Crypto Institutional FOMO

News

|

Posted 13/10/2020

|

5348

Bitcoin’s (BTC) uptrend gathered pace on Saturday with prices nearly testing $US 11,500 for the first time in over a month. The biggest cryptocurrency by market cap rose to $US 11,484– the highest it has been since September 3rd.

What drove the price higher was likely a wave of optimism generated from the prospects for a U.S. stimulus package. On Friday (in the U.S.), The White House boosted its offer to Democrats on a pandemic relief package to the north of $US 1.8 trillion.

A new round of stimulus will have positive effects on bitcoin in at least three ways:

- Central bank reckless spending around the world in response to the covid-induced slowdown will inevitably result in inflation, and therefore be positive for cryptocurrency, particularly bitcoin which is increasingly viewed as a store of value.

- Many investors are treating bitcoin like it's a tech stock, anything that boosts equities invariably boosts bitcoin.

- Stimulus paychecks would give individual investors’ money to invest – a chunk of those investments would likely go to "inflation hedge/store of value" assets such as bitcoin and bullion. Platforms like Robinhood have introduced a whole crowd to investing in both.

The price of bitcoin is particularly sensitive to the addition or removal of stimulus from central banks. Increased participation from institutional traders has to strengthen this relationship even on short-term charts.

Since the crash in March, stock market prices have been overwhelmingly driven by investor expectations that governments around the world, led by the U.S. and the Fed, will continue to print to support them – at unprecedented levels.

Many are holding out for the U.S. election in November, believing that a change in office would make a difference in the approach to “fixing” the covid crisis. However, the Federal Reserve and the U.S. Treasury have printed so much money that the likelihood is that we’re going to continue to see much more of what we already have regardless of who’s in the White House.

Bitcoin is fundamentally not correlated with stock markets because it is underpinned by a set of beliefs that are completely uncorrelated to that which operates and runs the world today. It is completely the inverse and transformative of how the financial infrastructure of the world operates. This is why so many get so excited – revolution.

Bulls were ignited at $US 10,500 earlier this week after payments giant Square announced that it has put some 1% of its assets into bitcoin.

The bitcoin and cryptocurrency community were encouraged by news payments company Square, led by Twitter CEO and outspoken bitcoin advocate Jack Dorsey, had bought $50 million worth of bitcoin.

Square, along with its CEO Jack Dorsey, has long championed bitcoin and its underlying philosophy of decentralisation. Dorsey, who earlier this month said bitcoin is "probably the best" native currency of the internet, has stated his conviction that bitcoin has the potential to be the world’s sole/reserve currency by 2030.

Back in 2014, Square began letting merchants accept the cryptocurrency, rolling out bitcoin buying and selling on its popular Cash App in 2018 and reporting bitcoin operations revenue grew 367% annually in the first quarter of this year. Square Crypto, an independent team within the company, was created last year tasked with supporting open-source bitcoin development.

"We believe that bitcoin has the potential to be a more ubiquitous currency in the future," Amrita Ahuja, Square's chief financial officer, said in a statement announcing the company's bitcoin holding.

Square has become the second publicly traded company in three months to add bitcoin to its balance sheet, following business intelligence and software company MicroStrategy's $US 425 million bet on bitcoin over the summer (as we reported here).

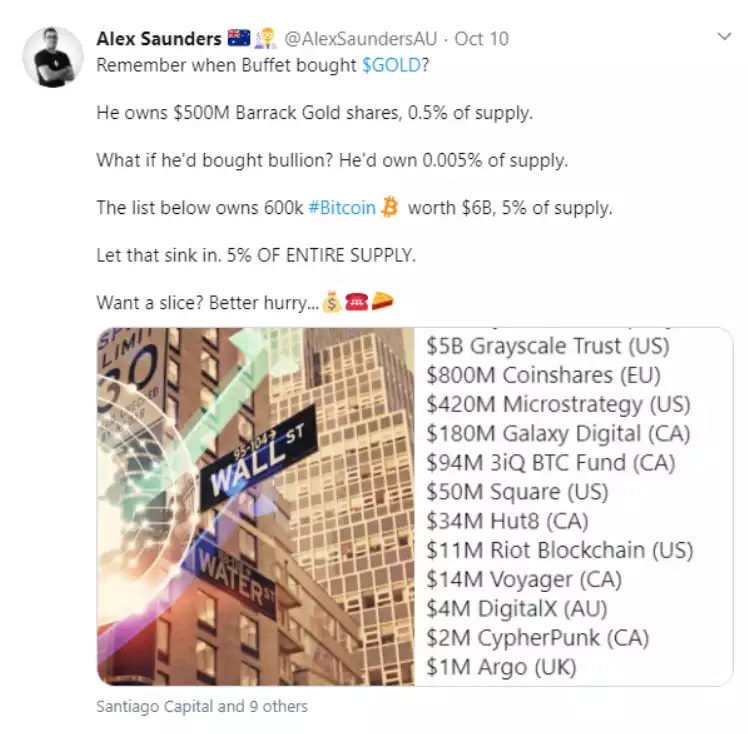

Alex from Nuggets News puts it all in perspective here:

We saw what happened in 2017 when retail investors got FOMO. What will happen when big institutional money gets FOMO?

It's slow but persistent. Every week the space has a new development – all of which are moving the space in the right direction. Whether that's institutional investors developing blockchain payment solutions or even central banks developing their own digital currency, everything points in the right direction. The run-on effects will be extremely bullish especially for the larger market cap cryptos. As accessibility and coin velocity increases, so will the price. As more hedge funds see the benefit of bitcoin as a potential hedge and buy in large quantities, the price will increase. One day funds won't have to justify why they own bitcoin but will have to have a very good justification if they don’t.