Bitcoin: Uncorrelated and Strong

News

|

Posted 20/10/2020

|

6033

Raoul Pal, the former Goldman Sachs hedge-fund manager who founded Real Vision, and a personal favourite of ours, believes the price of Bitcoin will hit $US1 million in five years.

In an interview with Stansberry Research on October 7, he pinned the predicted price increase to a wave of institutional funds pouring an “enormous wall of money” into the asset.

Bitcoin's price has exploded by about 40% year-to-date. It is also the largest digital currency by market capitalisation, with a current value of about $US200 billion.

“Yeah, I think [$US1 million is] about right. Just from what I know from all of the institutions and all of the people I speak to, there is an enormous wall of money coming into this,” he told host Daniela Cambone. “It’s an enormous wall of money. Just the pipes aren’t there to allow people to do it yet, and that’s coming, but it’s on everybody’s radar screen and there’s a lot of smart people working on it.”

Pal, currently the co-founder and CEO of Global Macro Investor, said the global economy is moving from the “hope phase” to the “insolvency phase” as investors realise an economic recovery from the COVID-19 pandemic will take much longer than anticipated.

"The economy is not going to recover for a lot longer than we expect," he said. "There's no stimulus around and we've got more problems to come to Europe, the US, and elsewhere. And businesses don't have enough cash flow, they're closing in droves and that's what I called the insolvency phase."

“The only answer is more from the central banks, so that’s why I started to buy more and more Bitcoin,” he added.

Other analysts sing a similar song.

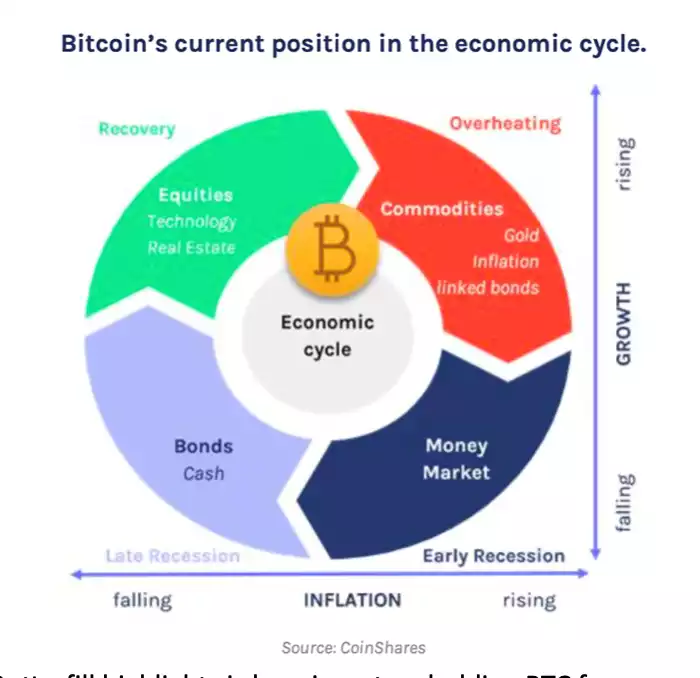

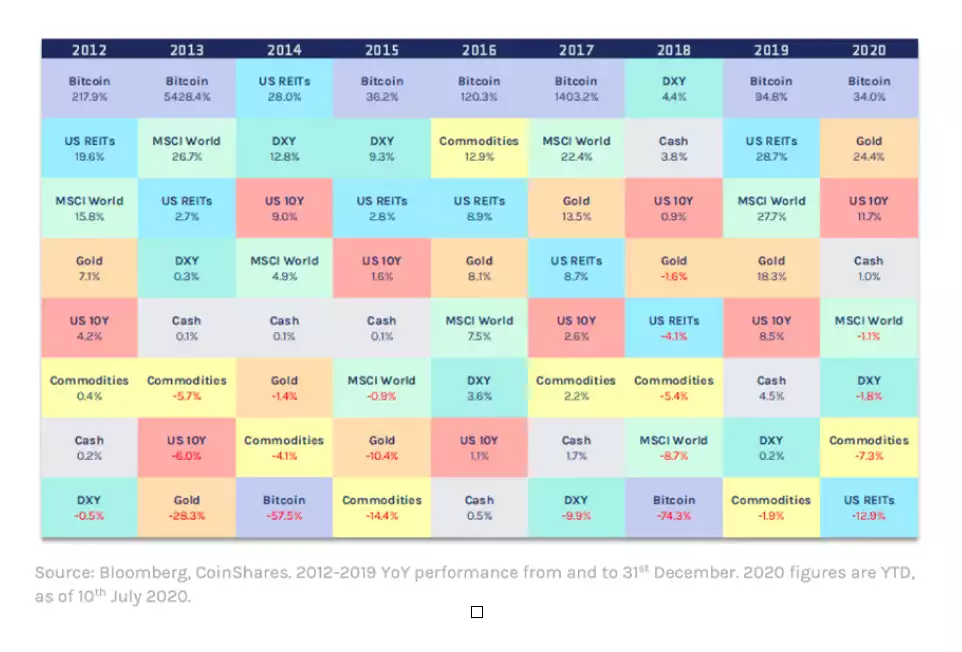

Coinshares Investment strategist James Butterfill published a new report on August 18 that shows bitcoin (BTC) is establishing itself as an investment store of value. The report claims that BTC is “less correlated to the economic cycle” and the crypto asset is uncorrelated to other asset classes in the investment world.

One of the trends Butterfill highlights is how investors holding BTC for one year or longer jumped from 30% in 2012 to 60% in 2020. Their researchers “believe this trend of investor participation is likely to continue.”

