Bitcoin Turns 11 – 304m% later

News

|

Posted 01/11/2019

|

19096

11 years ago yesterday, a new financial asset was born. The following from CoinTelegraph tells the story:

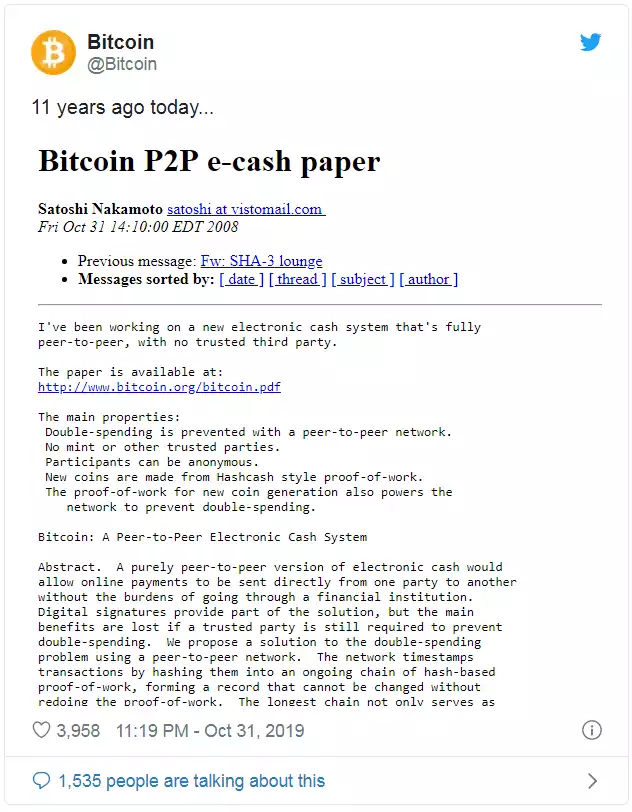

“Today, Oct. 31, marks eleven years since the publication of the Bitcoin white paper by the still-mysterious person or group pseudonymously identified as Satoshi Nakamoto.

A revolutionary text

Bitcoin: A Peer-to-Peer Electronic Cash System — published on Oct. 31, 2008 — outlined a tamper-proof, decentralized peer-to-peer protocol that could track and verify digital transactions, prevent double-spending and generate a transparent record for anyone to inspect in nearly real-time.

The protocol represented a cryptographically-secured system — based on a Proof-of-Work algorithm — in which Bitcoins (BTC) are “mined” for a reward by individual nodes and then verified by other nodes in a decentralized network.

This system contained the possibility of overcoming the need for intermediaries such as banks and financial institutions to facilitate and audit transactions — a major disruption to a siloed, monopolized field of centralized financial power.

304,033,233% all-time-price appreciation

Eleven years on, Bitcoin is consistently setting new records for its network hash rate — a measure of the overall computing power involved in validating transactions on the blockchain at any given time.

More power and participation establishes greater network security and attests to widespread recognition of the profitability potential of Bitcoin mining.

As of the middle of this month, network data revealed that since the creation of the very first block on the Bitcoin blockchain on Jan 3, 2009 — known in more technical language as its “genesis block” — miners have received combined revenue of just under $15 billion.

The figure includes both block rewards — “new” bitcoins paid to miners for validating a block of transactions — as well as transaction fees, which broke the $1 billion mark this week.

Bitcoin’s first-ever recorded trading price was noted on Mar. 17, 2010 — on the now-defunct trading platform bitcoinmarket.com, at a value of $0.003.

The cryptocurrency’s appreciation thus stands at a staggering 304,033,233% as of press time, with Bitcoin currently trading at $9,120.

As of this August, 85% of Bitcoin’s supply in circulation had been mined — leaving just 3.15 million new coins for the future.

Eleven years on, the mystery enshrouding the white paper’s author remains as impenetrable as ever.

Those both within and without the crypto community began attempting to determine Nakamoto’s identity as early as October 2011, just a few months after the mysterious figure first went silent.”

Newcomers to the space may not realise that Bitcoin was developed expressly to address the frustration of watching what was playing out with our Fiat, central and commercial banking system. Indeed imbedded in that genesis block was the following image of the front page of The Times demonstrating the very financial nonsense Bitcoin avoids.

