Can the AUD Last Up Here?

News

|

Posted 03/06/2020

|

20218

The Aussie dollar this morning nudged 69c for the first time since January this year from where it plunged to a 57c handle in March. At that time everything and everyone piled into the USD and Australia was thought to fair comparatively badly from the virus given our AUD is a proxy for commodities and China. That of course made gold and silver in AUD terms surge even harder than the USD spot price.

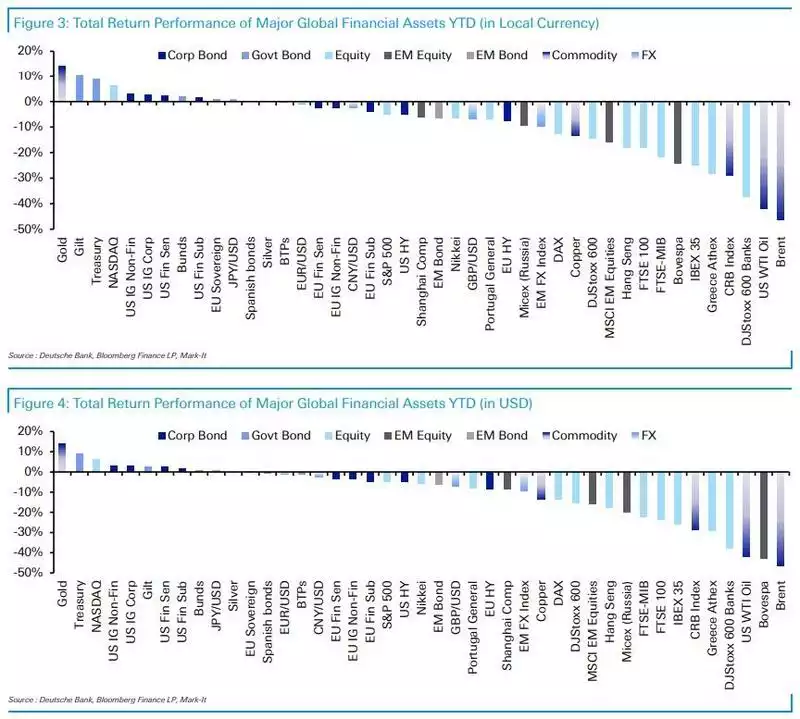

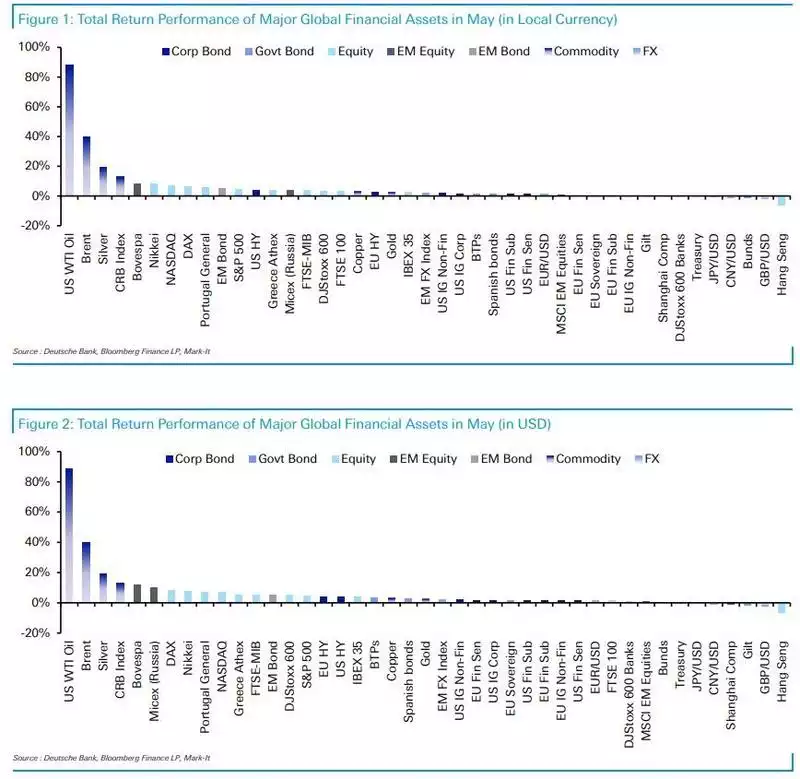

That rebound in the AUD has taken the shine off the performance of gold for Aussies bringing it almost back in line with the USD spot price performance for the year, up 14%, with AUD gold up 16%. At one stage we were in the mid 20%’s. Notably, however, gold is still the best performing asset this year:

And, as always, late to the party, silver was the third best performer globally in May:

Few would have thought we’d see a 69c AUD. The reasons however include a softening USD at present, a surging Iron Ore price due to virus supply constraints particularly from Brazil, and hopes that new stimulus being unleashed in China will see good ol’ China to the rescue again for our resources sector. There is also seemingly a sense that our virus response and isolated island home has seen us fair better than elsewhere. However that ignores the fact we are largely a supplier to a world that is not doing so well. We are largely a 2 trick pony of resources and building homes and what if the world doesn’t need our resources (and Brazil comes back on line) and immigration stalls to protect the aforementioned island?

Yesterday saw the RBA hold our interest rates at 0.25% and Governor Philip Lowe has again stated their taking rates into negative territory is "extraordinarily unlikely". That of course is bullish for the AUD in a world awash with zero and negative rates by comparison.

