Gold Rises On Various Concerns

News

|

Posted 18/08/2017

|

6436

This week has seen a confluence of events that have acted to resume the decline in faith in the dollar, the decline in Donald Trump’s approval and the appreciation of gold. Today let’s look at some of the recent issues contributing to this phenomenon.

All over the television news yesterday was the political analysis of the violence in Charlottesville; something, it seems, that is becoming an identifying feature of the American social construct. The impact on the financial space however came not so much from the violence itself but from Trump’s response to it.

This is not as subjective as one may first imagine as his comments, justified or otherwise, led ultimately to the disbanding of two business advisory councils after escalating pressure from high-profile CEOs. Commerzbank analysts remarked that “this quashes the initially big hopes that Trump could pursue a business-friendly policy. Ultimately, this could even prove damaging to the U.S. economy”.

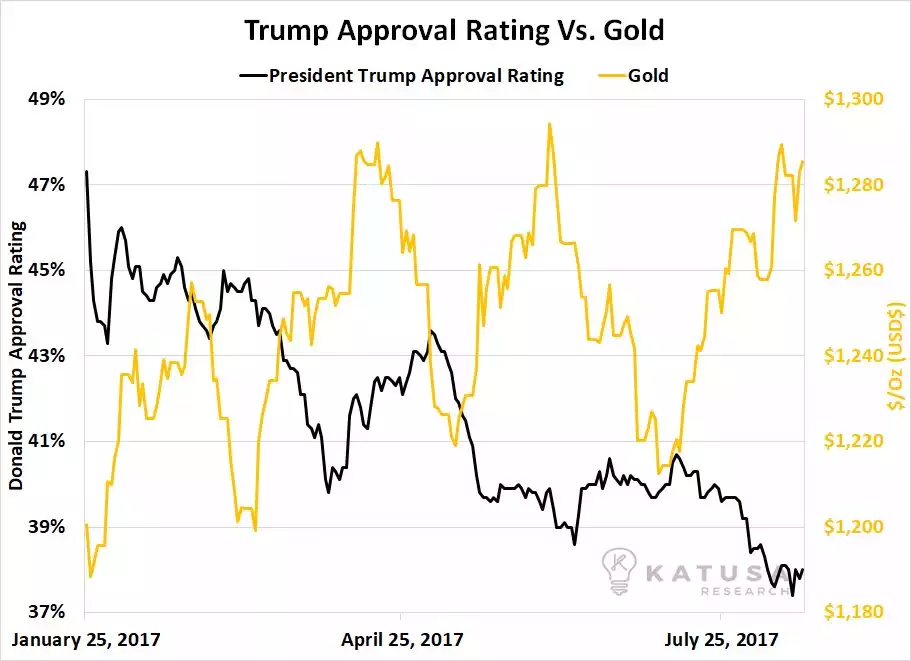

As Trumps approval fell, gold rose. This is interestingly a theme we’ve seen all year as captured in the following plot courtesy of Marin Katusa.

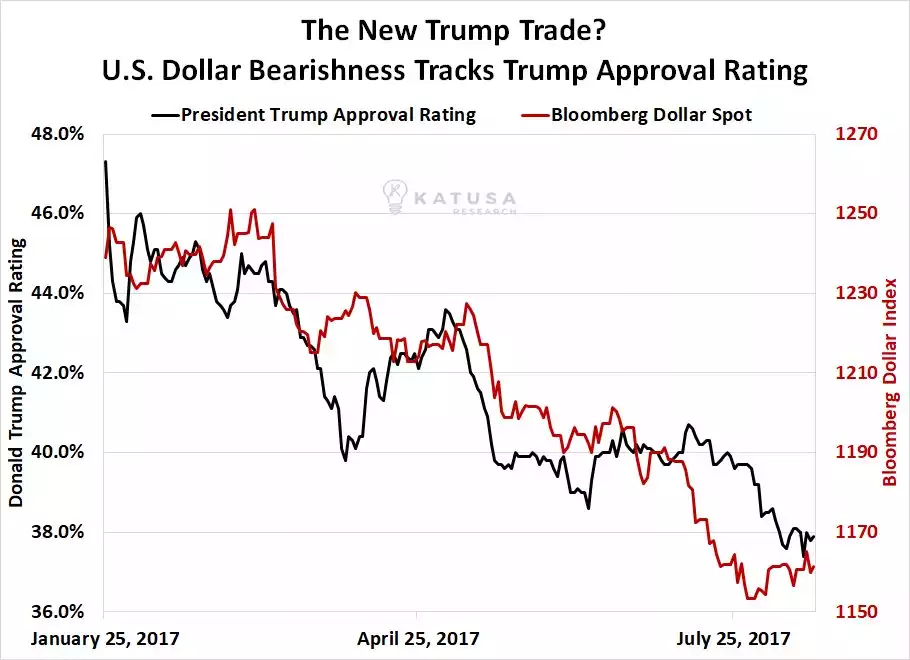

The inverse correlation here may be better explained by the fall in the USD this year as pictured below. Although any plot made against Trump’s approval rating could be observed as a chicken or the egg scenario, it’s arguable that the impacts are palpable in terms of the investment community’s outlook for the American economy.

With North Korean tensions still simmering in the background, this week also saw a major terror attack where a van was driven into a Las Ramblas crowd in Barcelona killing at least 13. Colin Cieszynski, chief market strategist at CMC Markets stated that the attack may have had an upward impact on the gold price.

Concurrently, gold also caught a bid from dovish minutes released from the Fed’s July 25-26 policy meeting. The take away was that Federal Reserve officials see U.S. interest rates rising more slowly than previously anticipated.

Commerzbank analysts again remarked that “as expected, the minutes of the latest meeting of the U.S. Federal Reserve gave no indication as to how the Fed might proceed in future. What they did show was the lack of consensus within the Fed, however. The biggest bone of contention is the inflation expectation in the U.S.”. Indeed, the minutes showed that some participants wanted to see a halving in further rate rises until such time as the trend of soft inflation is identified as transitory.

Regular readers will note the absence of any talk of balance sheet normalisation, something previously anticipated to commence in September. Analysts at Standard Chartered noted that "gold is likely to breach USD 1,300/oz as the market prices in a less hawkish Fed, particularly in a risk-off environment". This is an important area of price resistance that has proven tough to beat three times this year. ScotiaMocatto analysts cite current technical resistance for gold at the June high of $1,296.30 with Fibonacci support at $1,261.30.

Looking ahead, dollar followers are looking to the Federal Reserve's Jackson Hole Economic Symposium on “Fostering a Dynamic Global Economy” scheduled for August 24-26 for potential policy announcements.

There seems little direction and little safety in today’s investment landscape. In fact financial analyst Jason Burack describes the current investment outlook as “an economic minefield” and holders of Telstra shares would have felt that keenly yesterday. It is perhaps partly this ubiquitous danger that is pushing funds reliably into both the metals and Bitcoin in tandem at the moment, a trend not to be ignored.