The power of bitcoin is about establishing a financial asset with no counterparty risk, outside the modern fiat based and completely centralised financial system, geo-agnostic (i.e. fungible. It doesn’t care where you live or convert it), immutably secure (if stored correctly), easy and cheap to transfer, and for now, wonderfully volatile allowing non emotional traders to make serious money whilst it finds it’s fair value or long term dollar cost averages to potentially profit from its infancy as explained here earlier this week.

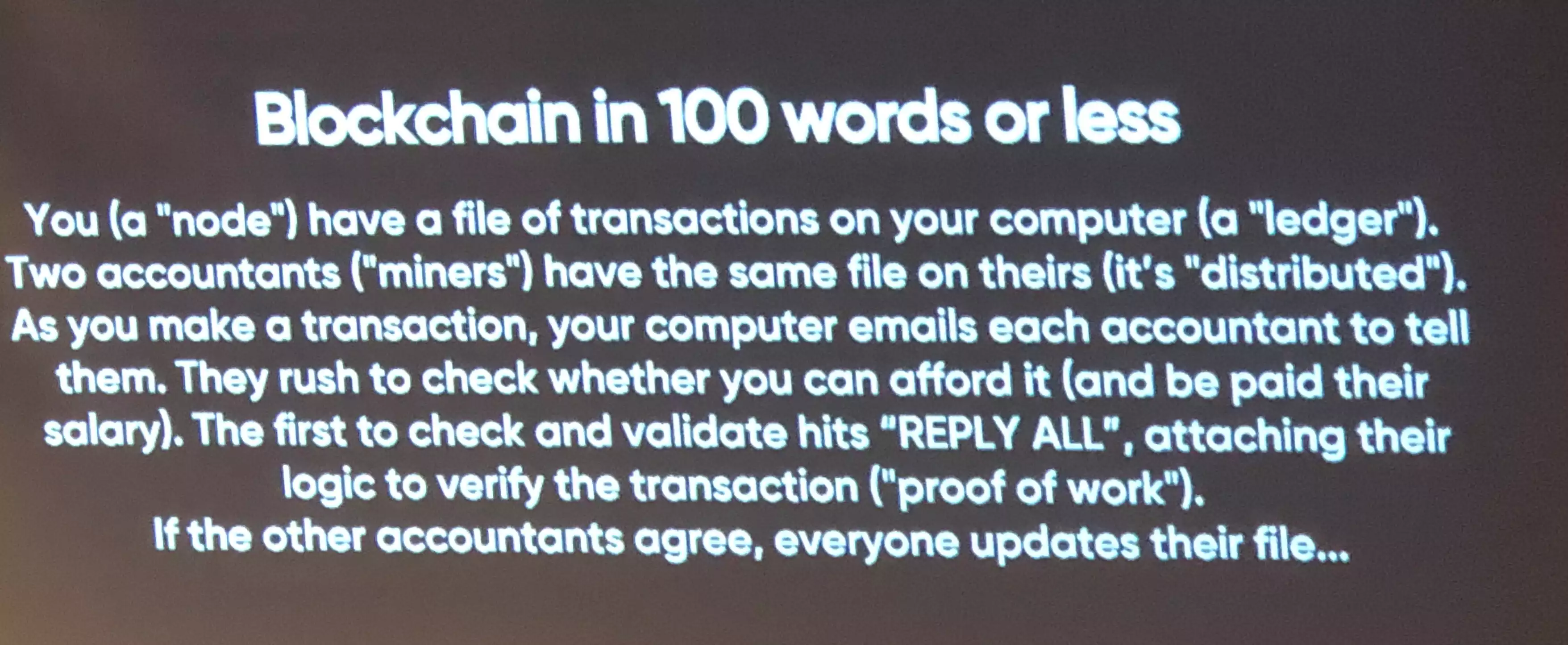

For those still unsure about this blockchain thing, we saw (and photographed) the following at last week’s GAIC conference which is probably the simplest and most effective explanation we’ve seen.

Finally, if you are interested there is a movie called Cryptopia showing for one night on Wednesday 20 November at the Elizabeth Picture Theatre in Brisbane City. Click on the image below to purchase your tickets.