Australia “Running out of Puff”

News

|

Posted 08/06/2017

|

6361

Headlines abounded yesterday of Australia’s world record streak of 25 years without a recession as we limped over the expansion line with a GDP print for the last quarter of just 0.3%. That print takes our annual rate down to 1.7%, nearly half the 3% normally associated with the strong employment market our unemployment rate implies, though few economists believe.

So whilst “ScoMo” was full of praise for this government somehow being responsible for this, the economic reality going forward is far less compelling. As Reuters lead in reporting this:

“Australia's economy may have achieved a remarkable winning streak, avoiding a recession for 25 years, but there are now clear signs that the consumers who have driven much of the growth are running out of puff.

With cash interest rates at a record low and house prices near record highs, the nation's household debt-to-income ratio has climbed to an all-time peak of 189 percent, according to the Reserve Bank of Australia (RBA).

That means there are an increasing number of people who have little cash for discretionary spending – on everything from cars to electrical appliances and new clothes - as their pay packets get consumed by large mortgages and high rental payments in the country's red-hot property market.”

They cite one analyst “estimates a record 52,000 households risk default in the next 12 months and that 23.4% of Australian families are under mortgage stress, meaning their income does not cover ongoing costs.”

This at a time when “Australians are also facing a cash crunch because price inflation in essential items such as food, electricity and insurance is accelerating at a 3.4 percent annual rate at a time when Australian wages are rising at their slowest pace on record, just 1.9 percent in the year to March.

Meanwhile, growth in retail sales, personal loans and luxury car sales are all at multi-year lows, suggesting the household sector - nearly 60 percent of Australia's A$1.7 trillion ($1.3 trillion) economy - is under severe strain.”

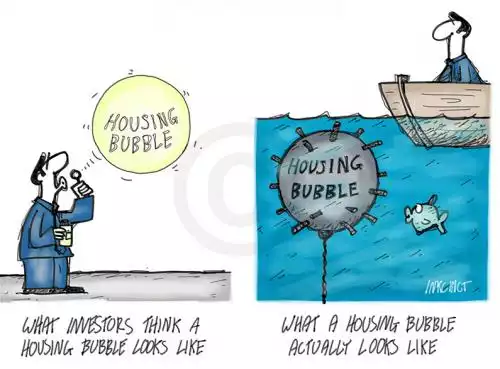

Citigroup joined the chorus of housing bubble concerns last week with their Chief Economist stating Australia is experiencing “a spectacular housing bubble” calling for tougher regulations, and that “"It had better be focused on immediately, to try and tether a soft housing landing,” and “Clearly if these things are not managed well they can be a trigger for a cyclical downturn.”

The upshot is Australia has for some time now been ‘buying’ GDP with more and more debt. We are on an increasing trajectory of how many dollars of debt we need for each dollar of GDP. At some stage the debt burden fundamentally weighs on growth to the point that it smothers it. Australians are feeling that at a personal level just as the government is at their level. Something eventually has to give…..