Ceiling v Deficit v History – Here we go again

News

|

Posted 15/09/2021

|

6294

Last night saw more losses on Wall St as the CPI inflation print again came in strong, albeit slightly lower than expectations. ‘Transitory’ took another hit. This fuelled a strong gold rally and shares fell, now putting them in the red for the month so far. The prospect of higher rates and tapering amid the debate over the US’s next massive $3.5 trillion deficit funding relief package and looming debt ceiling is increasingly weighing on the market’s mind. So let’s look a bit further at what is a truly mind blowing set up in the US.

First, a reminder the US official government debt is $28.76 trillion. NOT included in that number is all their committed but unfunded liabilities (such as future social security, medicare etc) of around $156 trillion that they simply choose not to put on their balance sheet. Any public company, under the GAAP rules, would have to do so, but not it seems, the US government.

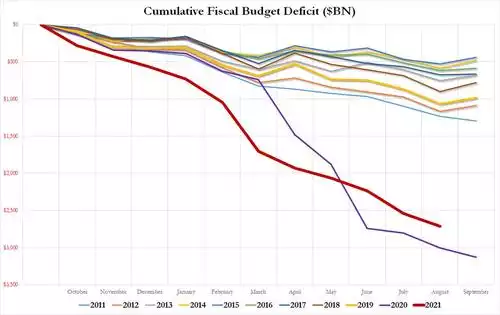

So how are they going paying that debt down? Well, they haven’t run a real budget surplus since 1969. But for context, lets look at the deficit spending over the last 2 years compared to previous years over the last decade. As you can see in the chart below, 11 months into the US fiscal year, they have spent $2.7 trillion more than they received, slightly better than the same period last year of $3 trillion. If we look at the 17 months from the start of the COVID crisis they have spent $5.1 trillion more than they received! Tax income now accounts for just 50% of the budget deficit….

And the kicker? The US is actually running TWIN deficits with their trade deficit also currently running over $1 trillion.

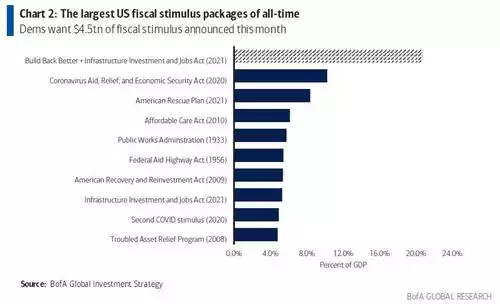

And so what are they doing to address this imbalance? The Democrats are right now trying to railroad through another $3.5 trillion stimulus package. The biggest of all time.

Somewhat inconveniently they also need to resolve the current ‘debt ceiling’. The word ‘ceiling’ is quite misleading for 2 reasons. Its more so a ‘target’ than ‘ceiling’ as they ALWAYS hit it. But even that is not right because for some time now they have implemented a ‘suspension’ of the ceiling rather than a new quantified ceiling. That means they say, ‘let’s not worry about it until X date’. That’s much easier than facing the public and saying ‘we are raising the debt ceiling to $X…. oh and by the way we are pushing through a $3.5 trillion deficit funded stimulus package’. Even the wilfully blind would see the implications.

On current projections the US government’s use of ‘cash and extraordinary measures’ (ala accounting tricks) will see them run out of money in late October unless a deal can be struck with the Republicans to ‘suspend’ or raise the ceiling. In 2013 we saw a total government shut down for 16 days seeing 800,000 American public servants stood down and an estimated 0.6% hit to GDP with $24b taken out of the economy. We then again saw the same in January 2018 and again over December 2018 to January 2019 to similar effect, the latter going 35 days.

You can read below Goldman Sach’s more detailed view but in short they are calling this the "Riskiest Debt Limit Deadline in a Decade." And concluding as follows:

“The upcoming debt limit deadline is beginning to look as risky as the 2011 debt limit showdown that led to Standard & Poor’s downgrade of the US sovereign rating and eventually to budget sequestration, or the 2013 deadline that overlapped with a government shutdown. Like in 2011, sizeable budget deficits have motivated Republicans to use the debt limit to win policy concessions. Like in 2013, the deadline falls soon after the end of the fiscal year, raising the prospect of a government shutdown on top of debt limit uncertainty.”

Yet again we have clear and growing signs of a grand credit cycle in its death throes. What a looming US default reminds us of is that of the two traditional safe haven assets, gold and US Treasuries (and indeed government bonds globally), only gold has no counterparty risk, is no one’s liability. Buying bonds is buying debt in a world saturated with the stuff and totally relying on the issuer to pay up. Interest rates are already zero or negative and hence bonds have very limited scope for higher prices regardless. Gold and silver have extremely limited supply, have no counterparty risk, no ‘paper promise’ whatsoever, and have proven to be the pre-eminent assets over 5000 years of countless credit cycles going pop.

In one of the most ironic quotes of the ages, J P Morgan himself reminds us “Gold is Money – everything else is credit”

Likewise the head of the world’s largest hedge fund, Ray Dalio famously said:

“If you don't own Gold, you know neither history nor economics.”

History is repeating. Are you paying attention?

If you are interested, Goldman Sach’s view on the debt ceiling playbook is as follows:

“We estimate Congress will need to raise the debt limit by mid-October, though it is possible the Treasury might be able to operate under the current limit until late October. It is possible, though not likely, that the Treasury might be able to continue to make all scheduled payments until sometime in early November if the deficit is smaller than expected.

There are two procedural routes congressional Democratic leaders can take to raise the debt limit, but neither is easy. Democrats would not need Republican support if they use the reconciliation process, but they would face a number of other procedural and political disadvantages. Attaching a debt limit suspension to upcoming spending legislation looks more likely, but this might not succeed and could lead to a government shutdown.

A failure to raise the debt limit would have serious negative consequences. While it seems likely that the Treasury would continue to redeem maturing Treasury securities and make coupon payments, if Congress does not raise the debt limit by the deadline the Treasury would need to halt more than 40% of expected payments, including some payments to households.

Beyond the direct impact, the debt limit could also affect the medium-term outlook for fiscal policy. We already expect the Democratic fiscal package to be scaled back from the proposed $3.5 trillion/10 years in new spending to $2.5 trillion, offset by around $1.5 trillion in new tax revenue. While there is not necessarily a direct linkage between the debt limit and the fiscal package, the more these issues become entangled the more pressure there may be from centrist Democrats to scale back the size of the fiscal package.”