Investing: It’s about context and education.

News

|

Posted 03/07/2017

|

6329

The new financial year is always a great time to take a step back and re-evaluate the world and our stake in it. There is, as seems to be the case now in modern times a rich, complex and rapidly changing geo-political and financial landscape.

As a brief example, take the news coming out of Illinois (especially over the weekend) where it is looking increasingly likely that we will see the official bankruptcy of an American state and all the implications that come with. Mike Adams expects to see a collapse of 30c on the dollar across the state pension fund landscape. Indeed, the situation in Illinois is so bad that the state Powerball and Mega Millions lottery sales have been suspended in an unprecedented step. Furthermore, ZeroHedge has reported that “Federal judge Joan Lefkow in Chicago ordered Illinois to come up with hundreds of millions of dollars it owes in Medicaid payment that state officials say the government doesn’t have”.

The point is that it is as difficult as ever to make sense of what is prudent and sensible in a world of distortions, both in terms of markets themselves and the sources of information reporting on them. How can the general population be expected to process complex information such as our small Illinois example above and devise effective financial plans for the future? Moreover, how are we expected to teach our children the skills required to navigate such geo-political and financial minefields? More on that later in this article.

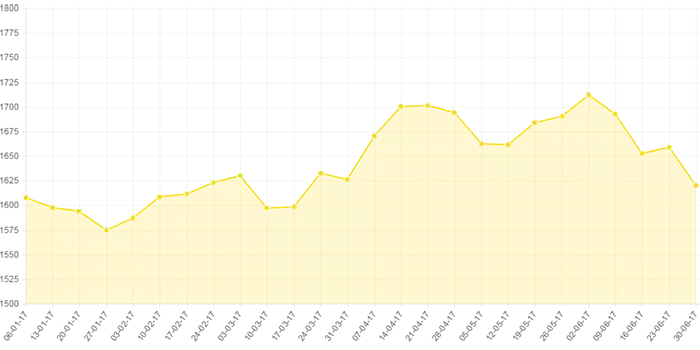

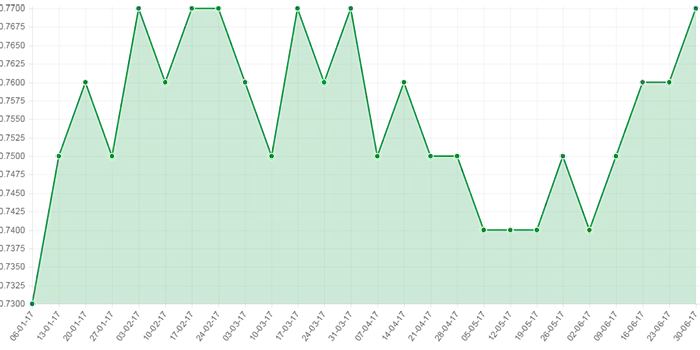

For now, let’s just address the first pillar of this article, that of “context” by addressing one of the recent developments in the investment space that’s captured attention; namely the recent drop in the gold price. It is true that gold has sharply dived in the last weeks as we’ve covered, but zooming out for a moment and using our price charting tool we can see the year to date performance of gold is still up approximately 0.8% in Australian dollars; and that is despite an approximate 5.5% appreciation in the AUD/USD pair. This fact is supported by CoinNews.net who report that “Most precious metals logged losses in June and the second quarter, but they all advanced through the first half of this year”. See the following plots from our charting tool.

Gold in AUD from Jan 1st 2017 to 30th June 2017

AUD - USD from Jan 1st 2017 to 30th June 2017

Gold has always been a long term proposition for those buying it as a fundamental component of a sound portfolio and when looking at this broader (6 month in this case) context, the falls since early June are somewhat abated. As always, we suggest “balancing your wealth in an unbalanced world” and gold should be part of that balancing with a focus on the long term context rather than the short term volatility.

The second pillar of this article relates to education. It is important to note that the role of diversification is not only applicable to the consumption of financial instruments, but also to news sources. We recommend augmenting articles such as this one with other sources to provide a range of views. There comes a point however where reading articles isn’t sufficient and for that, further education may be required.

In fact Ainslie Bullion hosted just such an event last year which provided information from an equity, property and bullion perspective. Such events are beneficial not only for the presented content but to experience the types of questions asked by attendees.

This is a good opportunity to promote our upcoming attendance at the NUU Understanding Money Conference on Saturday 26th August 2017. Suitable for all, this conference will exhibit a range of presenters on a number of topics from the definition of money, its past and future, cryptocurrencies and of course gold as the oldest form of money. Attending such events is an important component of acquiring the education and context required to make informed investment decisions. We look forward to seeing you there.