Chinese Gold Consumption Hits New Record

News

|

Posted 20/10/2015

|

4055

China’s insatiable appetite for gold has reached a new record high according to new official figures out of the Shanghai Gold Exchange. As at 25 September the year to date withdrawals hit an incredible 1,958 tonnes. As in the recent past this figure will vary significantly to the World Gold Council’s (much lower) estimate of gold demand and does indeed contain a very small amount of ‘internally traded’ gold which doesn’t represent true consumption. However the very thorough analysis and evidence put forward by respected analyst Koos Jansen, in our opinion, is clearly more transparent and believable. We won’t enter the busy realm of speculation on why the WGC likes a lower number (especially whilst the gold price is so low…) and whether the Peoples Bank of China is indeed fully reporting their official reserves. We recently reported the now monthly update for August and they have just released an update of official reserves for September, up another 14.9 tonnes to 1,708.5 tonnes. This is still a very modest number as a percentage of reserves and continues to attract disbelief by financial commentators. It also noticeably coincides with China offloading large amounts of US Treasuries from their reserves.

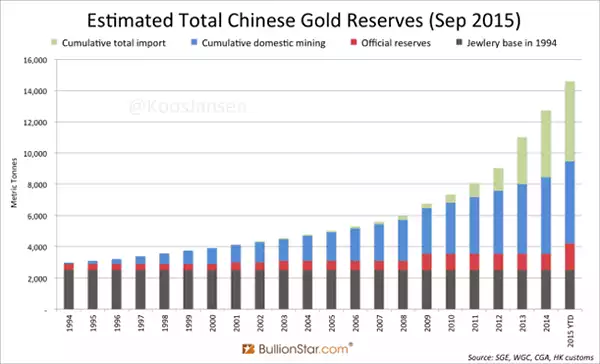

Koos Jansen (per the graph below) estimates there is 14,593 tonne of gold in total in mainland China. Whether ‘official reserves’ are indeed only 1709t seems a somewhat mute point in a communist regime. On any level there is an incredible amount of gold held in China and as we keep saying, these are traditional strong hands (long term holders), holding physical gold, not western speculators holding paper (ETF or Comex futures) claims to an ever decreasing pool of available metal. When you combine Indian consumption you are seeing consumption of physical gold greater than mine production. Where do you think it’s coming from?