Chinese gold double whammy

News

|

Posted 20/10/2014

|

3223

Many don’t realise that as well as taking the title of the world’s biggest consumer last year, that China also became the world’s largest producer in 2007. Barely an ounce of what they produce leaves its borders. The problem is that growth in gold production is about to end with projections of just 0.9% by 2018, down from the current 6%. The thing is there is nothing to suggest a reduction in consumption so that just means more imports which of course mean more strain on global supply.

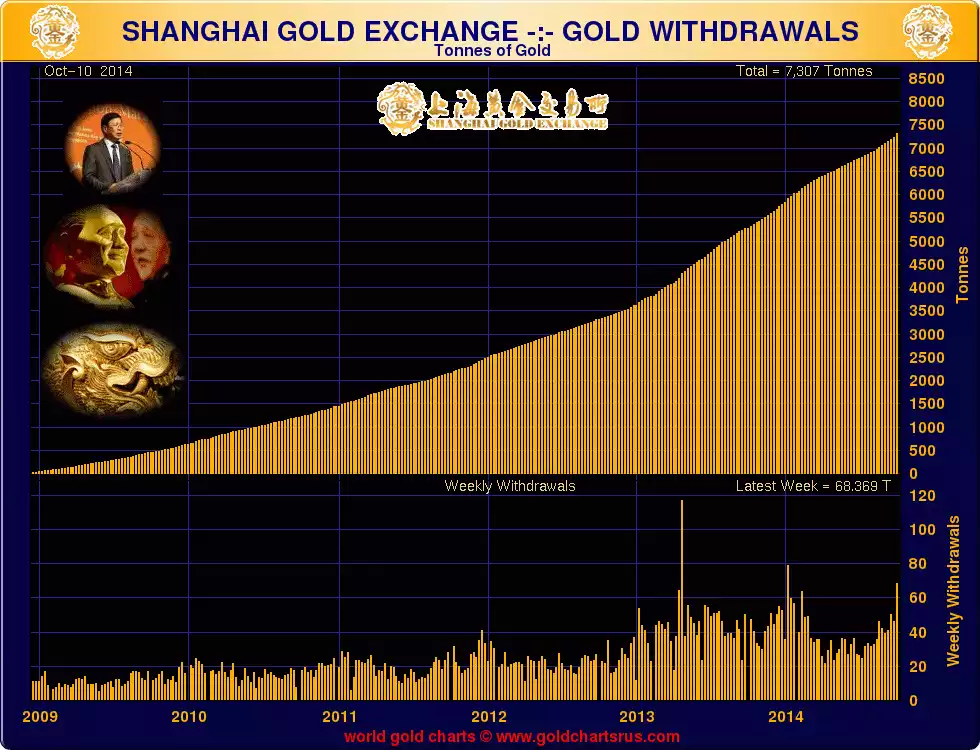

And how is that demand going? Well in the last week reported (ending 10 October) they consumed an incredible 68.4 tonne. As you can see in the graph below there have only been a two weeks higher, even in the record breaking 2013. So whilst ‘western forces’ are keeping the price in check, eastern demand amongst declining global production must inevitably win the price determination.