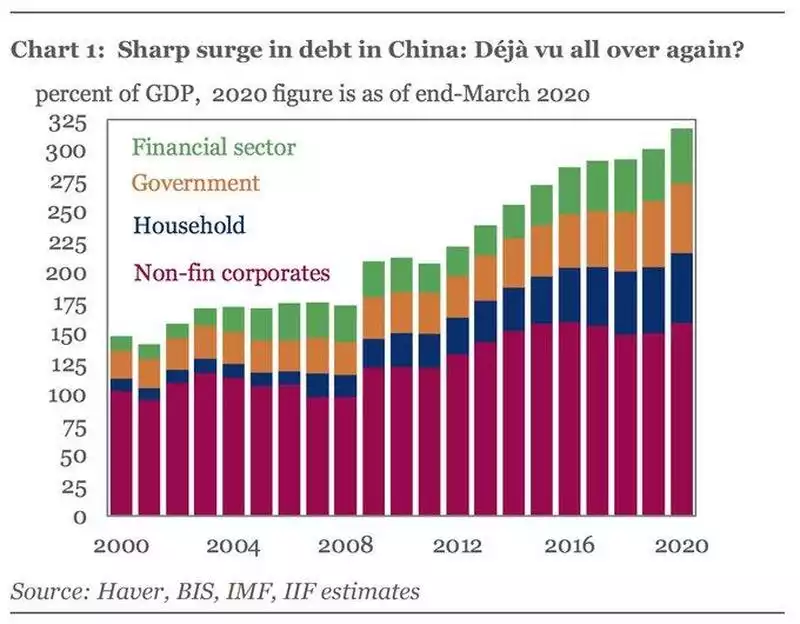

Adding fuel to this is the announcement yesterday that China will start their own version of QE which will see the PBOC buying 40% of un-collateralized loans to small and medium-sized firms from qualified local banks. The stated objective is to free up local banks’ balance sheets to allow them to, you guessed it, lend out (even) more to their businesses. This from a country with a world leading debt to GDP of 317% according to the Institute of International Finance (compared to the G7 leading 250% of Japan), and most of that in to such businesses.

Two prominent economists yesterday voiced opinions that, regardless of such RBA posturing, Australia could see negative rates within 12 months. Royal Bank of Canada Capital chief economist Su-Lin Ong and Westpac chief economist Bill Evans both sounded the same warning.

From the AFR:

"A serious case can be made for the RBA to consider further cuts and entering negative territory for the cash rate if it becomes apparent that the economy is deteriorating even more than is currently expected."

"Although there is a clear current message from the RBA that policy is on hold, circumstances can change and astute policymakers, as the RBA has proven to be over many decades, can be expected to adjust accordingly."

Mr Evans suggested a more competitive exchange rate stands out as the key benefit from the central bank moving to negative rates. As investors get lower returns on the money they lend in Australia then they are less likely to demand Australian dollars, which depreciates the currency.

"For small open economies like Australia and New Zealand, improving the competitiveness of the exchange rate has more direct implications for jobs and inflation than a large relatively closed economy like the US, or even Europe. "

That last paragraph is key. A measure of a currency is only ever relative to another or basket of others. Australia’s economy needs, and is only going to need more and more, a globally competitive AUD. The RBA know this and will throw the kitchen sink at making sure it doesn’t get too strong. Technically the AUD is now at a key resistance and pressure is to the downside. From a macro perspective Real Vision subscribers know that Raoul Pal is short the AUD as he both sees a stronger USD and expects a crash in commodities as part of the deflation crisis, and sees the AUD as a commodities currency proxy.

Today we get the first quarter 2020 GDP print for Australia which of course includes the lock down month of March. Westpac are expecting -0.4% and CBA -0.3%. A much worse negative print for Q2 is baked in the cake and that means a technical recession, our first in 30 years.

Today also sees the release of the April dwellings approvals numbers and Westpac are predicting a 15% plunge, in line with the already released AiG PCI (construction) index falling 16.3pts in April, led by apartments and commercial building. No surprises then that the government is looking to unleash more stimulus into the Aussie home Ponzi scheme. This multi decade fixation of artificially stimulating one of the world’s most inflated property markets because it is one of this pony’s only 2 tricks can only eventually end badly. We already have the world’s second highest private debt burden and they want it higher. Our public debt by comparison on the world stage is low (though that is quickly changing). Arguably the nation’s best independent property mind is National Property Research’s Matthew Gross who recently broke ranks from an industry begging for more by suggesting, God forbid, that Australia use this opportunity to grow new businesses and if we really need to prop up an industry that does admittedly employ 1 in 10 Australians, then make that investment in Australian housing more egalitarian. It is worth the read here.

Regardless of where it is spent, the central theme for Australia, as with the rest of the world, is monetary stimulus either via such government fiscal packages or central banks’ rates policies and QE. A strong AUD seems short lived.

Billionaire Wall St legend Paul Singer, founder and president of Elliott Management Corp describes gold’s role and prospects in this environment succinctly via his just released “Perspectives” investment letter:

“This is a perfect environment for gold to take center stage. Fanatical debasement of money by all of the world’s central banks, super-low interest rates and gold mine operation and extraction issues (to a large extent related to the pandemic) should create a fertile ground for this most basic of all money and stores of value to reach its fair value, which we believe is literally multiples of its current price. In recent months, gold has gone up in price to some degree, but we think that it is one of the most undervalued investable assets existing today...

[It] is the answer to the question: Is there an asset or asset class which is undervalued, underowned, would preserve its value in a severe inflation, and is not adversely affected by Covid-19 or the destruction of business value that is being caused by the virus?”