COMEX Buy Signal?

News

|

Posted 11/10/2016

|

4739

Last week we mentioned (here and here) the role COMEX played in the take down of gold and silver last week and that we were waiting to see what the Commitment of Traders (COT) report would reveal Friday night. Here are some comments from COT analysts together with a little education for those new to it:

From John Rubino:

“The quick and dirty COT story is that it's a snapshot of what the big players in gold/silver futures contracts are up to. There are two main groups in this market: the commercials (mostly big banks and companies that buy metal to turn it into coins, jewellery and industrial products) and speculators who bet on price moves. The former consistently fool the latter into guessing wrong at turning points. That is, the speculators are usually way long at the top and very short at the bottom. So you can tell where prices are headed over next the six or so months by looking at what the speculators are betting on and assuming that if they're excited, they're wrong.

This year they've gone record long, which explains the fast recovery in metals prices and mining stocks: The speculators were piling in. This, of course, sets the stage for an eventual correction. So what happened last week was to be expected (though it was several months overdue, illustrating the point that the COT report is great for direction but dangerously unreliable for timing).

So now that we know why the beat-down is happening, let's see what this indicator says about when (in very general terms) it might end.

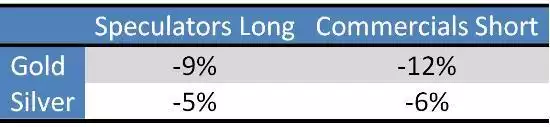

Note that the speculators are cutting their long positions while the commercials are scaling back their shorts.

The key conclusions:

-Both groups are moving in the right direction to establish a precious metals bottom. That is, if they keep this up, eventually the commercials will be long and the speculators short, setting up a situation where the speculators will be forced to close their shorts by buying gold/silver, thus sending their prices up.

-The commercials are moving a little more aggressively than the speculators to close out their positions. Not sure what that means.

-Neither group had done all that much as of Tuesday the 4th, which implies that the bottom is not yet in sight.

-Based on the brutality of the final three trading days of last week, next week's COT report will probably show a much bigger move in the right direction - that is, the speculators will be a lot less long. So on Friday the 14th (when Tuesday the 11th's results are reported) we'll have a better sense of how close that bottom is.

-The carnage in bullion and mining shares represents a great buying opportunity because eventually these paper games will stop working. The fundamental environment - negative interest rates, massive government deficits, steady increases in private sector debt, incipient banking/credit crises everywhere you look - is phenomenally good for real assets like gold and silver. So who knows? This might be the last chance to get in before the phase change.”

And from Hebba Investments:

“Summary

- The latest COT data show a massive drop in gold speculative bulls and increase in gold speculative shorts.

- The net position is back at levels that we deem much healthier for a gold bull market.

- Gold should see additional physical demand as buying increases from China and India.

- We believe gold investors should be taking this opportunity to buy back into gold.”

And finally from us… As stated above the timing is hard to predict. What is not is that metal will get very hard to get when it really takes off. Remember two wise messages:

“Better a year too early than a day to late”

“Trying to pick a bottom usually just results in a smelly finger”

Don’t leave it too late….