Bond Market Casino

News

|

Posted 16/12/2016

|

6285

Ouch… silver took a hit last night. It had held up beautifully all week against the Trump-phoria and USD surge with the Gold Silver Ratio getting down to 67’s. That all changed last night when it momentarily hit a USD15’s handle, down a full dollar and a GSR now of 70.6.

As you know its not just gold and silver taking a hit at the moment, bonds are being heavily sold too. Both are victims of the ‘everything’s awesome’ narrative we spoke at length about yesterday. If you haven’t read yesterday we (humbly) think it’s a must read. At the moment ‘EVERYONE’ is short bonds and to a lesser extent gold and silver.

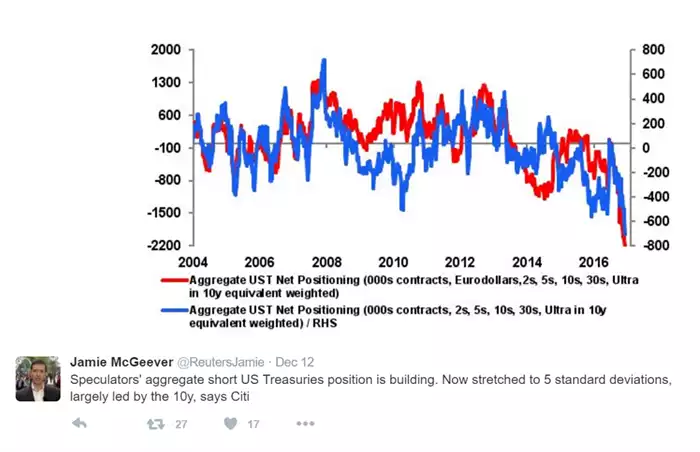

Check the following Tweet by Reuters’s Jamie McGeever:

From Edward Harrison:

“Jamie McGeever over at Reuters posted a chart from Citigroup that is very important. Citi research shows speculators’ aggregate net short position in US Treasuries now at 5 standard deviations above normal – meaning everyone is now on the same side of the trade – short US Treasuries. With everyone piled into a short position [betting on a fall, often with leverage] on safe assets, all we need is one crisis trigger to create the mother of all short-covering rallies back into safe assets, not just in the US but globally.”

And From Richard Breslow:

“Investors seem to have once again managed to fool themselves that geopolitics won’t matter. Be very careful with this one. Not every problem can be solved with monetary policy. And the response to every tweet won’t always be an editorial.”

Contrarian traders look for such setups as we have here. When the sheeple pile ‘all in’ in one direction, history shows those who look at this a little more objectively and bet against it can make huge gains, as the ‘flock’ turn en masse. Please don’t get us wrong, we’re not saying put everything on black when ‘they’ are on red… Just spread your chips so you don’t leave the house broke with the rest. To finish this analogy, the above chart suggests red just won 5 times in a row, everyone is on red again… what’s your bet?