China’s Bad Debt Problem Is Ours Too…

News

|

Posted 22/02/2016

|

5050

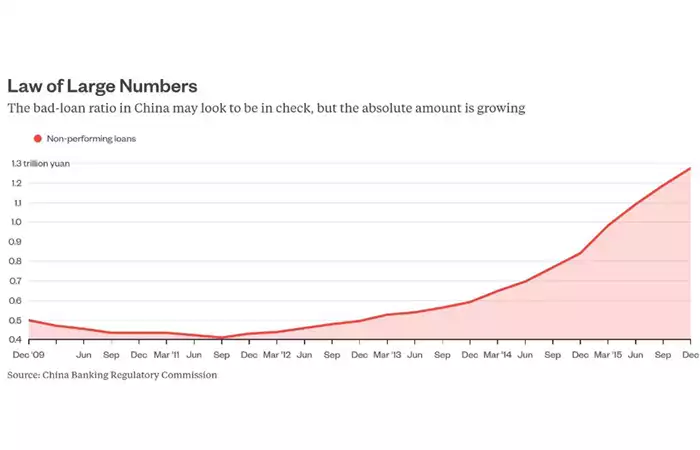

Last week we wrote about how China’s debt issue poses one of the key threats to the world economy right now. That article looked at the total amount of debt they have accumulated but what has some even more concerned is the number of ‘at risk’ or non-performing loans on the books. The chart blow illustrates how these have swelled to nearly 1.3 trillion yuan, up over 50% on a year ago.

If you include the so called ‘special mention’ loans (those showing signs of future repayment risk) that total figure is 4.2 trillion yuan. For context that is $645 billion and is the highest its been since June 2006 having blown out 256% in just the last 6 years. Coincidentally in 2006 just prior to the GFC, sub prime mortgages in the US totalled a significantly less $600 billion. De ja vue?

China’s response? Lowering the reserve rate required for banks to have to cover such debts to encourage… more debt!