Could Wall St Rally off Blackout Window?

News

|

Posted 29/10/2018

|

6479

There were more falls on Wall Street Friday night. With still 3 days left in the notorious crash month of October we have already seen the most lower closes (15) on the S&P500 this month than any since October 2008….and we all know where that then headed….

However there may be a genie about to be released from the bottle to save the day… this time. That genie is called the blackout period. To prevent insider trading on the results of earnings announcements there is a share purchase blackout in the weeks leading up to a company announcing its earnings results for corporations and their senior execs.

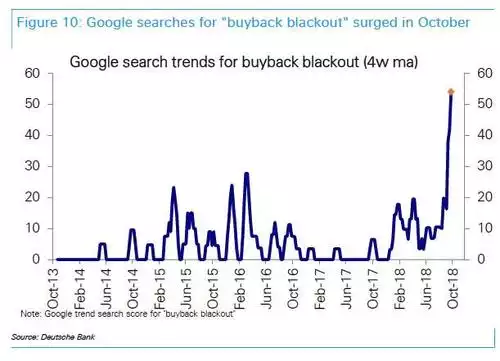

Deutsche Bank noted that Google searches for the phrase ‘buyback blackout’ surged to easily its highest ever this month.

We have written extensively on the phenomenon of record share buybacks in the US inflating the market. If you haven’t read any you need to. The last was here.

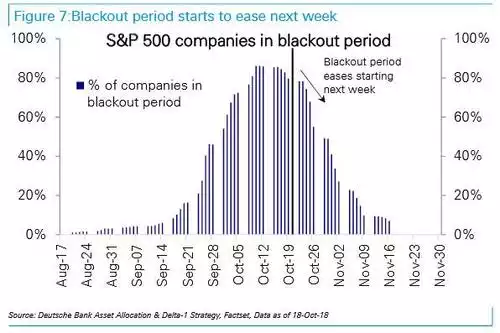

Goldman Sach's chief equity strategist David Kostin notes that during this October rout a large proportion of US corporates have been unable to buy their shares back due to the blackout. But that is all about to change as nearly half of the S&P500 is now out of the blackout period.

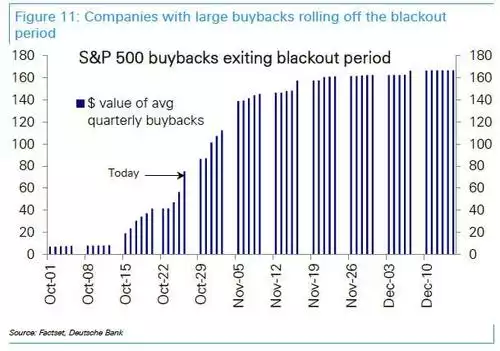

The chart above is by number but more telling is the size of the company’s buyback programs that are now about to re-enter the market. The chart below illustrates what’s coming by the size of their share buyback programs. Indeed DB predicts $100b of potential buyback potential this week and up to $145b next week.

That said, the $50b they predicted to come in on Friday either did not eventuate or was overwhelmed as we saw another 47 points or over 1.7% come off the S&P500 Friday again.

However if these buybacks do eventuate this week and we do see a rally, what then? Again, if you haven’t, read the article linked above, but in a nutshell Economics 101 says you can’t just keep borrowing more and more to artificially inflate your shareprice. The very respected John Mauldin has been predicting a great debt ‘train wreck’ and liquidation that he calls The Great Reset. He has been saying however that we probably still have a year or more before it fully plays out. That however just changed and one of the 3 reasons for the change (the others being Trade War and Italy) is Corporate Debt…

“My renewed fear comes from the very real possibility the global economy breaks down in the next six months. Anything could trigger a crisis, and it could well be something no one presently foresees, but here are three candidates.

Corporate Credit Crisis: As a whole, US companies are significantly more leveraged now than they were ahead of the 2008 crisis. We saw then what happens when the commercial paper market seizes up, and that was without a Fed in tightening mode. Now we have a central bank both raising short-term rates and slowly ending its crisis-era accommodations. Recent comments from FOMC members say they have no intent of stopping, either. A few high-profile junk bond defaults could ignite fears quickly.

There are trillions of dollars of low-rated corporate debt that can easily slide into the junk debt category in a recession. Since most public pension, insurance, and endowment programs are not legally allowed to own junk-rated debt, I can see where it could easily cause a debt crisis along the lines of the previous subprime crisis.”

So if we do indeed have a market rally off this correction, keep in mind what is likley driving it and ask yourself how sustainable that is.