China Joins Central Bank Gold Rush

News

|

Posted 13/02/2019

|

5586

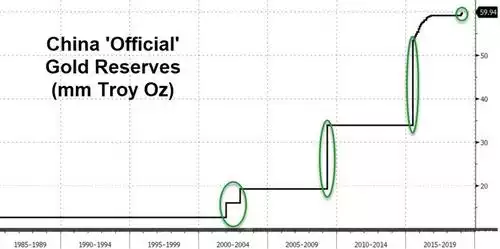

2018 saw the biggest year of central bank gold purchases since 1971, the year the US President Nixon scrapped the gold standard. However China, the world’s biggest producer and consumer of gold, largest foreign exchange holder ($3 trillion), and second biggest economy, was absent from the buying spree right up until December 2018. Indeed after their official increases in 2015 to 2016 (ostensibly to gain a seat at the SDR table as we reported here) China has not officially added any gold until December last year and then again in January.

Despite the rise in December and January China dropped to sixth place among the world’s largest holders of gold behind Russia. As we reported here, at 67.6 million ounces of gold Russia now stands in fifth place for gold reserves holdings behind the US, Germany, France, and Italy.

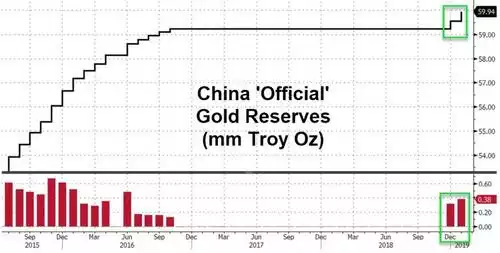

The additions in December and January were relatively modest, taking official reserves from 59.24m oz to 59.94m oz however analysts believe it is more about the signal it is sending given few believe they are fully disclosing their real holdings anyway. China historically have short periods of increasing their disclosed holdings with plateau’s of reporting in between, so this could be signalling the next buy up commencing.

The jump in the gold price also helped China see its biggest foreign reserves value increase in a year, up by $15.2 billion.

From the South China Morning Post:

“Jeffrey Halley, senior market analyst at currency broker OANDA, said geopolitical risks in the world, from US-China trade war to Venezuela, and risk aversion in stock markets had triggered a renewed interest to buy gold as a “safe haven hedge”.

“China has also long been trying to diversify its reserves away from the US dollar,” Halley said.”

It’s worth remembering the possible bigger picture here. Apart from Rickard’s SDR thesis in the first link above, or Bill Holter’s previously reported here, respected commentator Alasdair Macleod adds this slightly different take:

“It is hard to see how the US can match a sound-money plan from China. Furthermore, the US Government’s finances are already in very poor shape and a return to sound money would require a reduction in government spending that all observers can agree is politically impossible. This is not a problem the Chinese government faces, and the purpose of a gold-linked jumbo bond is not so much to raise funds; rather it is to seal a price relationship between the yuan and gold.

Whether China implements the plan suggested herein or not, one thing is for sure: the next credit crisis will happen, and it will have a major impact on all nations operating with fiat money systems. The interest rate question, because of the mountains of debt owed by governments and consumers, will have to be addressed, with nearly all Western economies irretrievably ensnared in a debt trap. The hurdles faced in moving to a sound monetary policy appear to be simply too daunting to be addressed.

Ultimately, a return to sound money is a solution that will do less damage than fiat currencies losing their purchasing power at an accelerating pace. Think Venezuela, and how sound money would solve her problems. But that path is blocked by a sink-hole that threatens to swallow up whole governments. Trying to buy time by throwing yet more money at an economy suffering a credit crisis will only destroy the currency. The tactic worked during the Lehman crisis, but it was a close-run thing. It is unlikely to work again.

Because China’s economy has had its debt expansion of the last ten years mostly aimed at production, if she fails to act soon she faces an old-fashioned slump with industries going bust and unemployment rocketing. China offers very limited welfare, and without Maoist-style suppression, faces the prospect of not only the state’s plans going awry, but discontent and rebellion developing among the masses.

For China, a gold-exchange yuan standard is now the only way out. She will also need to firmly deny what Western universities have been teaching her brightest students. But if she acts early and decisively, China will be the one left standing when the dust settles, and the rest of us in our fiat-financed welfare states will left chewing the dirt of our unsound currencies.”