Can’t Buy Me Love

News

|

Posted 31/10/2014

|

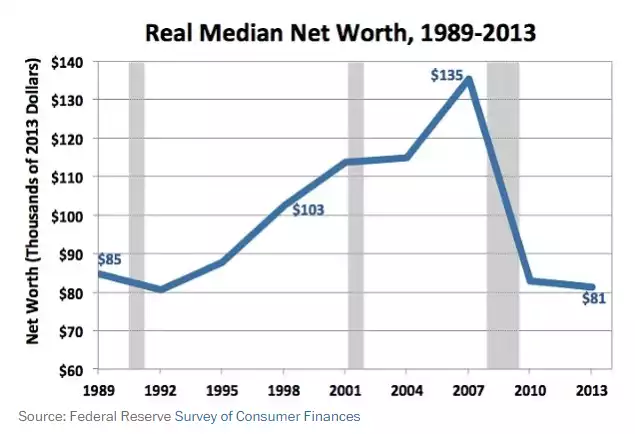

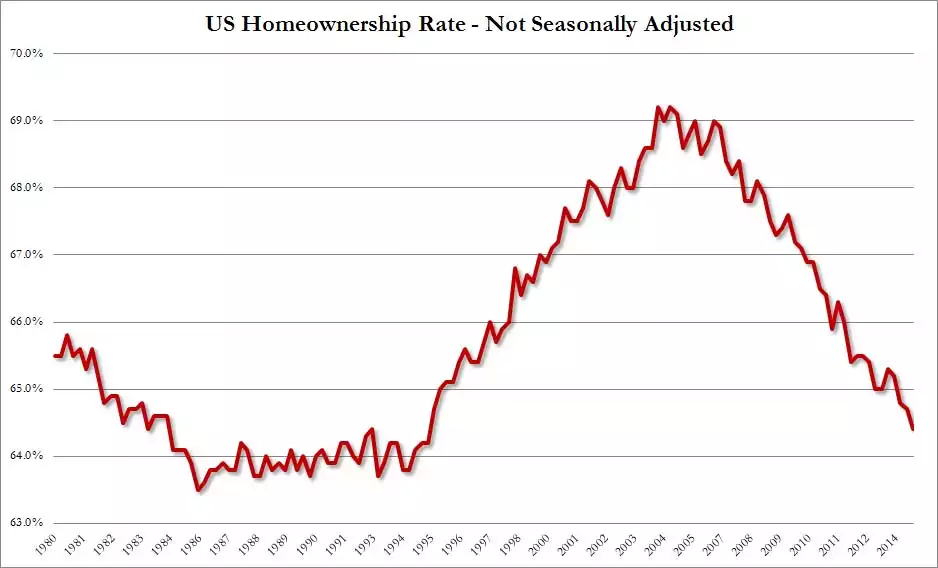

3862

Gold and silver were smashed last night and shares rallied largely off the release of a better than expected US GDP for the 3rd quarter, coming in at 3.5% annualised. As we’ve explained before GDP can be ‘bought’ with debt fuelled government spending or stimulus and it appears a strong component of last night’s print was exactly that as Bloomberg reported “Government outlays and a shrinking trade deficit boosted growth last quarter, buying time for consumer spending in the world’s largest economy to strengthen”. Buying time?? As we reported in today’s Weekly Wrap radio, the real bellwether of how the main economy is going is their housing market. QE has pumped up the sharemarket enriching the minority who own substantial share portfolios but it is the family home that most people have their wealth in and that is just plain sick at the moment as the following graphs (from ZeroHedge) illustrate perfectly. Not everyone understands macro-economics but most can do simple math and budgeting. If you continually spend more than you earn, if you accumulate more debt to fix your debt problem, borrowing to pay your interest bill, you may enjoy the ‘good life’ for a while but it must and will end badly. Every paper based asset in the system is linked inextricably to this Ponzi scheme. Gold and silver are not, and that is why they have survived as money for thousands of years.