Crypto Market Breaks Key Resistance Levels

News

|

Posted 24/08/2021

|

5903

The Bitcoin market has experienced yet another strong week, with prices rallying from the weekly low of $43,998 US to a new multi-month high of $50,500. Confidence, conviction, and positive sentiment has followed this uplift in prices, as Bitcoin climbs closer to reclaiming its Trillion-dollar valuation.

The price move follows a sustained overall market recovery over the past few weeks after bitcoin plunged to just below $30,000 in July. The surge in the prices came due to two significant developments for Bitcoin over the past week. PayPal has launched a cryptocurrency service in the United Kingdom. The announcement came yesterday after PayPal announced that users can buy, sell, or hold digital currencies and it will be the company's first international expansion outside of the US.

Another major announcement came from cryptocurrency exchange platform Coinbase said that the company will buy crypto worth US$ 500 million on its balance sheet as well as allocating 10% of the exchange’s quarterly net income into various crypto assets.

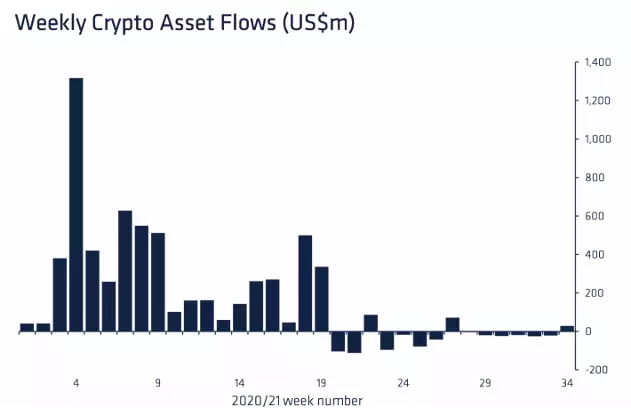

Also, crypto funds saw $21 million of net inflows last week as digital-asset markets rallied, pushing the total assets under management to $57.3 billion, the highest since May, a new report shows. The data reflected a reversal after six consecutive weeks of outflows.

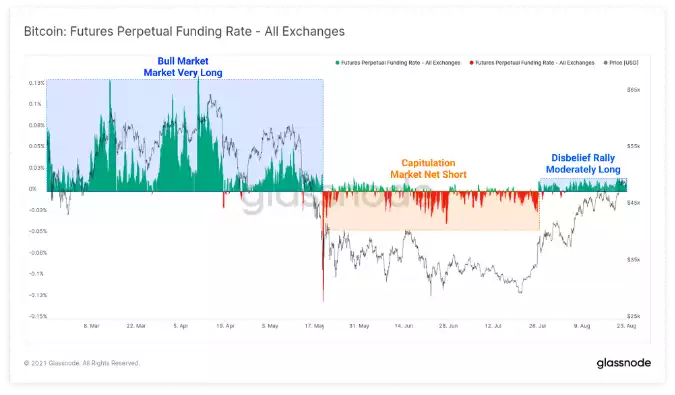

In terms of directional bias for traders, the perpetual futures funding rate has started to pick up again. Funding rates have traded positive since late July as futures markets trade above spot prices. However, the funding is nowhere near the peaks seen in the early 2021 bull trend. This may indicate that excessive leverage is not in play just yet, and perhaps the uptrend remains reasonably spot driven and healthy.

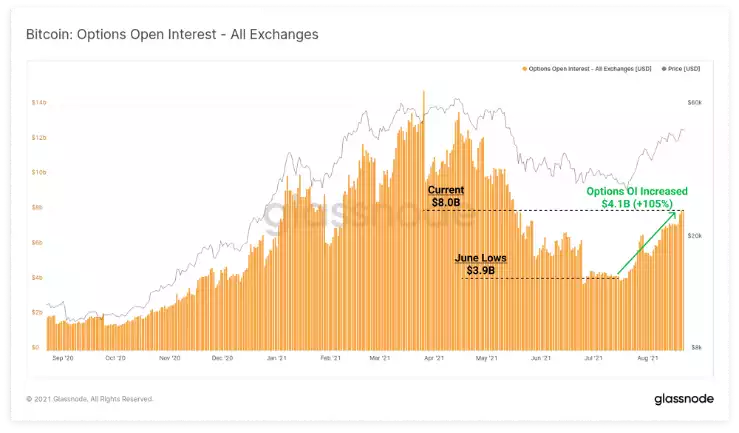

Options markets have also seen multi-month highs in open interest, rising by over $4.1B (+105%) since the lows in June. The current level of $8B in open contracts is similar to levels seen during the May sell-off, and in Jan-Feb 2021. This suggests that relative to the total market size, the degree of open interest in derivatives markets is low compared to the degree of leverage seen in the first half of the year, meaning that this latest bullish action is much healthier than at the start of the year.

