Is This The Bottom In Gold?

News

|

Posted 29/05/2018

|

9593

Today we look at a few different analyst perspectives on gold at a time where it is seemingly bouncing along a bottom. Firstly Jim Curry talks of a dominant 20 week cycle in the metal and the chart following speaks to that being around now:

Looking at the leads from the futures markets Greg Canavan published the following last week to his subscribers:

“In the week to 15 May, ‘managed money’ long positions (basically, hedge fund bets on gold going higher) fell by 6,252 futures contracts to 103,256. Short positions (bets on gold going lower) increased by 16,389 contracts to 84,258.

That means the ‘net long’ position was just 18,998 futures contracts. The last time the net long position was this low was back in early 2016, when gold was just coming out of a prolonged bear market.

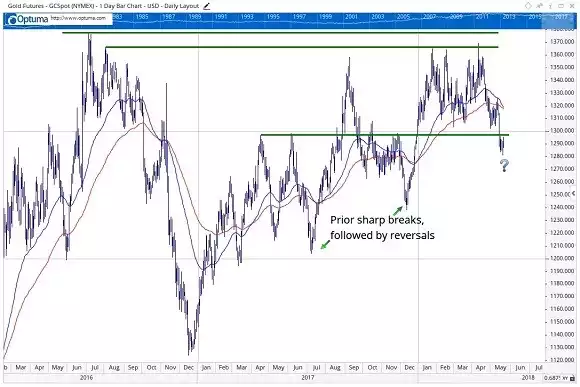

In other words, sentiment towards gold is as bad as it has been in more than two years. Yet it’s not in a bear market. And while it’s had a short-term setback by breaking below support recently (see chart below), that’s not unusual for gold.

As you can see, gold has done this before. In the two instances shown below, the net long position of money managers was quite low. Though not as low as it is now.

Money managers are currently ‘short’ around 8.4 million ounces of gold (each futures contract represents 100 ounces). It would only take a small piece of positive gold news to see a decent amount of those shorts ‘cover’ by buying back their position. That would send the gold price sharply higher.

So I’m still positive on gold. I see strong short-term upside potential.”

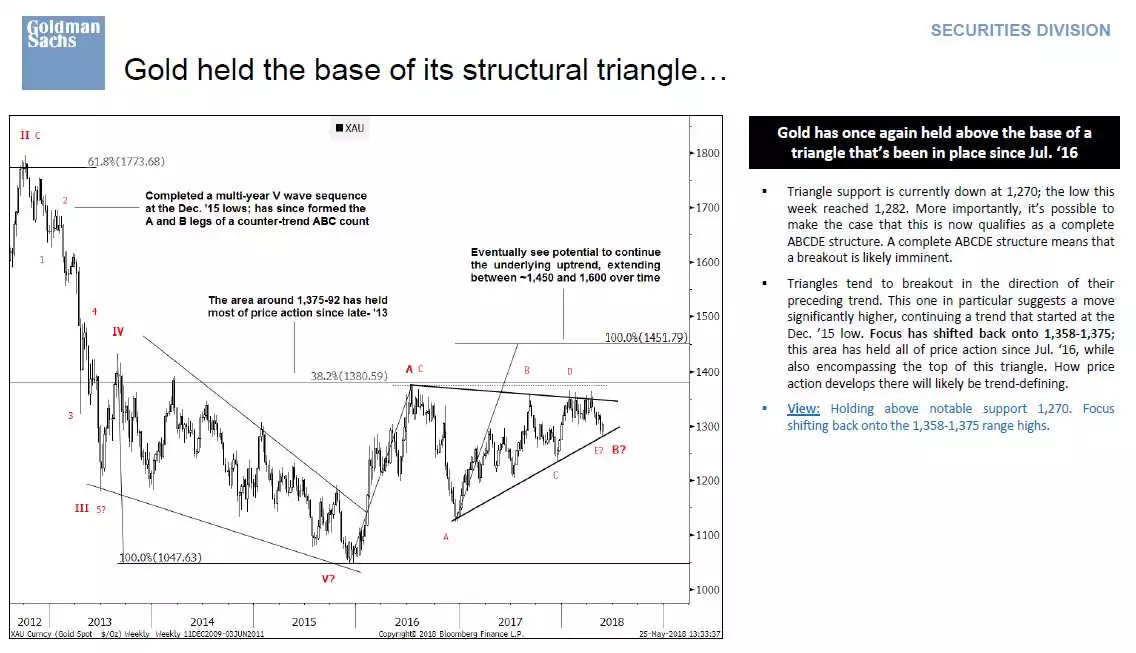

It’s not often you see the likes of Goldman Sachs talking up gold when they have all their financial assets to sell you but below is the latest from them:

And finally we found the following eerie comparison with the setup comparing gold to the S&P500 going into the start of one of the biggest gold rallies starting in the early 2000’s:

Making profit is about buying low and selling high however picking bottoms is notoriously hard without hindsight, and hence the saying ‘only monkeys pick bottoms’. The charts above suggest that there is a growing level of supporting evidence that we may indeed be close to this bottom in gold.