“Since its creation following the financial crash in 2008, Bitcoin has seen meteoric – and volatile – growth,” a Coinshares report called “Bitcoin – In a Class of its Own” states.

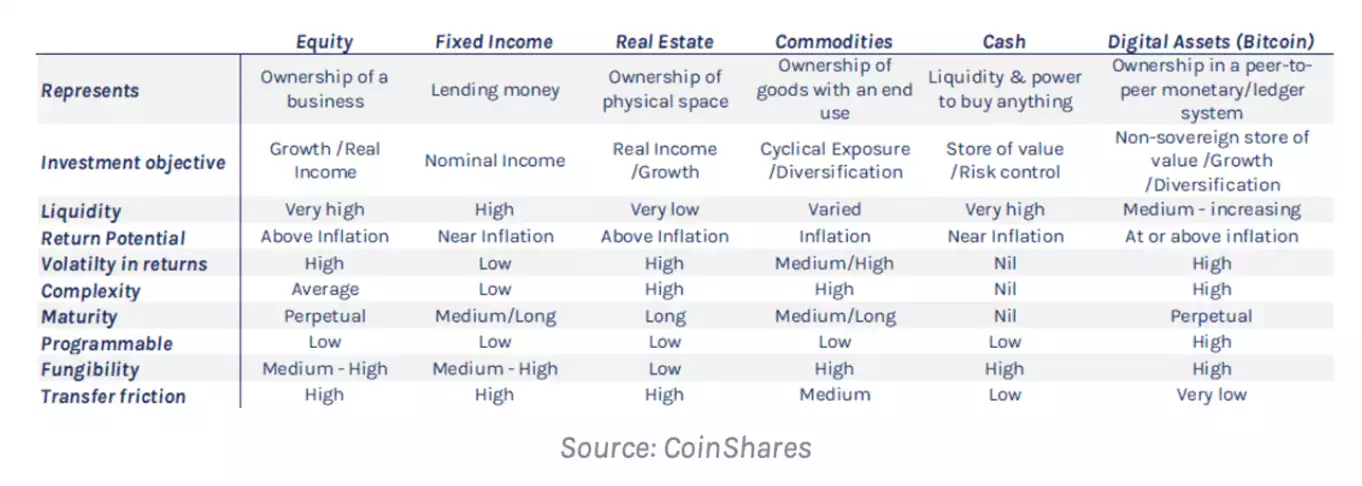

“Many attempts have been made at boxing in bitcoin into the pre-existing frameworks of current asset classes, but due to its unique collection of similar yet often non-overlapping attributes, it never quite fits any established mould.”

Butterfill’s report adds:

“Bitcoin perception is changing over time, its image as a money-laundering vehicle has subsided, with investors now taking a much keener interest in it. News story counts of potential money laundering were much more prevalent in 2013-14 but have since subsided, while counts of Bitcoin as an investment have become more of a focus.”

The report also details that during the early days (growth phase), BTC behaved much like a tech stock, but going forward researchers think “bitcoin will act more like a store of value (SoV).” However, Butterfill’s report recognises that in contrast to SoVs like gold and other precious metals, BTC offers other beneficial functions which will add its growth potential.

The strategist pointed to the fact that the crypto-asset offers programmable money functionality, the securitisation of digital ownership, and traceable recordkeeping with immutability.

Bitcoin has performed much differently than precious metals markets and traditional equities. The S&P 500 has jumped over 50% since the mid-March market rout, otherwise known as ‘Black Thursday.’ Recently the S&P 500 touched its first all-time intraday high in the last six months.

Despite equities and the S&P 500’s recent performance, Coinshares does “not believe bitcoin fits any currently established asset class moulds.”

“Because of its characteristics (scarcity, liquidity, high uptime), evidence suggests investors are increasingly using it as a store of value,” Butterfill’s report concluded. “This has started a self-reinforcing process of financialization which we believe will lead to increasing use as a store of value.”

Evidence of bitcoin's evolution to a store of value has been reinforced by data indicating that exchange holdings are decreasing steadily.

Cryptocurrency reserves held on digital asset exchanges have been dropping to new lows, as some of the top exchanges have seen significant bitcoin reserve balance drops. A few months ago, trading platforms had a lot more bitcoin reserves on hand and on-chain data shows a few exchanges have seen customers steadily drain 187,000 bitcoins from exchange-owned cold wallets.

In February, Coinbase had 1 million bitcoins under management and today reserves are down over 9%. According to Bituniverse’s online exchange balance rank tracker, the San Francisco trading platform has a mere 908,560 BTC under management.

Statistics show out of the top five crypto trading platforms over 187,000 BTC has left these exchanges since the June report.

Glassnode’s “Exchange Balance vs. Bitcoin” stats show that there’s 2.7 million BTC held on exchanges today. Glassnode’s stats indicate that out of the 21 million BTC cap, exchanges hold 12.85% of all that will exist, and 14.59% of the 18.5 million BTC currently actually in circulation.

1.8 million BTC out of the aggregate 2.7 million BTC held on exchanges sits in the world’s top five crypto trading platforms. Exchange balances have been riding lower consecutively for the last 15 months and the last time balances were this low was around May 2019.

To many crypto enthusiasts and traders, the low balances on exchanges suggest users are storing assets in a noncustodial fashion as opposed to leaving funds with a third party. The data from Bituniverse and Glassnode also suggests that liquidity and selling pressure may lower – all of which is leading to the current run-up that we are experiencing.

When you buy BTC from Ainslie Wealth you have the choice of receiving it onto your own existing non-custodial wallet, one of our cold Ainslie Crypto Wallets (offline with zero digital footprint) or in cold storage with one of our storage accounts where we store it for you.