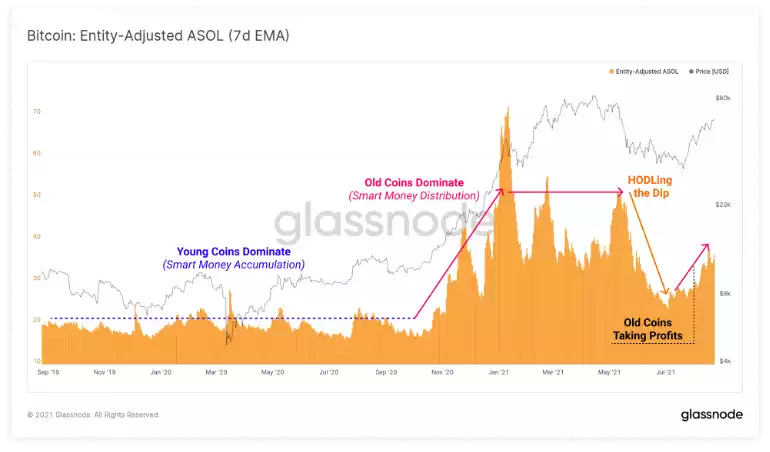

In their weekly report, Glassnode analysed the spending of older coins during this period of profitability. They have found that “The spending of older coins has also shown up as a trend in the ASOL metric which measures the average age of all spent outputs that day. This trend of rising average age has been in play since July and throughout this rally which suggests two things: Profits are being realised by old hands, confirming what has been observed in the charts above and that the market is absorbing the sell-side so far as prices have continued to climb. This indicates there is sufficient demand to absorb the coins being distributed.”

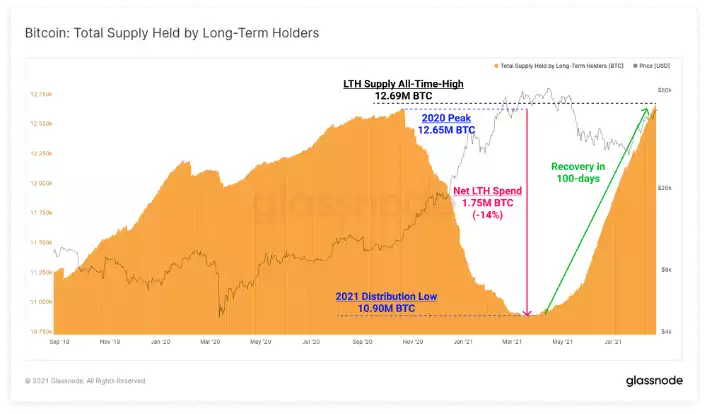

Throughout the Q1-Q2 bull market, long-term holders distributed roughly 1.75M BTC which ultimately created an oversupply in the market. This is what caused the market to roll over and enter the May sell-off. After this, market participants slowed down their spending, and the coins that were accumulated in late 2020 and early 2021 have consistently matured into long-term holders.

The recovery of long-term holders to an all-time high has taken just 100-days which goes to show just how significant the accumulation was in the early phase of this bull market and is likely an indication that large institutional money is accumulating now. The fact this trend has yet to slow down also demonstrates that significantly more coin volume is getting older and is held by investors less inclined to take profits. This adds further weight to the argument that the old hand spending observed this week is likely of low coin volume, and strategic de-risking, rather than a loss of conviction and a mass exit.

The cryptocurrency market appears to have turned a corner this month, with the combined crypto capitalisation currently hovering around $ 2.2 trillion. In contrast, the combined crypto cap fell below $ 1.3 trillion at the height of the July bearish market action. It appears that the market is lining up a push to the all-time highs. No doubt there will be volatility in between, but the fundamentals and technicals of this market continue to improve.