3 cuts to Zero – Why Australians Should be Worried

News

|

Posted 02/10/2019

|

10360

With the RBA cutting rates again yesterday to yet another new all time low, the ‘lucky country’ finds itself just 3 cuts away from zero as we fight rising unemployment, low wage growth, and low core inflation, and more concerning signs from the property market despite the price bounce in Sydney and Melbourne. Building approvals for new homes continue to fall, now down an incredible 28.9% for the year to August. Our large builder contacts in both Brisbane and Melbourne are telling stories of an illusion of activity based on finishing ‘year old’ contracts now but very very little in the pipeline going forward. The building approval data certainly supports that.

The RBA desperately wants to kick start inflation too. Why would they want inflation when there is no wage growth you ask? Because when you have one of the highest personal debt rates in the world, you either need to pay it off (which with our equally world leading income:debt ratio is most unlikely) or inflate it away.

However looking more broadly than our own woes, last night saw some big moves in markets with the Dow Jones & S&P500 both down nearly 1.3% and gold up 1.8% along with silver up 3% as a number of global economic indicators reminded markets that the central banks don’t ‘got this’.

First we saw the global economic trade bell-whether of South Korea post its first CPI contraction since records started in 1966. There were a range of manufacturing PMI’s all below 50 (contraction) including South Korea, Indonesia, South Africa, Italy, Sweden and the UK but the knockout punch was the ISM manufacturing PMI for the US posting a second month of contraction at 47.8, the weakest since the GFC, down from 49.1 in August and against expectations of a still poor 50.

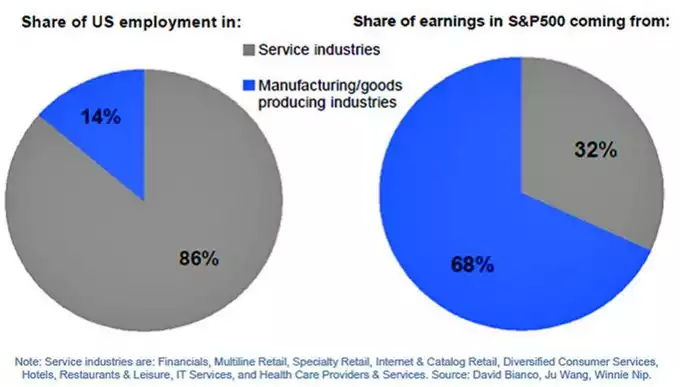

And to counter the calls from commentators saying a declining manufacturing sector doesn’t matter and is just a symptom of a ‘new digital world’ where somehow you don’t need to make stuff… please refer to exhibit A below. The VAST majority of US corporate profits still come from this contracting sector…

Australia’s economy is heavily reliant on our exports of stuff to make things. This does not in any way bode well for our future prosperity.

The RBA knows this. In the post-meeting statement Governor Philip Lowe said the bank “is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.” He went on to say afterwards: “It is reasonable to expect that an extended period of low-interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board will continue to monitor developments, including in the labour market.”

That all adds up to a lot of downward pressure on the AUD which already saw a 66 handle last night. The combination of a continued global flight to the safety of gold and silver, and a declining AUD makes for a tantalising mix for Aussie metal holders.