Buffett’s “Financial Weapons of Mass Destruction”

News

|

Posted 20/02/2017

|

6355

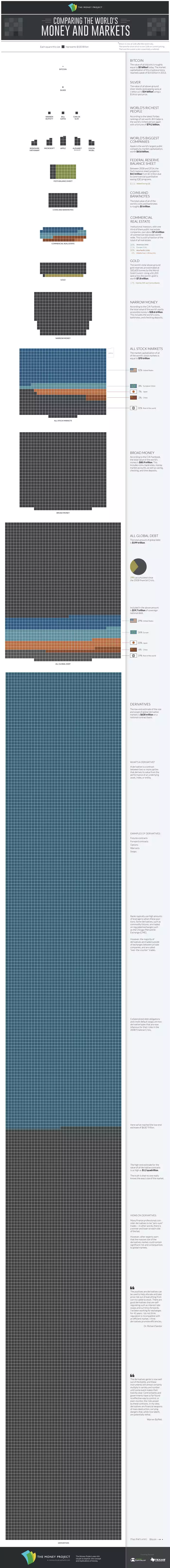

Today’s article is a little different as we invite you to walk through ‘all the world’s money’ as depicted by The Money Project. Start from the top and you will likely need to zoom in to read the explanations down the right hand side. Once finished, for true context, zoom back out to see the whole graphic on your screen.

Once finished, consider that only silver, gold and to a lesser, but still large, extent commercial real estate, can be held without any counterparty risk. It is those two words alone that could see the derivatives monster unleash. ‘She’ll be right’ proponents of derivatives argue that there are 2 sides to every derivative and that they can’t just collapse. That’s all fine and good when the other party can stand and deliver. But if they can’t it could start a domino effect that would make the GFC seem like a picnic. Or as Warren Buffett puts it in that last note on the right “…derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.”

(If you have trouble with the graphic below, try this link http://i2.wp.com/money.visualcapitalist.com/wp-content/uploads/2015/12/all-the-worlds-money-and-markets-dv.png?zoom=3&w=1130)

Also… yes we’ve noted ourselves that the Bitcoin amount is out of date being over $16b now after the recent rally. The same for silver which is over $18b on current pricing. That said the overall scale is essentially unaltered.