Fed Minutes Boost Gold

News

|

Posted 23/11/2017

|

6655

In yesterday’s article Jim Rickards said “Central banks are determined to get more inflation and will flip to easing policies if that’s what it takes.”

Since the last US Fed meeting at the beginning of this month, gold has outperformed all major asset classes, including the bull market S&P500, as the USD dropped. The market isn’t buying the December rate hike and ‘(QE) asset normalisation’ program.

Why? Because inflation, by the Fed’s preferred measure, isn’t happening. Rickards (courtesy of Daily Reckoning) had a bit to say about that too:

“But I remain sceptical about a December hike. As I explained above, the market is looking in the wrong places for clues to Fed policy. Jobs reports are irrelevant; that was ‘mission accomplished’ for the Fed years ago.

The key data are disinflation numbers. That’s what has the Fed concerned, and that’s why the Fed might pause again in December as it did last September.

We’ll have a better idea when PCE core inflation comes out Nov. 30.

Of course, the Fed’s main inflation metric has been moving in the wrong direction since January. The readings on the core PCE deflator year over year (the Fed’s preferred metric) were:

January 1.9%

February 1.9%

March 1.6%

April 1.6%

May 1.5%

June 1.5%

July 2017: 1.4%

August 2017: 1.3%

September 2017: 1.3%

Again, the October data will not be available until Nov. 30.

The Fed’s target rate for this metric is 2%. It will take a sustained increase over several months for the Fed to conclude that inflation is back on track to meet the Fed’s goal.

There’s obviously no chance of this happening before the Fed’s December meeting.

A weak dollar is the Fed’s only chance for more inflation. The way to get a weak dollar is to delay rate hikes indefinitely, and that’s what I believe the Fed will do.

And a weak dollar means a higher dollar price for gold.”

Overnight the minutes of that 1 November meeting were released and confirmed exactly those fears. Gold jumped nearly $12 on the news, putting it very close to the US$1300 resistance line. From Bloomberg:

“Several participants indicated that their decision about whether to increase the target range in the near term would depend importantly on whether the upcoming economic data boosted their confidence that inflation was headed toward the Committee’s objective. A few participants cautioned that further increases in the target range for the federal funds rate while inflation remained persistently below 2 percent could unduly depress inflation expectations or lead the public to question the Committee’s commitment to its longer-run inflation objective.”

And as for that financial markets bubble they are creating whilst they don’t raise rates?

“In light of elevated asset valuations and low financial market volatility, several participants expressed concerns about a potential buildup of financial imbalances. They worried that a sharp reversal in asset prices could have damaging effects on the economy.”

Indeed.,..

So again we have a Fed stuck between the ‘real world’ deflationary rock and the ‘financial assets’ inflated hard place. It’s hard to think of a result that isn’t favourable to gold.

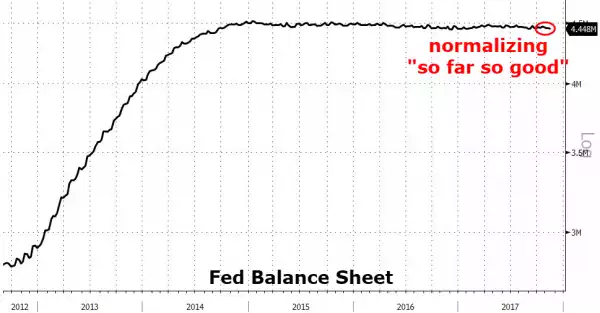

And finally for the joke of the day, and in regard to their stated reduction of their QE amassed balance sheet of bonds…

“A few participants mentioned the limited reaction in financial markets to the announcement and initial implementation of the Committee’s plan for gradually reducing the Federal Reserve’s securities holdings.”

Now why would that be?

If your eyes can’t pick it, of the $4.5 trillion in bonds they bought with freshly printed money, they have reduced it by 0.17%.... Hmmm, and no reaction? Could it be, like rate rises, the market has come to expect more verbal implementation than actual implementation?