A Gold Backed Digital Yuan – Is it Possible?

News

|

Posted 21/04/2021

|

7165

China is most definitely upping the global agenda of returning the ‘middle kingdom’ to what it sees as its rightful place as leader of the world. There is sabre rattling of the kinetic or ‘hot war’ kind through its actions in the South China Sea and overt threats around Taiwan and even now their CCP mouthpiece, The Global Times suggesting an Australian invasion should we interfere:

“Australia is geographically far from Taiwan. It serves more as an advanced base in the Asia-Pacific and a supply base for the US. US forces have deployed marines and bombers to its base in Australia. The Australian Defence Force comprises of only around 60,000 permanent personnel, and the number of forces that it could devote to a war effort is even less.

If Australia wants to get involved in the Taiwan question, it will consider whether China will use its forces to strike back at Australia, and if so, whether the US has the ability and will to protect Australia. That is what worries the Australian military most. To its dismay, the US would probably protect itself once a crisis occurs, and the Australian military must weigh up what losses a war would incur to Australia.”

We have also seen active cyber attacks and of course the elephant in the room, an economic attack.

The latter has always seemed counterproductive as China, the 2nd biggest foreign holder of US Treasuries, could indeed cripple the USD and by default the US; but who is going to do that when you will be the biggest loser?

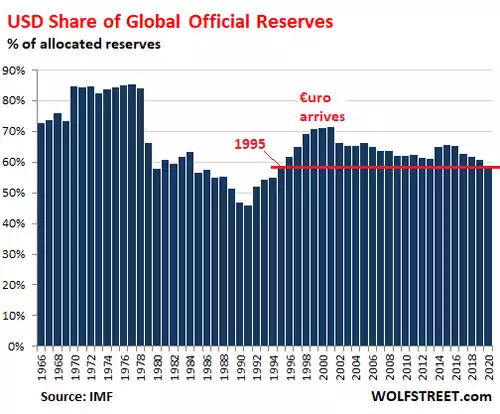

That said, China has been gradually reducing its holdings of US Treasuries and it is not alone. Recently, the IMF reported that the global share of US-dollar-denominated exchange reserves dropped to 59.0% in the fourth quarter, a 25-year low.

On Monday we wrote of the reopening of gold import quotas into China. Already it appears a whopping 150 tonne is on its way. You will see in the chart of that article the incredible accumulation of official gold holdings by China since the GFC and there is plenty of evidence to suggest there is a lot more not declared and held by the CCP’s SAFE department. And so, for a famously strategic and long term thinker as China, this frequently begs the question, ‘what are they up to’.

Respected financial commentator Alisdair Maclead wrote the following last year before news broke of China’s new central bank digital currency (CBDC) or ‘digital yuan’. The CBDC is potentially a game changing vehicle for China and the following is nothing but even more relevant now:

“With all its gold, by monetising it China could kill off the dollar tomorrow. Undoubtedly, this financially nuclear option has become a backdrop to her strategy in the ongoing trade and financial war against America. But the idea that by using this undoubted power over the dollar China gains a simple victory if through her actions the dollar is destroyed understates a more complex situation. It is not in China’s interest on many levels, not least because of her ownership of dollars is about $3.4 trillion, of which only $1.5 trillion is invested in Treasuries, agency, corporate and short-term debt in the US. The balance is actively used in loan finance to China’s commodity suppliers, those involved with the belt and road initiatives and other states with which China desires to gain influence.

Destroy the dollar and China’s heft around the world is destroyed as well, because only a small proportion of China’s loan-influence is in renminbi. In that sense, if the dollar collapses America gains a geopolitical benefit over China, her means of international influence being crippled. The Chinese leadership will be acutely aware of the consequences of the dollar’s demise and therefore will do nothing to encourage it. Indeed, if the dollar begins its collapse in the foreign exchanges, we could find China increasingly calling out the Fed on its inflationary policies. But then the Fed’s problem is and will continue to be an inability to stop its addiction to unlimited inflationism.

Unfortunately, a banking crisis is embedded in the script, which will have fundamental effects on all fiat currencies, some more than others. And since international banking is overwhelmingly a dollar affair, after a short pause the consequences are bound to weigh heavily upon it as the reserve currency. This credit cycle unwind is a Category 5 compared with 2008—09’s Category 2 or 3. It is only after such a cataclysm that China will have no alternative to abandoning all attempts to support the dollar and its means of buying overseas influence. China will then need to secure its own currency.

It will require a return to gold backing — the nuclear option so far avoided. While the cost will be writing off trillions of dollars and its means of securing overseas influence, there will be a monetary vacuum to fill. And compensation will be found in an increase in the value of China’s declared and undeclared bullion stocks, as well as the enrichment of its gold-holding people.”

The introduction of the Digital Yuan makes his closing 2 paragraphs all the more pertinent…

“There can be little doubt that a move to a gold yuan will have a profound effect on remaining fiat currencies. A short period of time between announcing these plans and their implementation will be required for markets to adjust. It is likely that fiat currencies would face downward pressure on their purchasing power, and China must be seen to be protecting her own interests by returning to sound money and not deliberately undermining the dollar.

Other nations, particularly those in Asia, are likely to follow China in implementing their own gold exchange standards, and all nations will be then faced with a stark choice: do they hang on to their welfare states and their growing difficulties in financing them, or do they stabilise their currencies? If China does adopt a proper gold exchange standard, she would neutralise all America’s geopolitical power, whether America follows suit or not.”

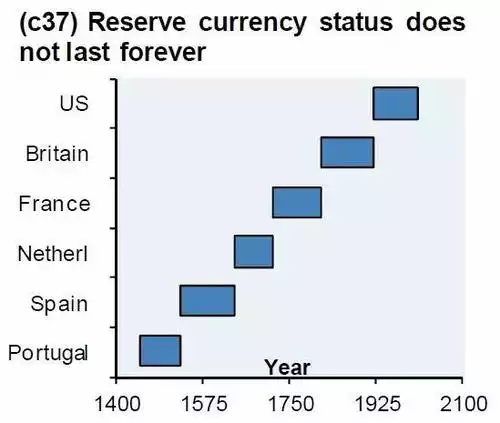

Many have held that a return to a fully or partially backed gold standard is nearly the only way out of this financial Ponzi scheme. If you can’t inflate assets and goods to remove the debt burden consuming everything, you tie a central currency to gold and inflate the gold price to reduce or remove the debt. The oft repeated graph below reminds us that no Fiat currency has lasted forever. At some stage human greed and political hubris sees the accompanying credit cycle reach a bubble that must inevitably pop.